Defining Credit Limits: An Exercise in Agility

16 November 2023How much credit should one grant a specific customer? On which parameters and risks should one concentrate? Like many aspects of Credit Management, establishing credit limits is an art rather than a science. Nevertheless, some businesses have elevated this process to the level of science by incorporating it into their scoring models.

Credit limits as a sales tool

Granting credit, however, also serves a sales tool. Determining credit limits & payment terms is often a matter of striking the best balance between your working capital, sales and revenue.

But what is a credit limit ? It is a threshold that a company will allow its customer to owe at one time, without having to go back and review its creditworthiness. It is the maximum amount a business is willing to take on an account, in case it goes wrong.

A credit limit is a threshold that a company will allow its customer to owe at one time, without having to go back and review its creditworthiness. It is the maximum amount a business is willing to take on an account, in case it goes wrong.

Benjamin Celis, O2C expert, CFO Services

Traditional or agile?

But about which risks are we talking when establising a credit limit? Are we only focused on external risks, such as the possibility that the customer may fail to meet their commitments, and in worst-case scenario, go bankrupt? Or are we also considering internal risks?

What is the impact of that credit limit on your trade working capital? Can your organization cope with that big credit limit & payment term ?

In a more traditional perspective, only the external risk is taken into account. Can the financials of the customer support the required credit limit as defined by sales?

In a more agile approach, particularly in the aftermath of the Corona outbreak, the impact of the credit limit on trade working capital should also be taken into consideration.

The longer the payment term, the higher the required credit limit

The first thing a business should evaluate is its own exposure and the type of exposure it can tolerate (payment terms, payment methods, payment behavior, etc.), considering its customer base (sector, type of consumers, commercial segmentation, etc.) in relation to its available working capital.

However, there is one unbreakable logic in relation to payment terms and credit limits: the longer the payment term, the higher the required credit limit. Thus, there is a clear interaction between your payment terms, credit limits, and working capital.

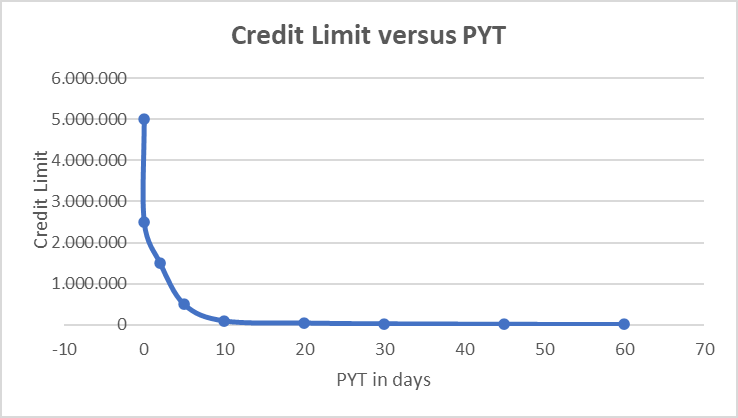

The ideal scenario, in terms of working capital, can be visualized by an inversely proportional curve:

High limits, short terms. Low limits, longer terms

- a high credit limit, should imply a short payment term, as it has a high impact on working capital

- a low credit limit could have a longer payment term, as it has less impact on working capita

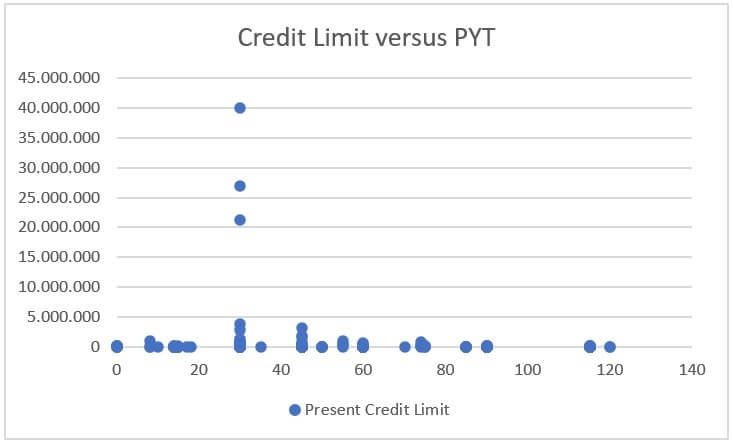

For a nutritional company where TriFinance is assisting in boosting working capital by enhancing the various components of the O2C process, the graph that plots Payment Terms (PYT) against Credit Limits is posted above. You can clearly see the inversely proportional curve from the payment term '30 days' onwards.

However, this also implies that these 30 days must be prefinanced.

By using a count-back method, one can counter the pressure on working capital by reviewing the available working capital and defining which amount can be employed in prefinancing customers

Benjamin Celis, O2C expert, CFO Services

Count-back method

It is evident that the inclination of the curve is different for each company.

Thus, a vital question is to define how much trade working capital one is willing to employ in customers (TWC= AR(?) + Inventory – AP). Often, companies forget to answer this question first, finding themselves later in a cash crunch situation.

In the equation however, there is also the element of inventory. Working capital wise, it would also be interesting to include the level of inventory needed for that specific customer, to understand fully the working capital impact of that credit limit. For big accounts, it’s certainly worth the effort.

The Corona crisis has created a “new” normal, with a significant impact on the economy. All too often this results in pressure on working capital. By using a count-back method, one can counter this threat by reviewing the available working capital and define which amount can be employed in prefinancing customers:

AR= TWC+AP-Inventory or in days: DSO=DTWC+DPO-DIO |

Subsequently, you can define your KPIs and reporting for follow-up. Based on these KPI’s, you can set out and define your credit limits and payment terms. Ideally, this should also reflect in your credit and payment term policy.

Image by rawpixel.com on Freepik

Related content

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance