- Cloud first strategy for business applications drives process standardization and role changes

- “Fit to standard” demands strong change management and adaptation of way of working

- The current “clean core” ERP concept requires rethinking the enterprise architecture and structured data governance

- Don’t just follow the hype: focus AI adoption on clear use cases with defined scope and real tangible business value

- Finance teams need stronger data/tech skills, requiring training and a different hiring focus

Finance Transformation is a critical process that reimagines the Finance function to become a trusted business partner, ensuring continuous improvement and agility. A successful transformation requires a clear vision, strategic planning, and the right mindset to overcome challenges. It involves making finance more dynamic, adaptive, and aligned with overall business goals.

To support you on this journey, we are hosting a series of webinars focused on key topics to help you address common challenges, gain valuable insights, and implement best practices. The fourth webinar ‘Driving Finance Transformation with Innovative Business Applications’ featured insights from TriFinance experts Johan Reunis and Cosie Goudesone, who shared their knowledge with participants from various companies. They discussed how innovative business applications can drive finance transformation, taking into account current trends and insights from our recent CFO survey.

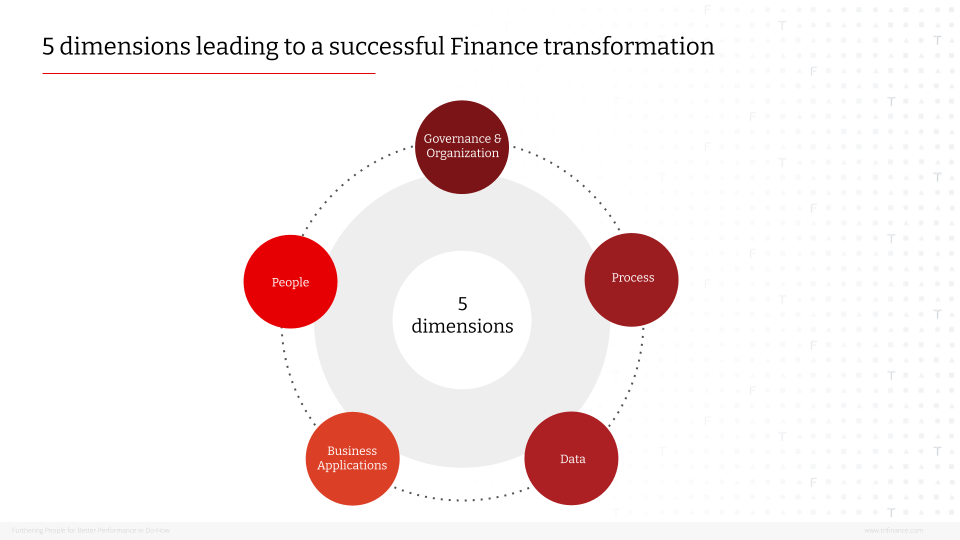

Five dimensions leading to a successful finance transformation

As shared in earlier webinars, we see five different dimensions that have an impact on a successful finance transformation: governance & organization, process, data, business applications and people. All dimensions are interconnected and influence one another. To achieve a successful finance transformation, each must be addressed comprehensively.

- Governance and organization: The organization and governance of the finance department encompass the visioning process—from defining the mission, values, and goals—to establishing the organizational model, which includes clear roles and responsibilities, governance structures, escalation and validation procedures, policies, instructions and guidelines, communication processes, as well as business relationships and service level agreements (SLAs).

- Process: This dimension includes the sequence of activities and their interdependencies, lead times, efficiency, workload, and quality, as well as the degree of standardization and the extent of process automation, including the use of workflow automation tools.

- Data: The data dimension covers the granularity of information, data quality along with associated controls and monitoring, the use of data analytics and predictive capabilities, the management of insights and information, and the effectiveness of reporting and business intelligence (BI) capabilities.

- Business applications: This dimension encompasses system architecture and integration, the use of end-user computing tools, the adoption of intelligent process automation (IPA), artificial intelligence (AI), and machine learning (ML), as well as the flexibility of systems to accommodate changes.

- People: The people dimension includes the necessary skills and competencies, mindset and organizational culture, talent and performance management practices, as well as ongoing training and coaching efforts.

Structured change management will become increasingly important to ensure adoption of new ways of working, driven by standardized processes in cloud-based applications.

Johan Reunis, Expert Leader Business Integration

Trends in Business applications and Finance Transformation

We see different trends in how business applications can support your finance transformation, both in daily practice at our clients and in the outcome of our recent CFO survey.

Cloud first strategy

According to the respondents of our CFO survey, insufficient technological infrastructure is the second largest obstacle in the optimization of your finance operations (after “Resistance to change”). We see a clear move to cloud first, with the advantage that cloud infrastructure can easily be deployed and upscaled.

The trends of cloud first strategy include scalability & future growth, start with best practice processes, less custom developments, different deployment options depending on flexibility (public cloud vs private cloud), subscription-based pricing model.

These trends have an impact on all dimensions of finance transformation:

- Processes: it requires the adoption of standardized best practice processes

- People: more functional knowledge is required, less need for technical experts

- Applications: enhanced scalability and agility but less control

- Data: improved data security and compliance, however depending on cloud provider

Composable ERP

According to the respondents of our CFO survey, a quarter (25,1%) of their investment budget for the coming two years goes to the implementation of next-generation ERP and the integration between ERP and different applications. Composable ERP is going even further: ERP will cover the core processes and additional modules or apps are connected to the ERP system to cover other needs.

The trends of composable ERP include a modular ERP approach that allows organizations to select and integrate best-of-breed applications (<> traditional monolithic ERPs). Next to that we see the integration of ERP with specialized tools and microservices such as budgeting and forecasting, reporting (e.g. Power BI, SAC), accounts payable automation (e.g. Coupa) and expense management (e.g. Concur).

These trends have an impact on all dimensions of finance transformation:

- Processes: difficult management of process knowledge and process documentation across applications

- People: specific skills depending on the applications

- Applications: multiple systems that all require maintenance and support, more (standard) APIs, importance of robust middleware

- Data: data consistency and governance across different systems, reporting on multiple data sources that need to be combined into one data lake

Artificial Intelligence

AI is today’s buzzword, also according to the respondents of our CFO survey: Two third of CFOs (65,9%) say that AI is one of their top 3 technological priorities. The challenge will be to explore the potential as well as the limitations, as AI will definitely not solve all our challenges.

The trends of AI include the automated financial processes with reduction of manual errors and inefficiencies, AI workflows (automated invoice processing and approvals), chatbots and virtual assistants for ad-hoc financial insights (Microsoft Copilot, SAP Joule, …). However, our advice is not to start implementing AI without a viable business case and learn what it can bring to your organization. Think of examples such as financial forecasting and budgeting (e.g. predictive analytics), invoice and payment processing (e.g. matching via machine learning, cash flow prediction) and fraud detection (e.g. in expense analytics).

These trends have an impact on all dimensions of finance transformation:

- Processes: more focus on validation and monitoring instead of manual execution

- People: train people in the intelligent use of AI, e.g. prompts and security, specific profiles and see AI as a companion on your journey

- Applications: system access and security, audit trail

- Data: data access and security need to be taken into account when introducing AI in your organization.

Standardization

Standardization is often linked to cloud strategy. The respondents of our survey share that improving process efficiency (48,3%) and the integration of finance with other business functions (44,2%) are your top priorities for the next 3 years.

The trends of standardization include the drive to unify processes across locations and countries (global templates, taking the local requirements into account), adoption of best practice processes, centralized master data management, central data model leading to unified reporting and the need for change management initiatives to increase adoption rate as the impact on the way of working will be significant.

These trends have an impact on all dimensions of finance transformation:

- Processes: potentially significant changes in current processes, increased need for governance

- People: change way of working, other roles and responsibilities, importance of change management

- Applications: more efficient maintenance of central/standard system

- Data: better reporting capabilities across locations, be aware of uniform data definitions

A successful implementation focuses on all 5 dimensions of a finance transformation and not solely the business application itself.

Cosie Goudesone, Project Manager TriFinance

Practical examples of how business applications are driving finance transformation

During the webinar we shared two reference cases where we showed the impact of business applications in finance transformations. Often manual processes were translated into standardized processes with new applications and new roles and responsibilities. This resulted often in many challenges throughout all dimensions during the rollout with high impact on the new way of working.

If you are interested in discussing these practical examples or the challenges of your own organization, please contact us via financetransformation@trifinance.be.

Conclusion

In conclusion, the key message of this TriFinance Finance Transformation webinar is clear: business applications are powerful enablers of finance transformation. The shift to cloud solutions is driving standardization and redefining roles, while the “fit-to-standard” approach demands a strong focus on change management. Transitioning to a clean core ERP, supported by a flexible ecosystem, calls for a fresh look at your application architecture and data governance. When integrating AI, don’t just follow the hype as success depends on having a clear use case and a solid business case. Finally, as technology becomes more embedded in finance, building data and tech literacy—through targeted training and smarter recruitment—will be essential.

More on Finance Transformation

Webinar calendar and insightsRelated content

-

Blog

Embedding Third-party Risk Management into strategic resilience

-

Reference case

Setting the standard for CSRD at a leading European retailer

-

Article

Beyond complexity: Driving sustainable change at a large Belgian insurer with TriFinance

-

Blog

Growth Story: Jorn Hillaert – Building change through people and co-creation

-

Blog

How cross-functional teams strengthen climate risk assessments

-

Article

The CFO's near moral duty to take the lead

-

Career in Internal Team

Client Partner | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Consultant – Business Controller

-

Career in Internal Team

Data Engineer