- Approximately 50.000 companies have to report from 2026 on in line with the EU taxonomy

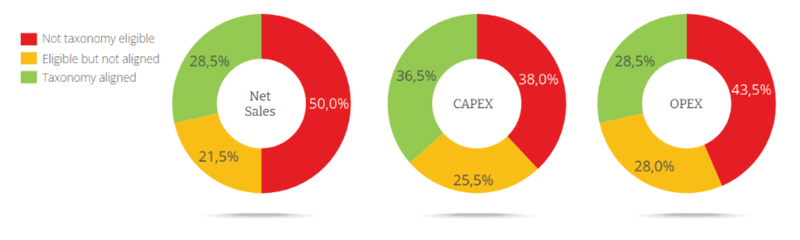

- Reporting on three different levels: Revenue, CapEx & OpEx

- Plan enough time for your taxonomy-project: time management is key

- Key data management is important, especially in the long run

- Taxonomy disclosures provide valuable information on a company’s sustainability ambition and performance

In the coming years, ESG compliance will have a significant impact on the sustainability landscape. To assist organizations in addressing these challenges and requirements, TriFinance is organizing a series of webinars on related topics to share meaningful insights and best practices.

The fifth webinar, 'The EU Taxonomy: what does it bring to the table’ featured insights from TriFinance experts Emilie Pitchot and Jan-Hendrik Paul, who shared their knowledge about the EU Taxonomy and the pragmatic roadmap to comply with this reporting framework. They presented practical examples and insight to get you started. Gaëlle De Baeck, Sustainability Lead at TriFinance, hosted the session.

The EU Taxonomy: what, scope and timing

An important element of the European Green Deal is the EU Taxonomy, one of the mandatory directives of ESG reporting. The EU Taxonomy is a classification system that indicates which economic activities are considered sustainable, requiring companies and investors—funds and real estate entrepreneurs—to demonstrate the sustainability of their investments. Resulting in fostering transparency for financial market participants and large companies related to EU Taxonomy.

Scope and timing: which companies need to report when?

- Already obligated to report: listed companies that exceed 500 employees

- In 2026 for 2025 figures: if you exceed two of the following three KPIs:

- > 50 mil. EUR revenue

- > 25 mil. EUR balance sheet total

- > 250 employees

- In 2027 for 2026 figures: every listed small and medium company except micro-enterprises

The eligibility & alignment assessment

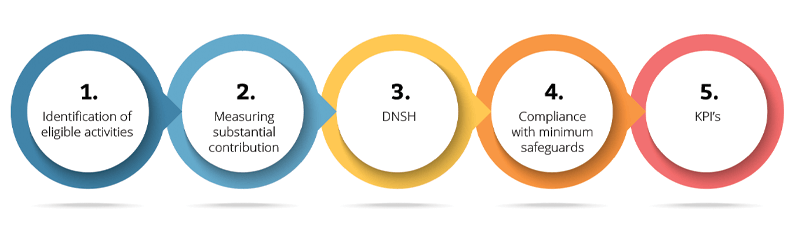

Companies have to take several steps to report in line with the EU Taxonomy. The first one is to assess the eligibility of your business activities.

When are you eligible?

The eligibility threshold for economic activities are defined in different EU regulations. One way to check your economic activities as a company is to use the NACE codes of your company.

When are you aligned?

An economic activity is considered environmentally sustainable / EU Taxonomy aligned if

- Substantial contribution criteria (SCC): The company is making a substantial contribution to at least one environmental objective

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection & restoration of biodiversity and ecosystem

- Do no significant harm: The company is doing no significant harm to any other environmental objective.

- Minimum social safeguards: The company is complying with the minimum social safeguards (OECD Guiding Principles on Business and Human Rights, Declaration of the International Labour Organization, International Bill of Human Rights).

Stay constantly connected with your auditor and align every milestone to ensure you don't get off course

Jan-Hendrik Paul

Reporting on KPIs

Companies have to report the listed KPIs for every identified economic activity:

- Revenue

- CAPEX: Investments in the reporting year to maintain and expand eligibility and / or aligned activities, to develop an eligible activity to an aligned one, to reduce your CO²-emissions

- OPEX: Not capitalized R&D expenses, Leasing, Building renovation, Maintenance and repairs

The importance of data management

Companies have to expand the key data information for their product portfolio and investments to create a high quality taxonomy report that can be recreated year over year without much effort. Current ERP systems don’t include data needed for the EU Taxonomy which will definitely lead to a higher workload in the coming year. Be well prepared for the EU Taxonomy as in the long run you will benefit from key data management.

Beyond reporting - EU Taxonomy as a strategic tool

We have pointed out this many times already: sustainability goes beyond mere reporting; it initiates a journey toward transformation. The EU Taxonomy is relevant for all companies, whether your company is eligible or not. It is a great tool to define the strategy and transition plans for your company. Take a look at these KPIs:

- Revenue: Gives a clear picture of where a company currently stands relative to the Taxonomy → Companies without activities eligible to the taxonomy can still aligned with the EU Taxonomy through CapEx and OpEx

- CapEx: Key variable for assessing the credibility of a company’s strategy, transition plans and/or environmental sustainability performance and resilience.

- Taxonomy-aligned CapEx, 3 ways:

- Related to assets or processes that are associated with Taxonomy-aligned activities

- Part of a plan to expand Taxonomy-aligned economic activities or to allow Taxonomy-eligible economic activities to become Taxonomy-aligned (“CapEx plan”) (within a period of five years)

- Related to the purchase of output from Taxonomy-aligned economic activities and individual measures enabling the target activities to become low-carbon or to lead to GHG reductions.

With the increase of data availability, Taxonomy disclosures will provide meaningful information on the level of sustainability ambition and performance of companies.

Emilie Pitchot

Link with CSRD and SFDR

Just as the EU Taxonomy, the CSRD and SFDR are two mandatory directives for ESG reporting. All three directives share the same purposes: reorient capital flows to sustainable investments, foster greater transparency and long-termism in financial & economic activity to achieve sustainable growth and manage financial risks arising from climate change.

- The link between SFDR and the EU Taxonomy: Financial market participants must disclose taxonomy alignment KPIs for financial products with sustainability claims that are marketed or manufactured in the European Union.

- The link between CSRD and the EU Taxonomy: Both frameworks have shared objectives related to combating climate change (the 6 objectives of the EU Taxonomy and ESRS E1, E2, E3, E4 and E5). The compliance exercise of the minimum safeguards (step 4 within the EU Taxonomy roadmap) overlaps with the objectives of the disclosure requirements of business conduct (G1) and the social standards of own workforce (ESRS S1) and consumers and end users (ESRS S4). The CSRD is expected to incorporate elements of the EU Taxonomy by requiring companies to disclose information on how their activities align with the taxonomy's criteria for sustainability.

In conclusion, be well informed and prepared about the necessary steps for the EU Taxonomy directive. During this fifth webinar we provided an overview of the different steps in the roadmap to comply with the EU Taxonomy. Just as for the other ESG directives, data management is key in order to be able to complete the reporting requirements timely. Many companies have not yet started with this exercise. We can only advise you to get started as soon as possible as you will need time and resources to be able to comply.

Discover more about our sustainability approach

Sustainability goes beyond mere reportingRelated content

-

Article

How Belgian C-Suite executives view financial reporting

-

Blog

Lessons from the Belgian e-invoicing frontline

-

Blog

#takeaways ESG Webinar 12: Navigating the recent changes in the ESG reporting landscape

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector