3 strategies to keep your (experienced) finance talent on board. Lessons from CFO’s.

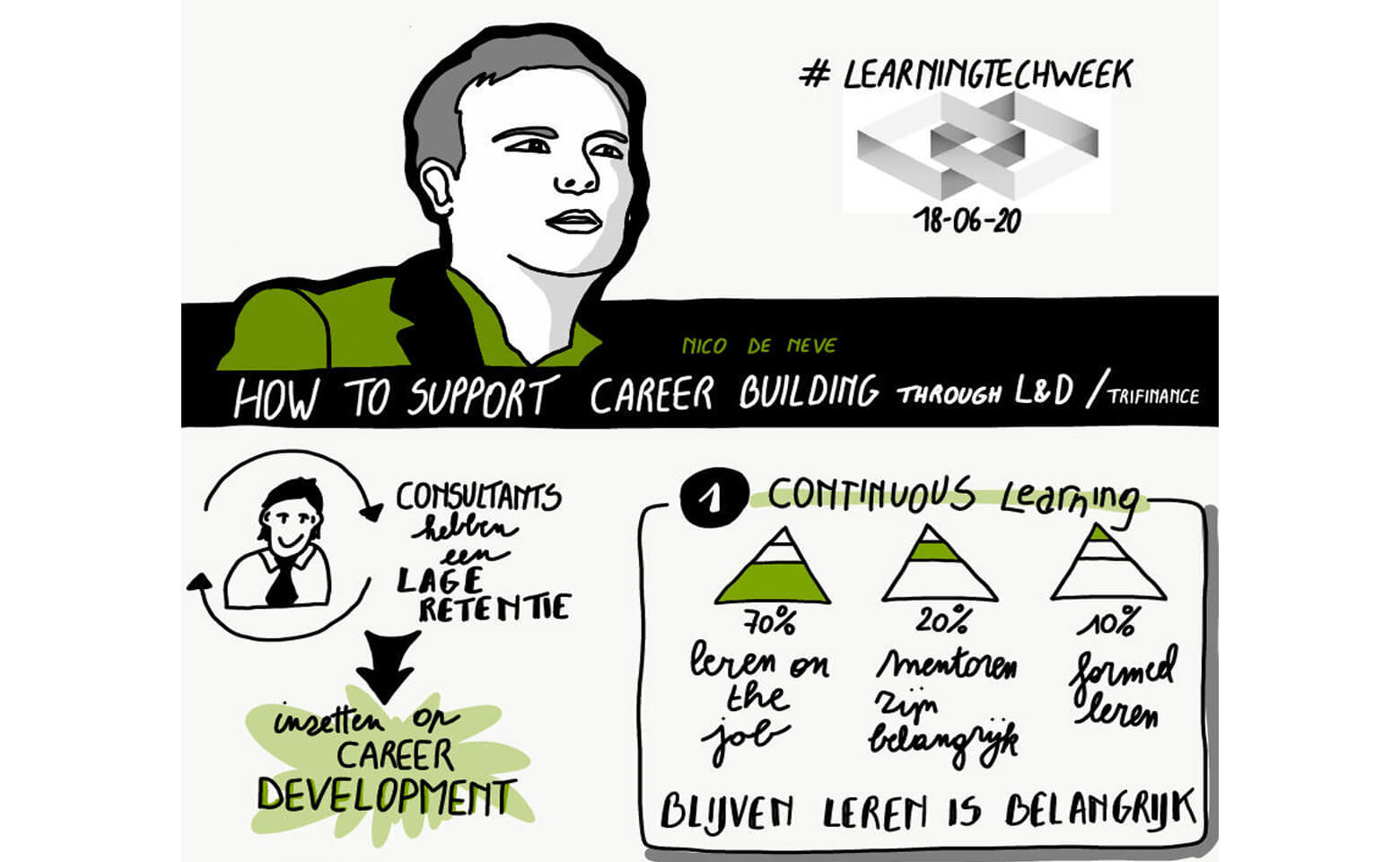

5 November 2021How to improve your employee turnover rate and keep your experienced professionals on board? On-the-job learning proves to be one of the most effective strategies, but a lot of finance departments struggle with the implementation. TriFinance learning & development expert Nico De Neve presents three essential lessons from CFO’s about lifelong learning and career-building for finance professionals.

Motivating experienced employees

Learning on the job has become a familiar term, every CFO acknowledges that it takes constant improvement to make it to the top. But how to organize a learning and development structure for finance professionals is easier said than done. If it’s one thing to motivate young employees, handing experienced professionals the right means to keep on growing is quite another. Nico De Neve, learning & development expert at TriFinance, presents three lessons learned based on 30 interviews with CFO’s (see the book ‘Zo Maak je carrière in finance’) and his own experience as a TriFinance mentor.

1. Create an optimal learning environment

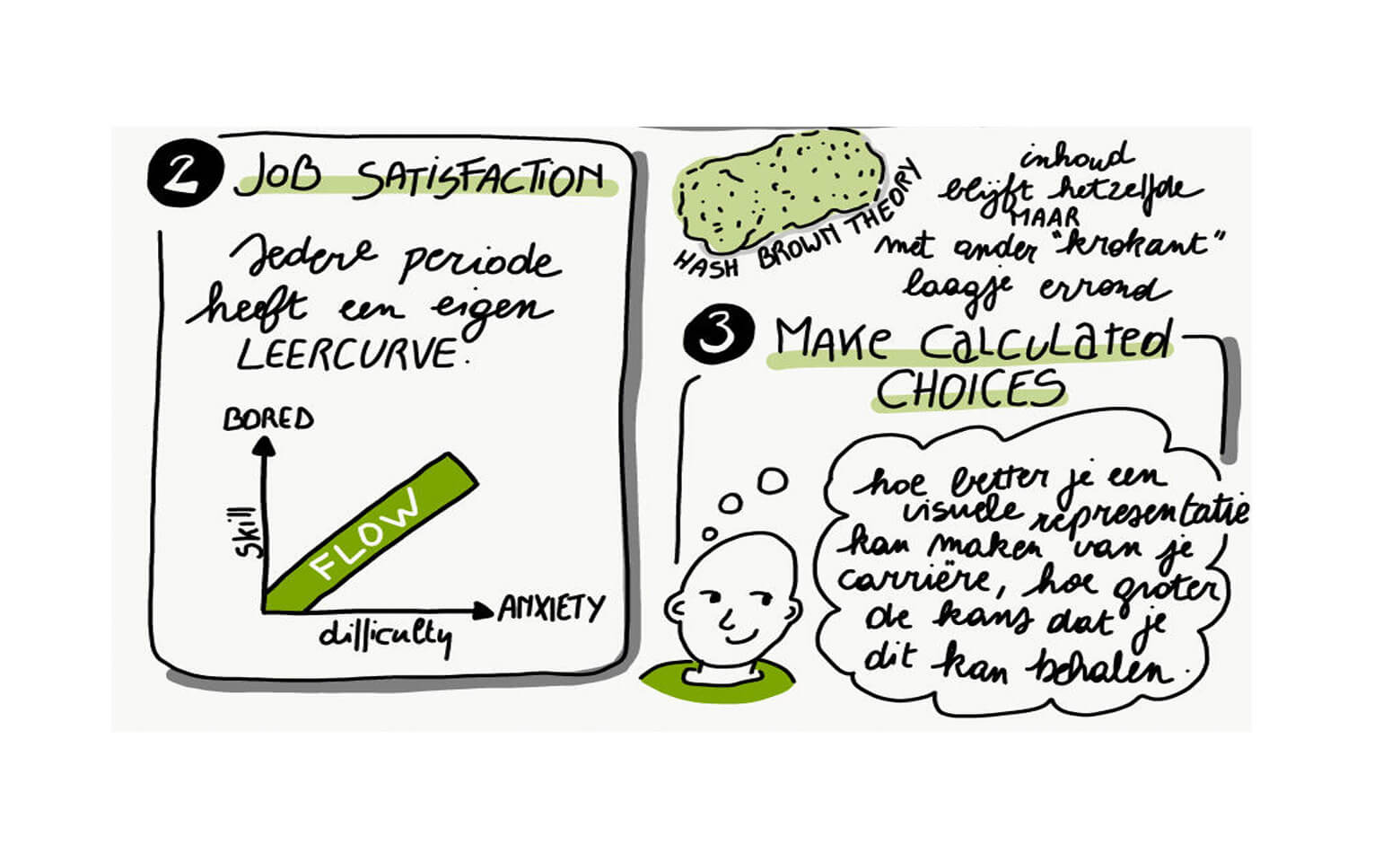

Optimal learning occurs somewhere in the middle between boredom and anxiety. Learning does not happen in the comfort zone (see psychologist Anders Ericsson’s work) but you won’t learn if you are on the brink of a burn-out either. Although the exact sweet spot differs from person to person, optimal learning occurs somewhere in the middle, rather than close to the burn-out axis. As psychologist Mihaly CsiCsikszentmihalyi explains, in that optimal zone between anxiety and boredom, flow occurs. Flow is the state in which you enjoy what you are doing, and time slips away. Not only is it an optimal learning state, but it is also an optimal point for feeling good at work. So it’s broader than just learning. Exactly where flow occurs, depends on the skill level of each individual. That’s the reason why, when you apply solutions that work for junior employees, they do not work for the more experienced ones. The latter need different challenges than the more junior ones to get them in a state of optimal performance and learning.

Learning and development are at the core of TriFinance’s philosophy. We support learning on the job according to the 70-20-10 model, which means that about 70% of learning comes from on-the-job experiences, 20% of learning is organized through the exchange of knowledge between peers, and 10% from courses and training.

2. Wrap a soft core in a new crispy outer layer

A lot of finance departments convey junior colleagues with 100% process-based tasks and their more experienced colleagues with 100% project-based tasks. The young ones get bored after two years of doing the same things over and over again, and they leave the company. The long-serving professionals fall out due to burn-outs and stress. This is where the crispy hash brown theory comes in. The theory originates with game designer Mark Rosewater, who has successfully reinvented games over and over again. “If you want to launch a new version of a game”, he explains, “the game needs to be both excitingly new AND feel familiar at the same time.” Rosewater compares it to a hash brown, which is both crispy on the outside and soft on the inside. “You create a new crispy outer layer to get the players excited. At the same time, you need to make sure that they recognize the soft, familiar core of the game. If it is too different, the players will not be at ease with the new version. If it is not different enough, they won’t feel the thrill.” It’s the same with learning on the job. The younger ones are only served the soft filling over and over again, and it doesn’t excite them anymore. At the same time, the experienced professionals tackle the hash brown crust, which is too rich for anyone’s taste. The senior colleagues can’t learn because their constant focus is on project delivery. The solution is simple: offer each a complete hash brown. Delegate more junior employees at least one challenging project to start with and gradually build up as they make their way on the learning curve. And let the experienced colleagues do some of the process-based tasks, so they have time to reflect and learn.

At TriFinance, we implement the second lesson via the selection of consultancy projects. Each consultant is accorded a project that feels familiar for 80%, which is the soft core of the hashbrown. And 20% of the tasks are new challenges, they’re the crispy outer layer.

3 .Team them up

Novel problems and challenges are generally dispatched to the more experienced professionals because companies assume that they are better fitted to come up with a solution. But if a problem is novel for the company, the more junior employees have as much chance of finding the solution as the more senior ones. The best solutions come from teaming up youngsters with experienced colleagues.

Not only do they both learn from each other, but both also get the opportunity to reflect on their broader career choices. Building a career is not a question of luck, it’s about making calculated choices. And it is okay to make bad decisions if you have the space to think over why it was a bad one, and what you can do to fix it. Functioning as a mentor for a younger employee gives experienced professionals the opportunity to think through what decisions they have made, and what the next steps could be. Only if you know where you want to go, can you figure out a way to get there: what to learn and how to learn it.

At TriFinance, each consultant is assigned a mentor for each new project. It could be a more experienced consultant, which allows both parties to learn from each other. It could be a mentor from the TriFinance basecamp team, such as myself. We’ve also developed a set of digital tools (BSK, LMI) that help consultants to reflect on their career path, so their choices are not a question of luck but a calculated choice.

Nico presented the lessons from CFO’s during the virtual Learning Tech Week. Order your copy of the book 'Zo maak je carrière in finance' or follow us on social media for regular updates on career-building & learning.

Related content

-

Article

From Consultant to Finance Manager: how TriFinance accelerates real‑life growth

-

Article

Restoring stability after a challenging ERP transition at SEB Professional

-

Article

Building a scalable financial backbone for pan-European growth at Macadam Europe

-

Reference case

How Data kickstarted a transformation at a leading financial institution

-

Reference case

Helping a major bank turn complexity into structure: Olivier Renard on his digitalisation mission

-

Blog

Final Call: E-invoicing

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector