- Know and get control of your value chain

- Be aware that climate change (E1) is the most demanding ESRS, with more than 200 data points

- Get your carbon accounting in place

- Make sure you have a well defined data management strategy

In the coming years, the sustainability landscape will be significantly impacted by ESG compliance. To assist organizations in addressing these challenges and requirements, TriFinance is organizing a series of webinars on related topics to share meaningful insights and best practices.

The ninth webinar, 'The environmental pillar of the European Sustainability Framework,' featured insights from TriFinance experts Mario Matthys, Koen Planckaert and Yannai Van Impe, who shared their knowledge with participants from various companies. Companies need to understand their impact on the environment and should gain insights on the actual and potential financial risk and opportunities that the environment can have on the company itself. Gaëlle De Baeck, Sustainability Lead at TriFinance, hosted the session.

The Corporate Sustainability Reporting Directive

ESG reporting is and will remain a moving target. We have seen several updates last year and these updates will continue in the years to come. Stay tuned for the EFRAG updates as they are relevant for your company as well, cfr. guidance on the DMA, updates disclosure requirements, etc. On their website you can also find an interesting FAQ overview. On 25 July 2024, EFRAG released an updated compilation of 188 questions, including 93 Explanations to respond to stakeholders’ technical questions on the ESRS, and 95 questions that were rejected as they had already been asked or answered. Click here to access the document.

As time passes by, we can conclude that it’s money time today for a lot of large companies to finalize their progress and to deliver their first sustainability reporting timely.

By mapping your entire value chain you gain a comprehensive understanding of your operational context and it will provide you with a full picture of how your business interacts with its external environment.

Yannai Van Impe, ESG Consultant TriFinance

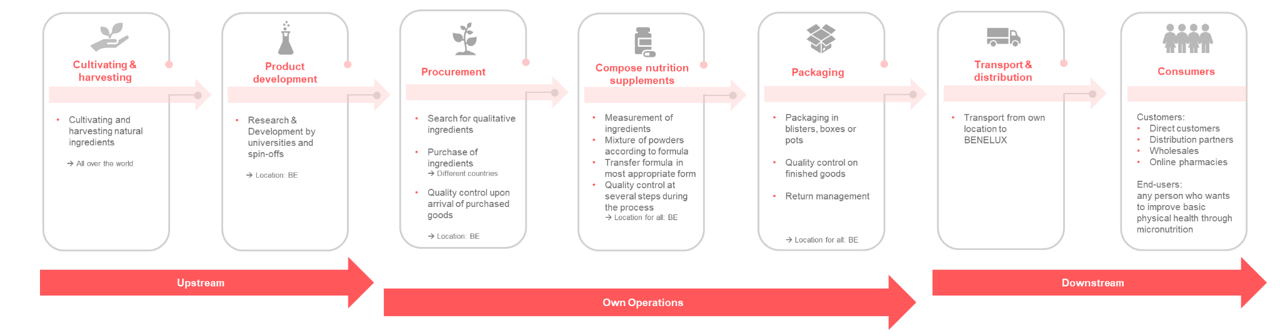

The importance of your value chain

The value chain plays a crucial role in mapping your organizational landscape. It involves all activities, resources and relationships across the entire lifecycle of your product or services offering. It includes your upstream value chain (actors upstream from the undertaking (e.g., suppliers) provide products or services that are used in the development of the undertaking’s products or services, your own operations and your downstream value chain (actors downstream from the undertaking - e.g., distributors, customers - receive products or services from the undertaking). So you need to report data of your entire value chain, and more particularly for the environmental pillar, you need to ensure that all aspects of your operations and their broader impact are assessed and reported in detail.

By mapping your entire value chain you gain a comprehensive understanding of your operational context and it will provide you with a full picture of how your business interacts with its external environment. It enables you to identify where significant Impacts, Risk & Opportunities (IROs) arise, which impacts all ESRSs. It helps ensure that sustainability efforts are not limited to only your direct operations, but also extend to every dimension of your value chain. This approach will lead to more effective and meaningful outcomes.

Important: not all disclosure requirements require value chain information. Yet it is crucial when material IROs arise beyond your company’s direct operations.

Why is the value chain so important? The CSRD and ESRS require that the sustainability statement includes material information about the upstream and downstream value chain. Take into account these guidelines:

- Focusing on own operations would provide only a partial picture of the impacts on people and the environment connected to the undertaking’s activities, products and services - eg. an electronic’s producer may have certain processes in place to control and minimize the packaging and other waste of its own operations, but these products may create electronic waste which can be harmful for animals or other wildlife when discarded.

- Focusing on own operations would not allow for an appropriate identification of risks and opportunities - eg. a European retailer creates toys in a non-EU factory using wood.This factory faces lenient legal requirements, leading to significant environmental and health risks from dust and chemicals. Workers and local communities are exposed to severe health hazards, which is crucial for assessing impact materiality. Financially, if local officials begin enforcing laws instead of accepting bribes, the manufacturer could face significant fines or closure, directly impacting the retailer.

Practical example on how to compose your value chain:

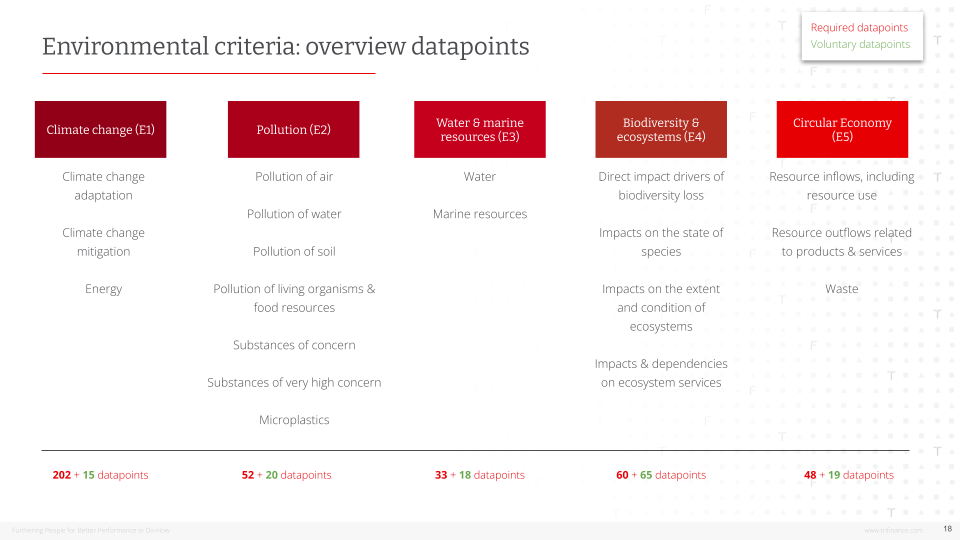

Disclosure requirements relevant for environment (E1, E2, E3, E4, E5)

Each ESRS is composed of both qualitative and quantitative reporting requirements. The qualitative part requires detailed reporting on key aspects such as governance, strategy, IRO management which involves detailed information about IROs, policies, processes and actions to mitigate potential negative impact. On the other quantitative side we see metrics and targets on which should be reported: measurable data that reflects your organization’s performance in various environmental, social and governance areas.

When we dive deeper into the environmental pillar of sustainability reporting, data points play an important role, not the least because of their volume. In total companies need to report on 395 required data points + 137 voluntary data points. Climate change (E1) is the most demanding ESRS, with more than 200 data points.

In total companies need to report on 395 required environmental data points + 137 voluntary environmental data points. Climate change (E1) is the most demanding ESRS, with more than 200 data points.

Koen Planckaert, ESG Consultant TriFinance

ESRS E1: Climate change

The objective of ESRS E1 Climate Change is to enhance transparency and accountability on how companies address climate change. It requires them to disclose efforts in reducing emissions, adapting to climate risks, and managing related risks and opportunities. This supports the EU’s sustainability and carbon neutrality goals, ensuring stakeholders have access to standardized climate-related information for informed decision-making.

The primary goals include mitigation and adaptation. Keep in mind that there are also EU regulations aligned with these objectives, such as the Energy Efficiency Directive (EED), the Renewable Energy Directive (RED), and the Carbon Border Adjustment Mechanism (CBAM).

Scope 1, 2 & 3 emissions explained

- Scope 1: company’s direct emissions, Including emissions from sources that are, example: company cars

- Scope 2: emissions from indirect sources, emissions created elsewhere during production of energy and purchased by the company.

- Scope 3: company’s indirect emissions, from indirect sources not owned by the company but result from the reporting company’s activities.

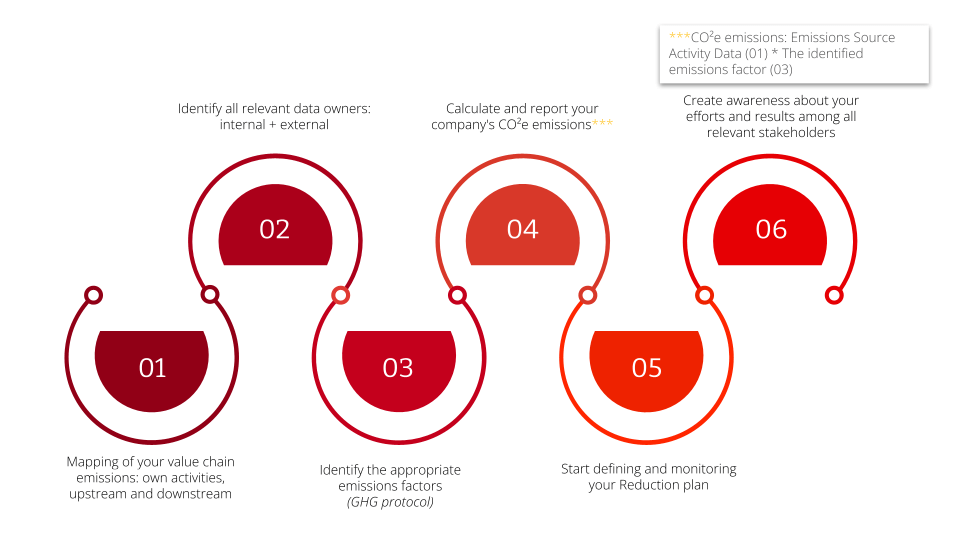

ESRS E1: Carbon accounting roadmap

Follow the different steps to create your carbon accounting roadmap:

ESRS E2: Pollution

Pollution is part of the European Sustainability Reporting Standards (ESRS) and is designed to instruct companies on how to report their impact of non-GHG pollution (e.g. Ozone (O3), Nitrogen dioxide (NO2), Carbon monoxide (CO), Sulphur dioxide (SO2), Particulate matter (PM10 and PM2.5) to air, soil and water.

The objective is to ensure companies disclose comprehensive information on how their activities contribute to or mitigate pollution. It focuses on transparency regarding the impact of corporate operations on air, water, and soil quality, as well as their efforts to minimize harmful emissions and substances. These are all the pollutants not covered under ESRS E1, which focuses solely on greenhouse gases (GHGs).

ESRS E3 - Water & marine resources

The objective of E3 Water and Marine Resources is to promote transparency on how companies manage and impact water and marine ecosystems. It focuses on sustainable water use, protecting marine resources, managing related risks, and preserving ecosystem health. The goal is to ensure responsible practices that support water conservation and marine biodiversity.

ESRS E4 - Biodiversity

The objective of E4 Biodiversity is to promote transparency on how companies impact biodiversity and ecosystems. It focuses on biodiversity conservation, sustainable resource use, managing risks related to biodiversity loss, and preserving essential ecosystem services. The goal is to align corporate practices with broader efforts to protect and restore natural habitats. Keep in mind that there are also EU regulations aligned with these objectives, such as the EU Biodiversity Strategy for 2030, the EU Nature Restoration Law and the EU Deforestation regulation.

ESRS E5 - Resource use & circular economy

The objective of E5 Resource Use & Circular Economy is to promote transparency on how companies manage resources and adopt circular economy practices. It focuses on efficient resource use, recycling and waste reduction, and innovation in sustainable business models. The goal is to support the shift toward resource-efficient and sustainable operations. Here is where your value chain traceability is foremost important. Keep in mind that there are also EU regulations aligned with these objectives, such as the EU Circular Economy Action Plan (CEAP) and the EU Critical Raw Material Act.

Be careful on how you communicate your environmental performance. It is important to share your efforts and progress, but this will also be regulated in the near future by the EU Green Claims Directive and the EU Greenwashing Directive. Common goals of these directives is to create transparency about the sustainable character of products throughout their entire life cycle and to give confidence to consumers about the communicated sustainable labels.

Key takeaways

In conclusion, the key message of this ninth webinar is to successfully comply with the environmental pillar of the CSRD, you need to know and get control of your value chain. Be well prepared before you start and don’t underestimate the impact of the ESRS, especially the most demanding ESRS: climate change. Get your carbon accounting in place and make sure you have a well defined data management strategy. And don’t forget to keep other related environmental legislations in mind as it does not end here…

Discover more about our sustainability approach

Sustainability goes beyond mere reportingRelated content

-

Article

How Belgian C-Suite executives view financial reporting

-

Blog

Lessons from the Belgian e-invoicing frontline

-

Blog

#takeaways ESG Webinar 12: Navigating the recent changes in the ESG reporting landscape

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector