Profitability Improvement in a changing financial world

- The current context banks and insurance companies are operating in

- The combination of services TriFinance is offering

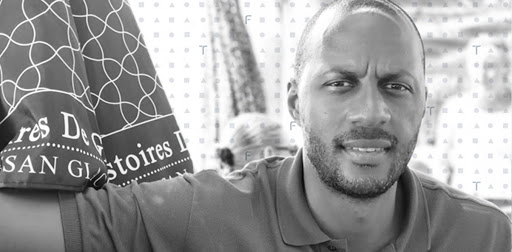

- What role does André play

TriFinance has adapted its Financial Institutions operating model to the changes in the financial world. André explains: Profitability Improvement is a growing concern for our clients. It’s a central theme at TriFinance and the coordinating framework of our whole USP. Robotic Process Automation (RPA), process redesign and profitability reporting are several examples of service offerings that have been given a more prominent place in this context.

"With the corona crisis, teleworking and digital contacts are the latest links in the chain of changes that are shaking up the financial world. Earlier, there were tightened rules after the financial crisis. These are changes that you have to place against the background of the newcomers to the market, such as the fintech companies, which FI is helping to grow. They are forcing the traditional financial institutions to reposition themselves. It causes fundamental shifts of which new technology and digitalization are some of the drivers", André explains. He refers to new entrants, new initiatives, and new ecosystems such as the cooperative bank NewB, the cooperation of Belfius and Proximus in ‘Banx’, and the subscription-based model of Aion, to name a few.

"New initiatives jeopardize the business model and profitability of traditional institutions. They are facing operational risks and challenges due to tightened regulations. It is forcing them to rethink their way of working and introduce a new culture. This raises the question of the mindset required to deal with such important changes. Traditional institutions are carrying a cultural and technological legacy that is a growing challenge they must all face."

Introducing Expert Practices

In order to support our clients in facing these challenges, André developed the framework that caused FI to modify its operating model, introducing the notion of Expert Practices. An Expert Practice is a competence centre, focused on one of our core domains within Financial Institutions. The focus can be transversal like “Process or Project Management” or Functional like the “Finance, Operations, Risk and Compliance” departments of FIs. Expert Practices act as competence centers with a focus on meeting the needs of the market, customers and prospects. Additionally, they focus on the growth of their practice members in their desired expertise.

"We provide business expertise through Transition & Support (T&S) and Pragmatic Advisory. T&S entails operational support and business expertise which are housed in our Functional Expert Practices. Helping to absorb periodic peaks in the volume of work, eliminating gaps in the workforce, and providing business expertise up to and including the C-level, are paramount here."

Operational support and pragmatic advisory go hand in hand

Several Expert Practices also provide Pragmatic Advisory. Roughly outlined, they facilitate change, manage processes and projects, and innovate working methods. The overarching goal is to increase customer performance. André gives Robotic Process Automation (RPA) as one of the examples in which we support several clients. Core Banking Renewal or Core Insurance Renewal are other flagship programs he puts forward. Such programs require professionals with expertise in different roles such as product owners, feature designers, project management officers and process managers, supporting transversal programs aiming at providing a new core banking or insurance architecture. It also includes the re-design of business processes, in order to maximise automatizations and digitalization, focusing on the business of our clients.

"The combination of our services is in the DNA of TriFinance. We are breaking the silos. We work together across Expert Practices and more broadly across Blue Chip Boutiques. Operational support and pragmatic advisory go hand in hand. It is our strength. Because FI focuses on the financial sector, we speak the language of the client. We know the context, understand the challenges and help them to find and implement pragmatic solutions."

TriFinance's first asset is its professionals

The fact that FI's Business Managers have all started their careers as Project Consultants in the field is another asset of TriFinance. They are part of the internal team, the BaseCamp, that stands behind each Project Consultant. "Because above all, let's not forget that TriFinance's first asset is its professionals. Our Project Consultants combine business knowledge and soft skills which make them rapidly deployable," André emphasizes.

He adds that the company moved quickly when teleworking and virtual contacts became the norm due to the corona crisis. The Project Consultants are the starting point of TriFinance. They act as entrepreneurs of their careers, Me inc.®'ers (me incorporated). When they feel good about their work - which brings Economies of Motivation® - it also benefits the client and TriFinance as an organization.

More about André

André Greca studied Marketing in Brussels at the 'École Pratique des Hautes Etudes Commerciales’. He had worked for several asset servicing and asset management institutions for six years, when he became a Project Consultant at the BCB Financial Institutions of TriFinance in 2010. "FI was still a small team back then, a start-up existing for three years. TriFinance had been founded seven years earlier." Today, the BCB FI employs some 100 professionals.

André chose the consulting business to be able to explore other horizons in the financial world. He did not want to specialize in a specific financial niche: "I wanted to keep the overview.” Five years followed as a Project Consultant in the field, in the middle/back offices and trading rooms of large corporate investment banking players, as a functional and business analyst, and finally as a Project Manager.

His professional journey continued from 2015 as Business Manager of FI's BaseCamp, the internal team assisting each Project Consultant and its portfolio of clients. André then became a Client Partner supporting the definition of the commercial strategy, translating FI's vision into concrete actions for the client, and designing, implementing, and monitoring the BCB's way of working.

Related content

-

Blog

Important: Fraudulent Whatsapp messages claiming to be from our company

-

Press release

TriFinance appoints Joost de Bruin as Group Managing Director

-

Event

EPM webinar: How CCH Tagetik can support your EPM journey

-

Article

Expanding Enterprise Performance Management across the company

-

Blog

What is Enterprise Performance Management (EPM)?

-

Blog

5 reasons why TriFinance is the perfect EPM partner for your organization