- Sustainability is fundamentally stakeholder-driven and should be embraced as a core value and a primary driver of company value, moving beyond mere regulatory compliance.

- A focus on short-term profitability risks missing the significant, market-wide sustainability movement and the opportunities it presents.

- For IFRS preparers, it remains crucial to actively follow the evolving jurisdictional regulatory developments across Europe and in their specific member states.

In the coming years, the sustainability landscape will be significantly impacted by ESG compliance. To assist organizations in addressing these challenges and requirements, TriFinance is organizing a series of webinars on related topics to share meaningful insights and best practices.

The recent ESG webinar, ‘Navigating the recent changes in the ESG reporting landscape,' featured insights from TriFinance experts Mario Matthys and Gaëlle De Baeck who shared their knowledge with participants from various companies. They discussed how the recent evolutions will impact the ESG reporting directives. Gaëlle De Baeck, Sustainability Lead at TriFinance, hosted the session.

Europe’s green deal turns pale…

Earlier this year the European Commission surprised the world with their far-going proposal to drastically reduce and delay sustainability reporting in Europe. The so-called Omnibus package aims to reduce administrative burdens by 25%, simplifying regulations and helping businesses navigate high energy costs. The proposed relaxations could save up to €40 billion and make state aid more accessible.

However, the Omnibus package effectively encourages many companies to halt their CSRD reporting. Suddenly, the European Green Deal turned pale. With around 80% of companies exempt from reporting requirements, its credibility is now at risk.

Without a broad mandatory reporting, how can we realize the objectives of Europe’s green deal? The European Union seeks balance between sustainability ambition and geopolitical realism. Under political pressure, these OMNIBUS amendments were already published:

- "Stop the clock!": 2 years delay for wave 2 companies, applicable as of 2027

- Adjust the scope of application: 1000 FTE & 450 Mil. EUR revenue

- Simplification of ESRS data points: drastic reduction of complexity & number of datapoints (only 30% left)

- Restriction of value chain information

- Shift from reasonable assurance to only limited assurance

And in the meanwhile: VSME was launched for SME's, not falling under the CSRD.

Read more in the articles we published on the recent evolutions:

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

The Omnibus vote: Europe votes to weaken sustainability reporting rules

The Omnibus reversal: a decidedly unsustainable step backward in ESG policy

The Omnibus-update

The European Council agreed to simplify the rules on sustainability reporting with a decreasing number of data points where companies need to report on. But where do we go from here?

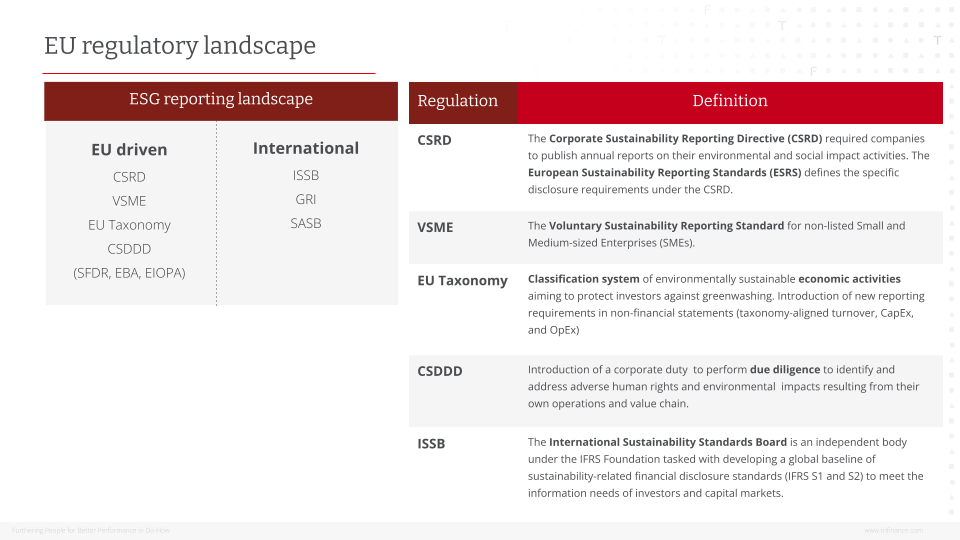

The various EU regulations still apply: from CSRD to EU Taxonomy and ISSB, see this overview:

After the Omnibus update of 13 November the scope and timing of the different regulations has changed:

CSRD - new standards

- Wave 1 - listed companies - deadline FY24 - 1000 employees + turnover of 450 MIO EUR

- Wave 2 - Large companies (deadline FY27) - 1000 employees + turnover of 450 MIO EUR

- Wave 3 - Non-EU parents of EU subsidiaries (deadline FY28) - Net turnover of 450 MIO EUR in the EU on group level

EU Taxonomy - new standards: aligned with new CSRD scope & timing

CSDDD - new standards:

- 1 wave remains - deadline FY28 - 5000 employees - Net turnover of 1,5 B EUR

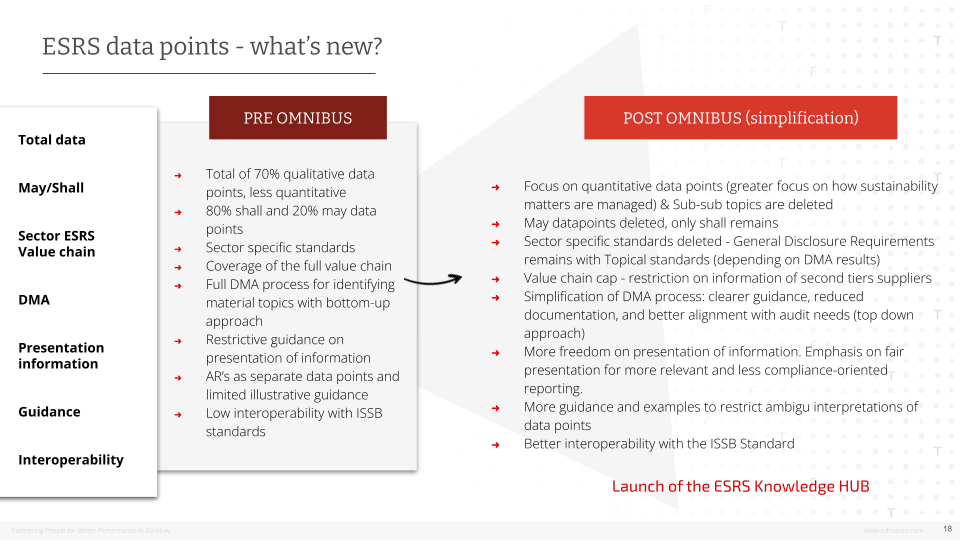

The decrease in the number of data points is significant: from 1090 to 347, a decrease of 57%. Below you can find a general overview of the changes, from pre-Omnibus to post-Omnibus. You can find a complete overview of the data points that you need to disclose here.

These recent evolutions are still very volatile and will be further determined in the coming period. Keep in mind that when it's not yet published in the official journeys, it’s not yet final. Feel free to consult the ESRS Knowledge Hub to stay up-to-date.

Shift your focus from compliance reporting to stakeholder reporting to create transparency and accountability. Choose the most pragmatic approach, where CSRD still may be the best framework for your company to use.

Gaëlle De Baeck, Sustainability Lead TriFinance

ISSB: a global passport?

Next to the European Sustainability Reporting Standards (ESRS), we have the International Sustainability Standards Board (ISSB). The scope for the latter organization are companies that prepare their financial standards in accordance with IFRS standards.

The ISSB has released two standards: the S1 and S2. The objective of S1 is to disclose information about its sustainability-related risks and opportunities while S2 wants to disclose information about climate-related risks and opportunities to understand the use of resources and evaluate strategies, business model, and operational adaptation abilities.

At this moment, the European standards are becoming less stringent while the scope of the international standards is actually being broadened. Both organizations (EFRAG and ISSB) are working closely together on the interoperability project to make sure that the two sustainability standards are compliant in both directions.

While the EU is scaling down its sustainability ambition, many non-EU countries are getting ahead with sustainability regulation. In a global world, it is important to stay alert and keep pace with your sustainability ambition. Otherwise, the sustainability rules for EU companies will be written by other lawmakers, such as for example the home country of your parent company. Losing the ability to define standards, Europe will slide into the role of a follower instead of a driver for sustainability.

Mario Matthijs

Why continuing voluntary ESG reporting post-omnibus?

It remains very important to know the expectations of your stakeholders, whether you need to be compliant or not. Start with your own employees, suppliers and clients and make sure you communicate transparently about the sustainability standards you apply as a company.

Anticipate future changes of the regulatory environment. If your company is not in scope today, it can be in the near future. See your reporting journey as a value driver and keep investing in sustainability as it is an added value for your company. You can only implement actions if you also want to track and report on them. This helps to be transparent on your sustainability DNA and the actions you are taking.

As TriFinance we promote a pragmatic approach on how to continue your sustainability journey.

- ESG strategy and stakeholder demand: collaborate with the board to develop or refine the company's ESG strategy and articulate its fundamental values. Simultaneously, consult with all stakeholders to identify and prioritize their material concerns. Keep in mind your potential risks (IRO)

- Analyze available data: Review and analyze all collected ESG data and prior (published or unpublished) reports based on the established reporting framework (GRI, CSRD, EcoVadis, etc.).

- Choose a framework: Select the optimal ESG framework based on your organization's existing data.Noting that a "partially aligned" CSRD approach may be the most pragmatic choice.

- Collect data: Measure and collect all data available to mitigate your risks, develop clear actions and meet stakeholder demand. Transform sustainability data into valuable insights.

- ESG report: publish your ESG report (regardless of the framework used) to demonstrate transparency and track follow-up actions necessary for achieving sustainable change.

In conclusion, the key message of this TriFinance ESG webinar is to look beyond what is legally required. Sustainability is fundamentally stakeholder-driven and should be embraced as a core value and a primary driver of company value, moving beyond mere regulatory compliance. A focus on short-term profitability risks missing the significant, market-wide sustainability movement and the opportunities it presents. And last but not least for IFRS preparers, it remains crucial to actively follow the evolving jurisdictional regulatory developments across Europe and in their specific member states.

Related content

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector