- A panel discussion

- Save the date: September 30, 2021

- Predictions for the 'Future of Banking'

The financial sector is being disrupted. Traditional banks are investing in ambitious digital transformation projects and creating 'super app' ecosystems. New 'challenger' digital banks are promising consumers better services, better experiences and better value. New innovative fintechs are disrupting everything from payments to lending and KYC/AML.

TriFinance and Aion Bank are joining forces

With all this disruption, what does the future of banking hold? How are new technologies and new business models changing the Financial sector? To what extent is Beyond Banking a hype or reality? And most importantly, how can we ensure that, ultimately, it will be the consumer who wins?

In an attempt to answer these questions, TriFinance and Aion Bank are joining forces.

Practical details

September 30th, 2021, 12am - 2pm via Live Streaming

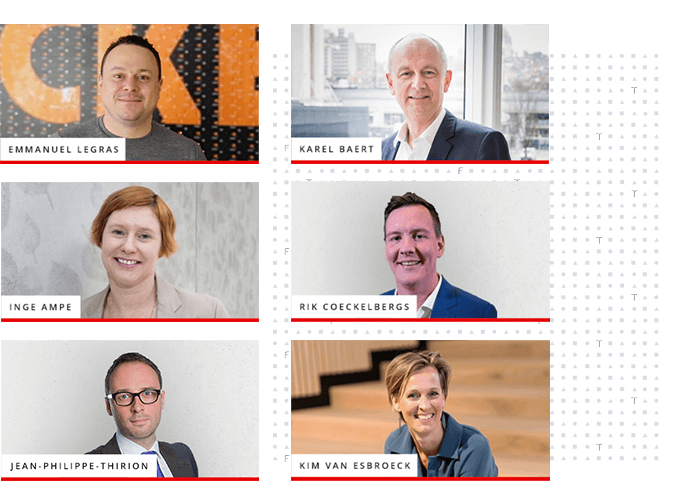

Joining in are:

- Emmanuel Legras, CEO Belgium at Nickel

- Inge Ampe, CCO at Argenta

- Jean-Philippe Thirion, BU Leader Financial Institutions at TriFinance

- Karel Baert, CEO at Febelfin

- Kim Van Esbroeck, Country Head at Aion Bank

Rik Coeckelbergs from The Banking Scene will moderate the discussion.

Emmanuel Legras - CEO Belgium at Nickel

Its name may not sound familiar in your ears, but in France, Nickel has attracted some 1.9 million customers since its birth in 2013. Bought in 2017 by the BNP Paribas group, which owns 95% of it today, this establishment works in a very particular way for the banking sector. Indeed, it essentially relies on a network of about 6,000 tobacconists in France. Nickel offers a "payment account for everyone". No own agencies but client contact through local press shops or tobacconists.

Karel Baert - CEO at Febelfin

Febelfin represents the Belgian financial sector. It acts as the interlocutor and spokesperson with policy makers, regulators, professional federations and interest groups. It represents some 250 financial institutions, and accounts for some 55,700 direct jobs. In addition, it is committed to a socially responsible and transparent banking system.

Inge Ampe - CCO at Argenta

Argenta is one of the established banks in Belgium. It remains true to its basic philosophy and core values: close, entrepreneurial, pragmatic and simple. More and more work is being done digitally. Nevertheless, for Argenta the branch network remains of crucial importance for providing personal advice to customers. Argenta remains strongly committed to proximity and personal contact.

Jean-Philippe Thirion - BU Leader Financial Institutions at TriFinance

TriFinance is an innovative service provider that offers tailor-made pragmatic advisory and transition & support services in risk & compliance, finance and operations. The company employs more than 800 professionals spread across the Netherlands, Belgium, Luxembourg, and Germany. TriFinance focuses primarily on large and medium-sized companies, both in industry and in the services sector. Clients include banks, insurance companies and organizations from the public, semi-public and non-profit sector.

Kim Van Esbroeck - Country Head at Aion Bank

Aion Bank is a full service digital bank that combines the best in technology with the breadth of services and guarantees of a traditional bank. Seated in Brussels, it operates under a Belgian banking license and offers its members unique products to save and invest in addition to daily banking services. With one of the highest interest rates for savings accounts and commission free ETF investing, Aion Bank is laser focused on helping its members grow their money.

Rik Coeckelbergs (moderator) - Founder and CEO at The Banking Scene

The Banking Scene is a banking community and network organization for the financial industry. It aims at offering a platform to connect banking professionals across the Benelux. Its key activities are conferences, workshops and seminars that discuss the future of banking and the consequent discomfort of change.

New innovative fintechs are disrupting everything from payments to lending and KYC/AML. With all this disruption, what does the future of banking hold?

About Trifinance

TriFinance is an international network organization that puts the growth of people first and offers many tailor-made services in finance, operations, and advisory services. The company employs more than 800 professionals - Me inc.® employees (me incorporated) - spread across the Netherlands, Belgium, Luxembourg, and Germany. Thanks to this network, TriFinance can quickly establish new connections, and share and offer knowledge. The company offers a unique combination of services, bundling Transition & Support, Advice and Recruitment & Selection into a high-quality and pragmatic total package. The network organization does not deliver thick reports but concrete and appropriate solutions. With this Do-How approach, TriFinance focuses primarily on large and medium-sized companies, both in industry and in the services sector. Clients include banks, insurance companies and organizations from the public, semi-public and non-profit sector. TriFinance is part of ParkLane Insight, which also includes Tri-ICT

Related content

-

Article

Expanding Enterprise Performance Management across the company

-

Article

"ESG reporting is not a compliance project"

-

Blog

Why Ask Why?

-

Blog

Me inc.®’ers take their career into their own hands at TriFinance

-

Article

Embracing the Future: 5 Key Evolutions in Project Management.

-

Article

"Misunderstanding innovation, we create systems that inhibit randomness and the beauty of serendipity"