How to select the correct credit management tool?

Good credit management has multiple advantages: you can free up more working capital, more cash, and make better analyses on how profitable your customers really are. But don’t be mistaken: a customer with bad debt or a high cost of credit could harm your business. When you operate in a market with low margins, one bad debtor could sink your margins. Being able to manage and even foresee possible bad debtors could give you an advantage, enabling you to control your profitability margin.

When government support will have been withdrawn, over 50.000 bankruptcies are expected on top of the usual 10.000 bankruptcies. As consultants, however, we still see multiple companies without an end-to-end-dunning process, where AR officers centralize information, spending a lot of time on non-value-adding tasks.

Why choose a dedicated credit management software?

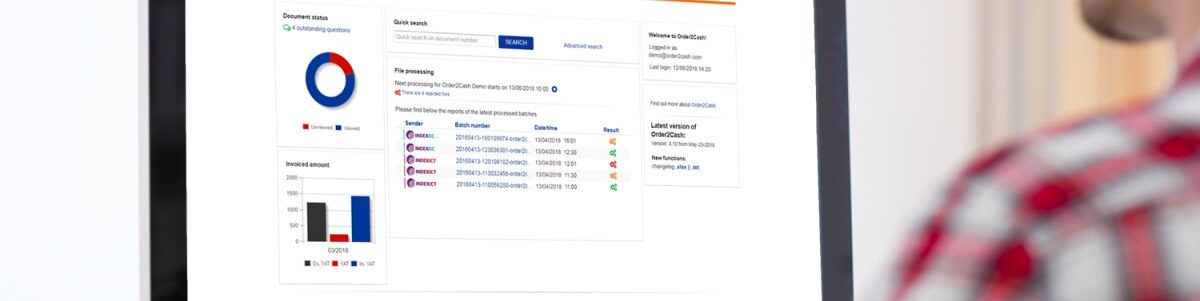

A lot of today’s credit department employees are working on ageing balances, sending dunning letters to their customers. These repetitive tasks can be automated by credit management software. The software can create clear tasks, insights and you can focus on what’s really important and is adding value to your business: managing your working capital, guiding sales, defining the creditworthiness of your customer with your own data. Most credit software also has a module for complaint handling. Never call a customer who filed a complaint before it is resolved, track the number of complaints, and solve them in a structured way.

The necessity of a custom implementation

It is highly likely that your company’s dunning strategy is unique (think about how you approach your customers and the dual character of accounts receivable, divided over data and the personal relationship), off-the-shelf software will not be beneficial. To get all your processes aligned, a custom implementation is necessary. As we are talking about a custom implementation, it does not mean it will break your bank. Even for small to medium-sized enterprises, using dedicated credit management software can give you a high return on investment.

Being able to manage and even foresee possible bad debtors could give you an advantage, enabling you to control your profitability margin.

Lander Coene

Define your objectives

In considering a credit management software, you should define your objectives: What do you want to achieve with this implementation? What is the main driver to do this change in your company? Here are a few objectives for your business. You can also take them into account in making your investment plan.

- I want to reduce my bad debt by X%

- I want to reduce the outstanding invoices by X %

- I want to minimize my DSO (days sales outstanding) to X

- I want to gain insights into my future cash flow

- I want to reduce the resolution time of my invoice disputes and keep better track of them

- I want a clear view of my outstanding tasks today

- I want a detailed report per customer on its payment behavior

Define your needs

After the clarifications of the goals of the project, you should describe the as-is situation to analyze the current credit management process flow. Consider the following issues:

- To optimize the credit collections process, you can list the different stakeholders and have a look into what could be adding value to their daily tasks. Which information should be where? How are complaints to be raised? How should they be treated? Next to this, create an overview of the reporting and insights into the credit process. Think of ageing reports, DSO reports or creditworthiness calculations for example

- How to organize your customer segmentation? With credit software, each customer can be approached differently and in a more personal way. Some customers need more reminders than others. Studies have shown that a more personalized way of contacting your customers results also in a better payment term. Think about the differentiation between letters and emails. However, this personalized way does not mean manual work. The software can help you automate these tasks.

- The credit collection process can be optimized per customer group. Never lose an invoice or a task again. Credit management software can set you and your colleagues up with the best to-do lists.

All this information will result in a new, ‘to-be' process that will not only involve the different business units in the process, but also the wishes of the collections and finance department to get a better insight into their credit department.

Related content

-

Blog

#takeaways ESG Webinar 12: Navigating the recent changes in the ESG reporting landscape

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector