5 tips to collect cash fast and effectively

- Maximize your collectors’ cash flow contribution

- Make collectors pick up the phone to get ‘facetime’ with customers

- Redefine KPIs in function of the cash flow consumption

Growing a business is hard work. But it’s almost impossible to grow if you don’t properly manage cash flow and its underlying processes. Effective cash flow management is crucial to the overall health of the company as it ensures the pre-financing of the daily operational activities.

Credit managers should focus on the company's overall profitability

One of the main underlying processes is debt collection. Unfortunately, debt collection is often seen as a ‘necessary evil’, rather than a strategic business process and is also treated this way. All too often, debt collection is treated as a stand-alone process, in a department that does not collaborate with other stakeholders.

Lately, a consensus has emerged in Credit Management circles that credit managers should not exclusively be chasing outstanding debt, but adopt a coordinating role. Especially in our current situation, where working capital and healthy cash flow are top priorities for companies struggling to survive, credit managers should focus on the company’s overall cash position.

During Corona, Cash Flow is a top priority

As the environment in which we operate is changing faster and faster, business processes and rules have become more dynamic, needing constant monitoring.

With cash flow a top priority under the Covid-19 threat, business processes and rules are being altered continuously to counter that threat. The debt collection process is no exception here. You could even say it is in the eye of the storm.

The credit manager needs to share his insights here, and together with other departments organize the 'maintenance' of these processes to ensure that they actually reflect the changing environment.

Here are a 5 tasks that should be at the top of every Credit Managers' priority list.

1. Review the debt collection process

The first process to be reviewed is the debt collection process. In most cases, debt collection focuses on minimizing accruals, bad debt, and reducing the DSO. The parameters are mainly P&L-driven, not cashflow-driven. Very rarely, there’s a reflex to collect the outstanding amounts with the biggest cash flow impact first.

When collecting, you typically start from the due date, but perhaps you should start earlier, from the shipment date, inventory date, or the production date, as that is the date at which you start to ‘pre-finance’ the sale.

Perhaps you can alter your payment terms and/or organize sales differently asking for advance payments. In ‘Practices in Collecting Cash’, Jean-Marie Bequevort emphasizes that 32 percent of Belgian companies taking part in our research use partial or full upfront payment.

For each invoice, you need a business rule to determine its cash flow impact, based on the amount outstanding, the production/inventory or shipment date and the spread

Benjamin Celis

2. Review business processes in the dunning software

In any case, a strong collaboration with Sales is key, sharing insights (in OTC processes & cash flow consumption), elaborating the ‘best possible sale’. These days, the credit manager is gradually turning into the sales department’s co-pilot.

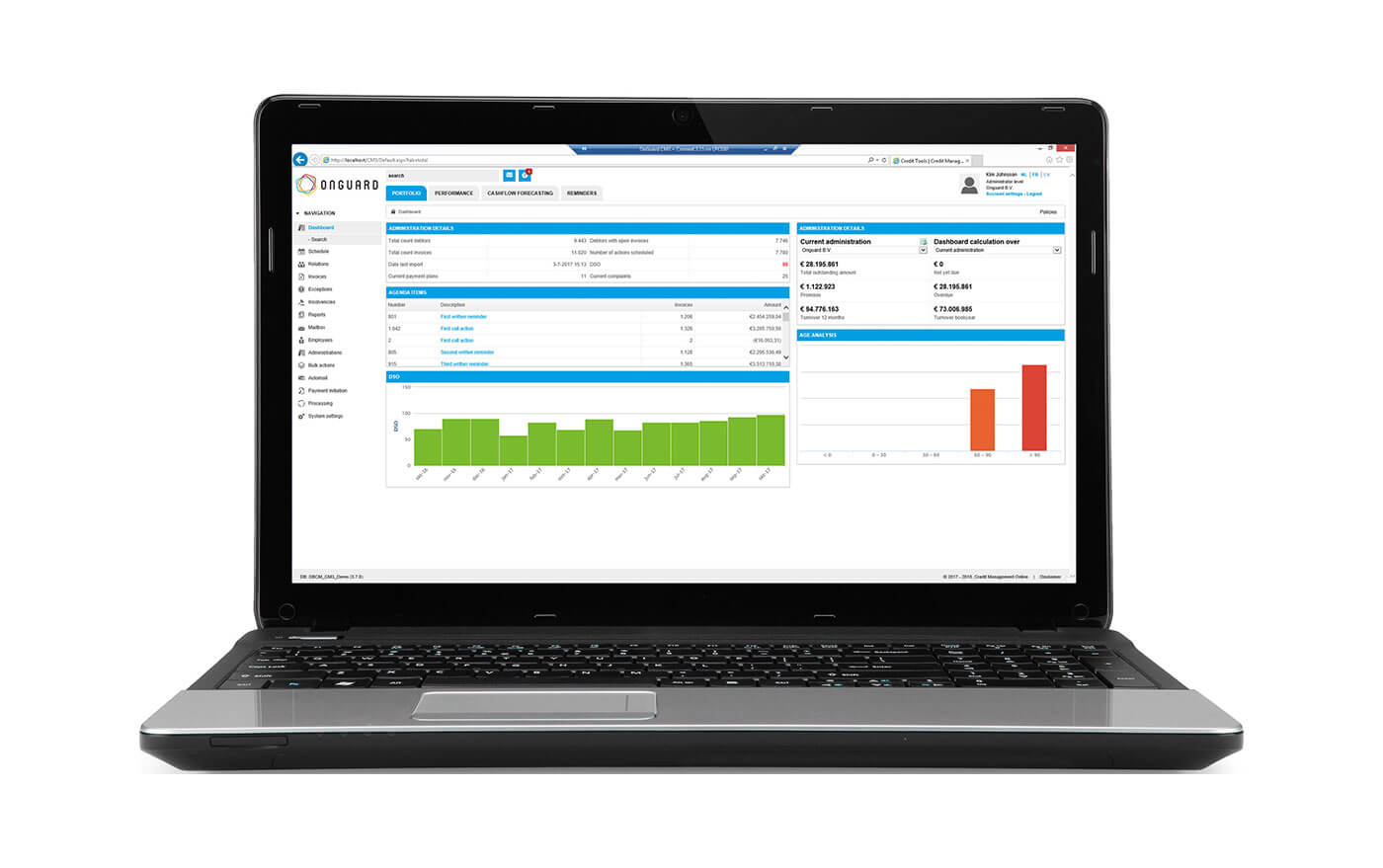

In regard to this new setting, the credit manager should also review the business processes in the existing dunning software. Would you still like your collectors to just execute the daily activities formulated by your dunning software, which are based on the ‘old normal’ and thus obsolete? Or would you like to design a different process, focusing on your cash flow ?

When deciding to set up a new process design, you should maximize your collectors’ cash flow contribution. You don’t want collectors to spend time on small amounts with a low chance of collecting. The best thing to do in that case is to outsource the collection of these small amounts to a collecting agency with a no-cure no-pay agreement.

3. Prioritize collection by your outstanding's cash flow impact

To maximize your cash flow contribution, you should set up your system in such a way that the collecting of the outstanding is prioritized by its cash flow impact, rather than prioritizing by overdue buckets.

For each invoice, you thus need a business rule to determine its cash flow impact or consumption, based on the amount outstanding, the production/inventory or shipment date (as a starting point), and the spread (number of days beyond payment terms) to follow up.

An example might shed some light on the relevance of this adaptation: the cash flow impact of a 5.000 euro sale to a customer around the corner with a payment term of 30 days invoice date and a spread of 6 days is completely different from the cash flow impact of a 500.000 euro sale to a customer in China (with an INCO-Term DAP, DPU or DDP, 2-month shipping and 7 - 14 days customs clearance (or even longer), which must be pre-financed), a payment term of 30 days invoice date and a spread of only 2 days.

The China sale has a much bigger cash impact. Yet most dunning systems will first define an action for the customer around the corner when the invoice has moved to the overdue bucket '5 - 15' days, triggering the system to send a reminder letter, although both invoices have become payable.

With the quarter-end closing coming up, collectors should grab the phone and/or visit the customer

Benjamin Celis

4. Create real added value through facetime with customers

Once you have reviewed the ‘prioritizing rules’ in your dunning software, you have to review the method to collect the outstanding. You don’t want to send ineffective reminder emails to customers with an exposure that has a high cash flow impact. You need the collecting efforts to be as effective as possible, making facetime with these customers a necessity.

Real added value is actually only created through facetime with customers, whether it’s sales, CS or collecting. These days, with the quarter-end closing coming up, your collectors should grab the phone and/or visit the customer in order to collect. At the same time, your collectors should work out ‘tailormade’ agreements to follow up the exposure, to ensure that all complaints and anomalies like missing invoices are addressed in the best possible way to minimize their cash flow impact.

5. Rethink your KPIs

Last but not least, you also have to rethink your KPI’s, as they should reflect the 'new' normal and you surely want to monitor the effectiveness of your new collection approach. To measure the effectiveness of your new approach, ou have to formulate cash flow related KPIs for your collection department.

In Mapping the Credit function in Belgian organizations, Jean-Marie Bequevort observed that the ageing balance and DSO remain the most popular metrics to monitor the effectiveness of credit and collection activities. The most striking, however, is not the use of those metrics, but the fact that one out of four companies taking part in our research do not track any of those measures at all.

If you don’t monitor your processes and results, it is impossible to evaluate the effectiveness of your work and adjust your way of working if needed.

By reviewing your collection processes this way in a close collaboration with sales, your collection processes take on a dynamic character, opening the possibility to play a strategic role in your business. Your Credit & Collection department will not only maximize its contribution to the company's working capital but also leverage your sales, get you more business, higher margins, eventually creating a competitive advantage over your competitors.

Related content

-

Article

Pieter Geers: A growth journey shaped by the 'TriFinance mindset'

-

Article

How Belgian C-Suite executives view financial reporting

-

Blog

Lessons from the Belgian e-invoicing frontline

-

Article

Stabilizing Finance functions in a European bank in transition

-

Article

Restoring stability after a challenging ERP transition at SEB Professional

-

Reference case

From back-office support to informed business insights at OMP