Why Finance can be the engine of data-driven organizations

19 September 2025For 25 years we’ve been told that organizations need to become 'data-driven.' The term gained real traction with the rise of big data around 2010 and has become almost a management cliché over the past decade. But how far have we actually come, and is it Finance’s role to take the lead?

The shift toward data-driven finance and, more broadly, toward an organization with a data-driven mindset, is a logical evolution. CFOs and their teams are in a strong position to accelerate that development. Doing so, however, requires a sharp, forward-looking vision. To explore this challenge, we brought together a group of TriFinance experts for a roundtable discussion.

Why Finance should be data-driven

Why is it essential to operate in a data-driven way, both within Finance and across the broader organization? What concrete technical, process, and organizational steps are needed to turn analytics into a true strategic lever?

Four of our experts discuss these questions:

-

Jean-Alexis Dombret, Business Unit Leader, Transition & Support, Louvain-la-Neuve

-

Stuey Hamelink, Project Manager, Public Sector

-

Maarten Lauwaert, Business Unit Leader, Management Information & Systems and Expert Practice Leader, Data & Analytics

-

Stéphanie Struelens, Business Unit Leader, Pragmatic Advisory & Implementation for Financial Institutions

Data-driven Finance: From numbers to strategic insights

What does data-driven finance look like in practice? “Using financial and other data to make better, structured, and evidence-based decisions,” says Jean-Alexis Dombret, offering a straighforward definition. Stuey Hamelink echoes this view: “It means that decision-making in Finance, and across the organization, is not based on gut feeling. Decisions, optimizations, and, where needed, transformations are guided by data and solid rationale.”

More data, more analytics: Technological and cultural evolution

Finance and data have gone hand in hand for decades, but today Finance is far more data-driven than in the past.

“It has always been about numbers, but the playing field has expanded,” says Maarten Lauwaert. “Everything that happens operationally within a company generates data, and organizations are making more use of it today.”

A similar trend is visible within Finance departments. “Where Finance once focused on standard reports and data that had to be requested from other departments, today’s teams increasingly dive directly into raw data themselves.”

According to Stéphanie Struelens, this broader scope is partly thanks to technological advances. “Innovations like AI in financial reporting and advanced analytics strategies give organizations the tools to accelerate. They can enrich data, combining internal and external insights, and have access to tools that extract much more value, including powerful capabilities for predictive analytics in Finance.”

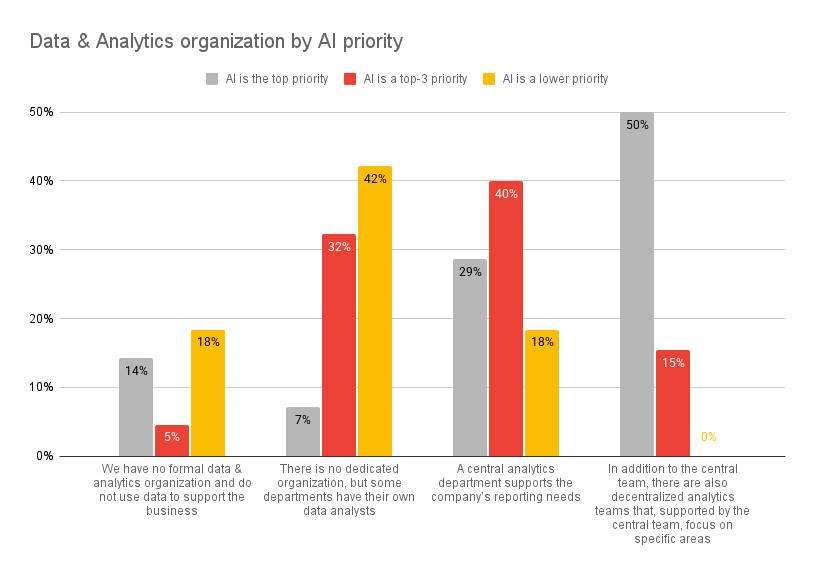

Recent TriFinance research confirms this trend: companies that invest heavily in artificial intelligence (AI) generally have a more mature data and analytics organization. Half of the companies that regard AI as a top priority have, in addition to a central analytics department, decentralized teams supporting finance data analytics initiatives.

In data-driven finance, decisions, optimizations, and transformations are backed by data and solid reasoning

Stuey Hamelink, Project Manager Public Sector

From compliance to strategy

The number of reporting requirements is increasing rapidly. The panel observes that companies, organizations, and governments are facing ever-growing reporting obligations. At the same time, there is a growing recognition that financial data and finance data analytics can serve as a strategic lever.

“Whether it’s financial figures, sustainability, or policy impact, authorities expect accountability,” says Stuey. “That naturally leads to data and reporting, with Finance consistently playing a key role.”

The banking sector illustrates this new reality, according to Stéphanie. “Since the financial crisis, regulations have increased significantly. This requires not only more data and finer granularity, but also compliance in the financial sector and a stronger focus on master data governance.”

“Because of this, investments for many years focused primarily on legally mandated financial reporting,” she explains. “Management reporting and the strategic use of data received less attention. But that shift now seems to be gradually taking place.” Jean-Alexis also sees awareness growing: “Data doesn’t have to just describe the past. With a well-developed predictive analytics strategy and robust finance and data analytics capabilities, you can anticipate trends and make better decisions.”

Finance taking the lead in strategic data initiatives

Finance has a clear responsibility in this, emphasizes Maarten. “Meeting reporting obligations is obvious. But use this momentum to do more with data and elevate the data-driven mindset to a higher, strategic level. That’s where the real value lies.”

This shift requires collaboration, but Finance can take the lead. “It makes sense for the lead to come from those closest to financial data, data management, and the broader data strategy,” Maarten concludes.

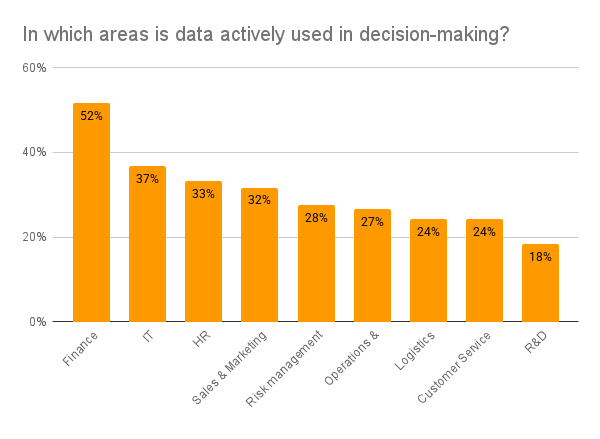

The research also looked at which departments base their decision-making on data. It’s no surprise that Finance comes out clearly on top. Yet there’s still plenty of room for improvement, especially in Belgian companies and from the perspective of leaders other than the CFO.

It’s a shift CFOs and their teams should kick off sooner rather than later. “The volume of data streams isn’t getting any smaller,” says Jean-Alexis, “and the world is moving so fast that the time to make decisions has shrunk dramatically. Waiting weeks for a dataset and then analyzing it at leisure is simply unthinkable in 2025.”

Finance as the engine of a data-driven strategy

“The abundance of systems and (financial) data is actually the biggest challenge,” says Stuey, translating this into a data-driven perspective. “It’s not easy to maintain an overview in the jungle of ERP, BI, and other applications.”

For business to develop a data-driven strategy, it all starts with fundamental questions: what does the organization really want to know and measure? “That step is still often skipped. Technical teams start from the data that’s available and turn it into polished reports. But are these the insights that truly matter to the business?”

This is why Finance should take the lead: asking the right questions and filtering out unnecessary or siloed data, a role that also requires a shift in personal mindset. Understanding the basics of data engineering skills (how data is collected, structured, and made accessible) helps Finance professionals bridge the gap between raw data and actionable insights.

Maarten adds: “Anyone who wants to be a true business partner must do more than interpret financial numbers. You need an interest in the business, in finance data analytics, and you need a solid data strategy. You don’t need to be a data science or data engineering expert, but familiarity with data tools and data management is essential. Technological innovations, such as predictive analytics in Finance, pave the way.”

This interest and foundational knowledge also help mobilize the rest of the organization, the experts emphasize. “That’s a crucial task,” Stéphanie adds. “A healthy interplay, where Finance becomes more data-driven and Operations more finance-driven, is essential.”

Data strategy

Anyone looking to leverage data & analytics to strengthen business strategy first needs a clear data strategy. This goes beyond simply asking the right questions. Ad hoc or disconnected data projects should be avoided.

“Given the significant costs involved and the need to secure management support, you must put a clear vision on paper,” says Maarten. “Once you invest, you embark on a path you ideally shouldn’t deviate from. Carefully consider the scope: don’t overextend yourself and assess how much value the data actually adds. Also think about the systems and capacity required. These systems need maintenance, and your people need training.”

In short, a data-driven organization relies on strategically grounded investments in people, technology, and processes. “Data are always the final piece of a process,” says Stuey. “Careful reporting provides insight into how processes can be optimized, making data more reliable and accurate.”

It makes sense for the lead to rest with the people who are naturally closest to the financial data, the data landscape, and the broader data strategy

Maarten Lauwaert, Expert Practice Leader Data & Analytics

Data management

The people–systems–processes triangle is a powerful but double-edged sword, says Stuey. “It can accelerate a transformation, but real progress only happens when all three are in balance.”

A critical factor often overlooked is data culture. “If an organization isn’t accustomed to working with data and doesn’t properly maintain its systems, the value of a new data infrastructure will not materialize. Data culture is therefore a true success factor.”

Data quality is equally crucial: missing, incorrect, or duplicate data can undermine any strategy. The guiding principle: address it from the start and embed data quality considerations into your vision and data strategy. Maarten notes, “Data management often only comes onto the agenda when something goes wrong. By then, it’s too late. Fixing issues is always more expensive than preventing them.”

Change management is essential to remove barriers. Human, technical, and process aspects are tightly intertwined.

“Many companies carry trauma from previous system implementations or migrations,” says Stéphanie. “Everything goes according to plan and stays within budget until the data migration starts: transferring history, mapping data. That’s when things often go off track. As a result, organizations often fear starting new data projects, uncertain about the investments opening this ‘Pandora’s box’ will require.”

Related insights

Discover more about Data & Analytics and get inspired to build your own data strategy and architecture. Explore our insights, reference cases, and solutions.

Related content

-

Reference case

From back-office support to informed business insights at OMP

-

Article

Boomerang story: “Leaving showed me how unique TriFinance really is.”

-

Article

From e-invoicing compliance to a scalable finance architecture

-

Article

Building a scalable financial backbone for pan-European growth at Macadam Europe

-

Article

AI in the boardroom: From pilot to priority

-

Article

Where background stops defining the future: consultancy paths open up at TriFinance

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector