Finance in transition: Toward a strategic role in an era of continuous change

3 June 2025Finance Transformation survey results – Part 1

“We can no longer ignore it: this is the era of continuous transformation,” says Filip Ceulemans, CFO Services Client Partner. “Change is happening more frequently than ever. And everything is changing at once. It may sound like a cliché, but we truly live in a world of constant, accelerating change.”

Between March 26 and April 3, 2025, TriFinance conducted an online survey on the transformation of the Finance function. The focus: how organizations are redefining, reorganizing, and preparing Finance for the future. The survey gathered responses from 120 participants, mainly from the C-suite and senior management.

- Continuous transformation is the new normal

- Process improvement and digitization are the main drivers of transformation as such

- Finance continues to evolve toward strategic partnership

A purpose-driven focus for long-term value creation

The survey aligns with earlier research conducted by TriFinance in 2022. “Even then, we observed a shift toward a paradigm of continuous transformation,” says Filip Ceulemans. “Six out of ten CFOs in organizations undergoing transformation at the time indicated that it was driven by a long-term vision. Four out of ten respondents emphasized that a purpose-driven focus for long-term value creation formed the basis of their transformation.”

For two-thirds (67%) of the companies redesigning their Finance function, Artificial Intelligence ranks at the very top of their technology priority list

Transformation across all levels

In this year's survey, conducted in March 2025, no less than 73% of Belgian C-level executives report that a transformation is taking place within their organization.

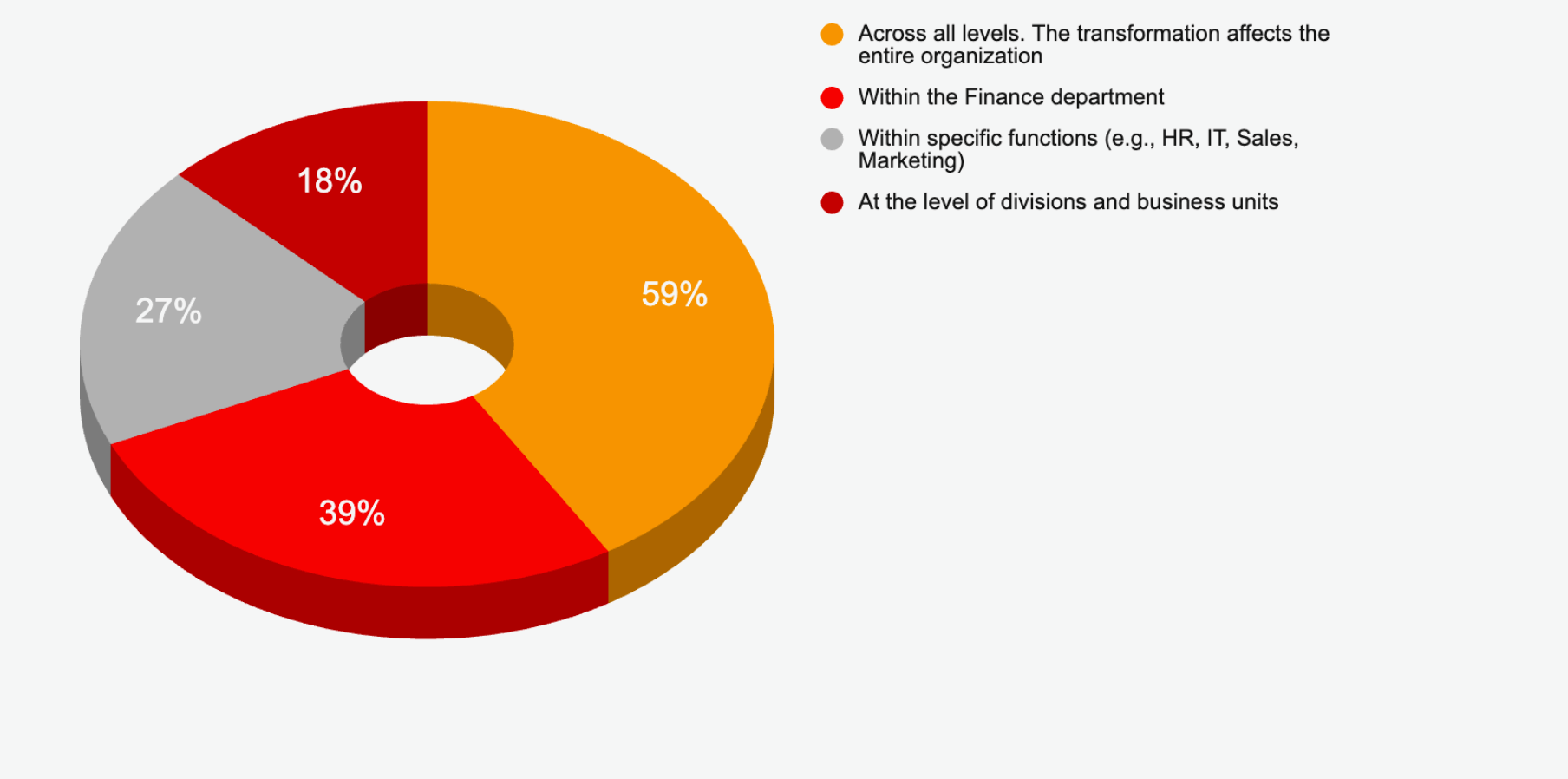

Notably, six in ten executives (59%) say the transformation spans the entire organization. One in four (27%) transformations is focused on a specific function such as HR, IT, Sales, or Marketing. In four out of ten cases, the Finance function is undergoing transformation. The number of transformations occurring at other levels (such as in other functions, divisions, or business units) is significantly lower.

Transformation goals: from process optimization to cultural change

The results show that most transformations are primarily focused on improving and digitizing processes. No less than 61% of respondents report focusing on process improvement, followed by the digitization of internal processes (51%) and increased operational efficiency (42%).

AI and automation within Finance are equally high on the agenda (34%), indicating growing maturity in technology adoption.

The relatively low score for compliance-driven change (19%) suggests that the current focus is more on internal optimization than on external requirements, an observation supported by the only limited attention to sustainability transitions (26%).

Notably, broader strategic and cultural themes are also gaining importance: 38% of respondents are working on digitizing their business model, while 34% cite organizational and cultural change as a transformation goal.

Transforming the Finance Function

By Finance Transformation, we mean a transformation of the Finance function and department that goes beyond simple process optimization or the implementation of new tools.

It involves a strategic redesign of the function to make it more efficient, effective, and aligned with the broader objectives of the organization. This requires changes in processes, technologies, organizational structures, and skill sets.

As Finance increasingly takes on the role of strategic partner, its processes, systems, and people must be prepared to adapt—both internally and externally—to fulfill that role.

Of all the ongoing transformations, 43% relate to the Finance function. Half of these are taking place in the private sector. The public sector (37%) and non-profit organizations (14%) are less represented. More international companies (50%) than Belgian companies (42%) are transforming their Finance departments. Among companies redesigning their Finance function, two out of three (67%) place Artificial Intelligence at the very top of their technology priority list. This might also explain why as many as 60% of C-level executives driving Finance transformation are under the age of 35.

In the next blog post, we’ll take a closer look at the current state of the Finance department, its role in the organization, and the key operational challenges it faces:

What are the biggest obstacles and issues in Finance operations, how advanced is the automation of financial functions, and how well do existing financial systems (such as ERP systems, accounting software, or other financial tools) integrate with other business tools (such as ERP, HR software, CRM, procurement, and purchasing software)?

More on Finance Transformation

Webinar calendar and insightsRelated content

-

Reference case

From back-office support to informed business insights at OMP

-

Article

Boomerang story: “Leaving showed me how unique TriFinance really is.”

-

Article

From e-invoicing compliance to a scalable finance architecture

-

Article

Building a scalable financial backbone for pan-European growth at Macadam Europe

-

Article

AI in the boardroom: From pilot to priority

-

Article

Where background stops defining the future: consultancy paths open up at TriFinance

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector