AI in the boardroom: From pilot to priority

23 January 2026Artificial intelligence has moved beyond the experimental stage. By 2026, it is an economic reality with a significant impact on productivity, organizational structure, and competitive positioning.

Boardroom discussions have fundamentally shifted, from questioning whether AI is relevant to deciding who sets the strategy, how AI creates value, and when that value becomes visible.

A TriFinance survey of 120 Belgian decision-makers reveals an uncomfortable truth. AI is widely recognized as strategically important, yet many organizations struggle with hesitation and executive ambivalence. The results show no single “AI story,” but highlight a tension between strategic ambition, budget realities, and technological uncertainty.

- AI is widely seen as strategically important, but only a small fraction of organizations place it as their top tech priority.

- Many companies view AI both as a risk and an opportunity, with 44% ranking digital disruption including AI among their top five risks while leaders increasingly see AI‑driven analysis as key to improving efficiency.

- C‑level leaders, especially younger executives, place AI higher on the priority agenda than non‑executive staff, showing a leadership gap in how AI’s relevance is perceived and acted upon.

AI as a risk and an opportunity

One of the top risks respondents see for 2026 is “digital disruption, including AI.” For 44% of those surveyed, it ranks among the five most significant risks facing their organization. It follows talent shortages (66%), cyber- and data security, and changing regulations (both 60%).

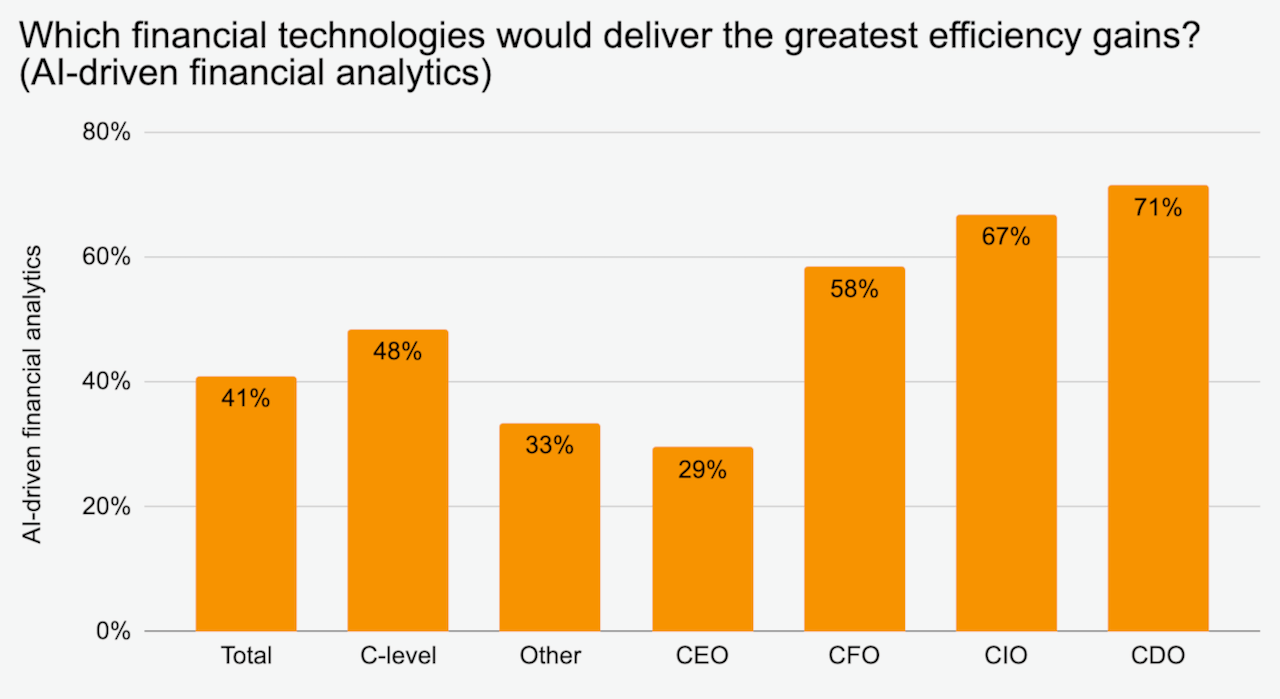

Yet AI is primarily viewed as an opportunity. Nearly half of surveyed C-level executives (48%) believe the grass is greener on the other side. For them, AI-driven financial analysis is the technology most likely to improve efficiency within the Finance function. Its relevance increases as respondents become more data-savvy.

While 42% of CEOs share this view, the figure rises to 58% of CFOs, 67% of CIOs, and 71% of CDOs. In companies where AI is the top technological priority, 78% of respondents believe AI will boost efficiency.

Nearly half of Belgian C-level executives (48%) believe AI-driven financial analysis is the technology most likely to improve efficiency within the Finance function

AI: Strategic importance recognized, but rarely embedded

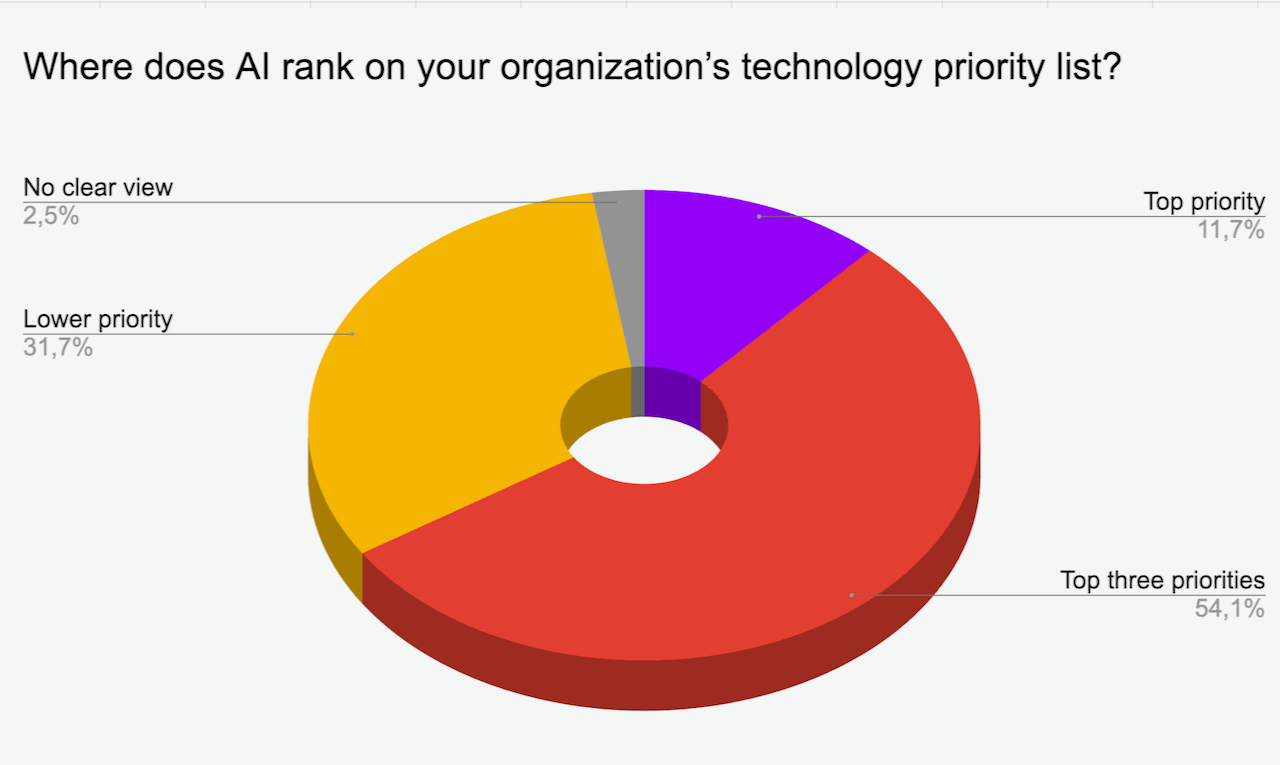

The TriFinance survey results reflect this tension. Only 12% of respondents name AI as their single highest technological priority.

At the same time, AI ranks in the top three tech priorities for more than half of the companies surveyed (54%). This points to broad recognition of AI’s strategic importance, but also to competition with other urgent investment areas, such as cybersecurity, ERP modernization, and compliance.

Nearly one-third of respondents (32%) consider AI a lower priority, while 2.5% admit they have no clear view of AI’s place on the technology agenda.

Budgets follow strategy, or not

57% of respondents report having an AI budget, while 17% explicitly say they do not, and 25% do not even know if their organization has allocated one. This uncertainty is not marginal. Organizations that are unsure about an AI budget are also less clear about AI’s strategic role. Budget uncertainty and strategic ambiguity go hand in hand.

The connection with overall investment capacity is striking. Companies that allocate larger technology budgets (from €500,000 to over €1 million) are significantly more likely to place AI in their top three priorities—or even as their top priority—and are more likely to have a concrete AI budget for 2026. In this group, a substantial portion combines strategic ambition with financial capability.

On the other hand, organizations with smaller or no planned technology investments tend to view AI as a lower priority. In these cases, the absence of an AI budget—or uncertainty about one—is the norm.

A significant generational gap between younger executives and those 55+

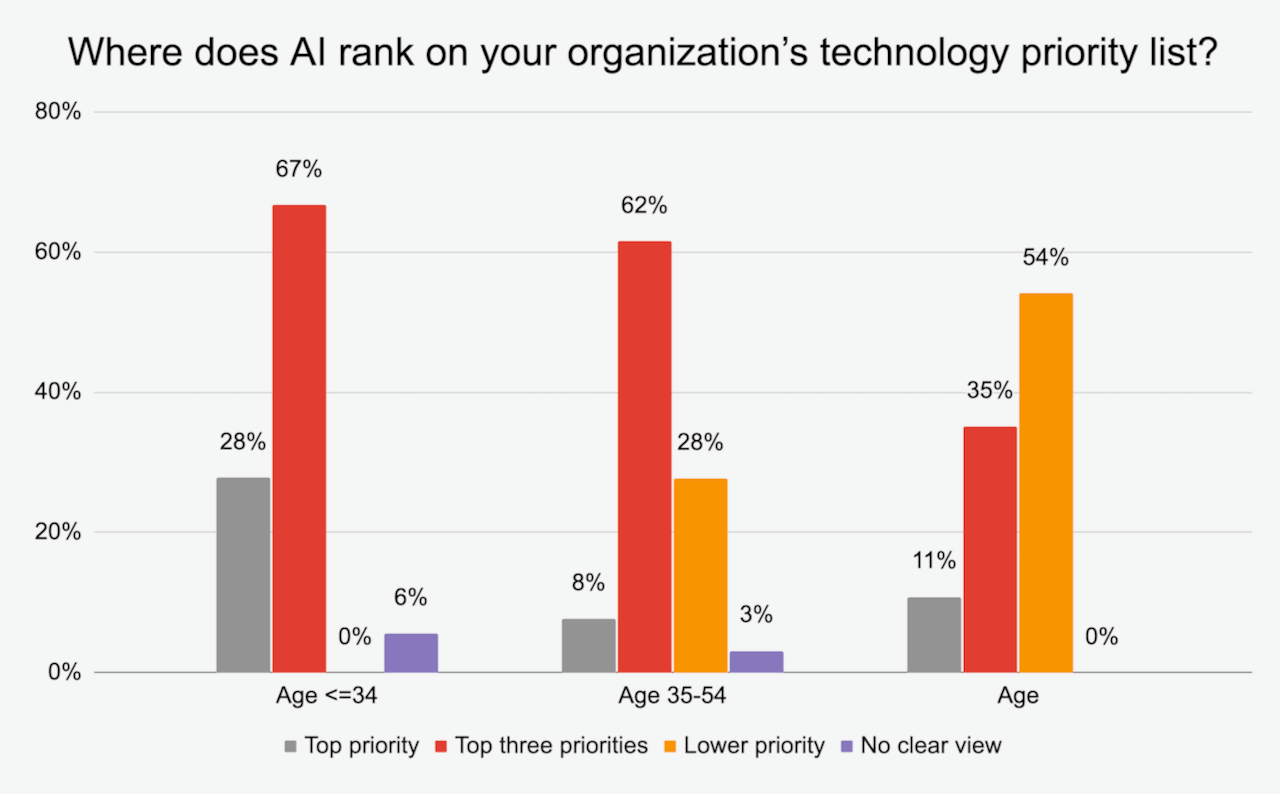

These figures on AI priority gain added significance when looking at role and seniority. Among C-level respondents, two-thirds (67%) report that AI ranks among their top priorities. For non-C-level respondents, AI is much more often considered a lower priority (45%).

Uncertainty about AI’s strategic position occurs almost exclusively in this group. This points to a classic divide: AI is alive in strategic discussions at the top, but loses weight once concrete decisions or initiatives are taken further down in the organization.

Age amplifies the pattern. Younger respondents (≤34 years) show the highest enthusiasm for AI. Over a quarter (28%) see it as their top priority, and 67% place AI in their top three priorities. They slightly outpace the 35–54 C-level cohort, revealing a notable generational gap.

Among the 35–54 age group, only 11% consider AI their top priority. For respondents aged 55 and older, 54% explicitly rank AI as a lower priority, creating a wide generational divide compared with younger employees. In the 35–54 cohort, 28% consider AI a lower priority, while none of the under-34s take that view.

The clear AI champions are the under-34s. For 95% of this group, AI is either the top priority or ranks in the top three.

The maturity illusion

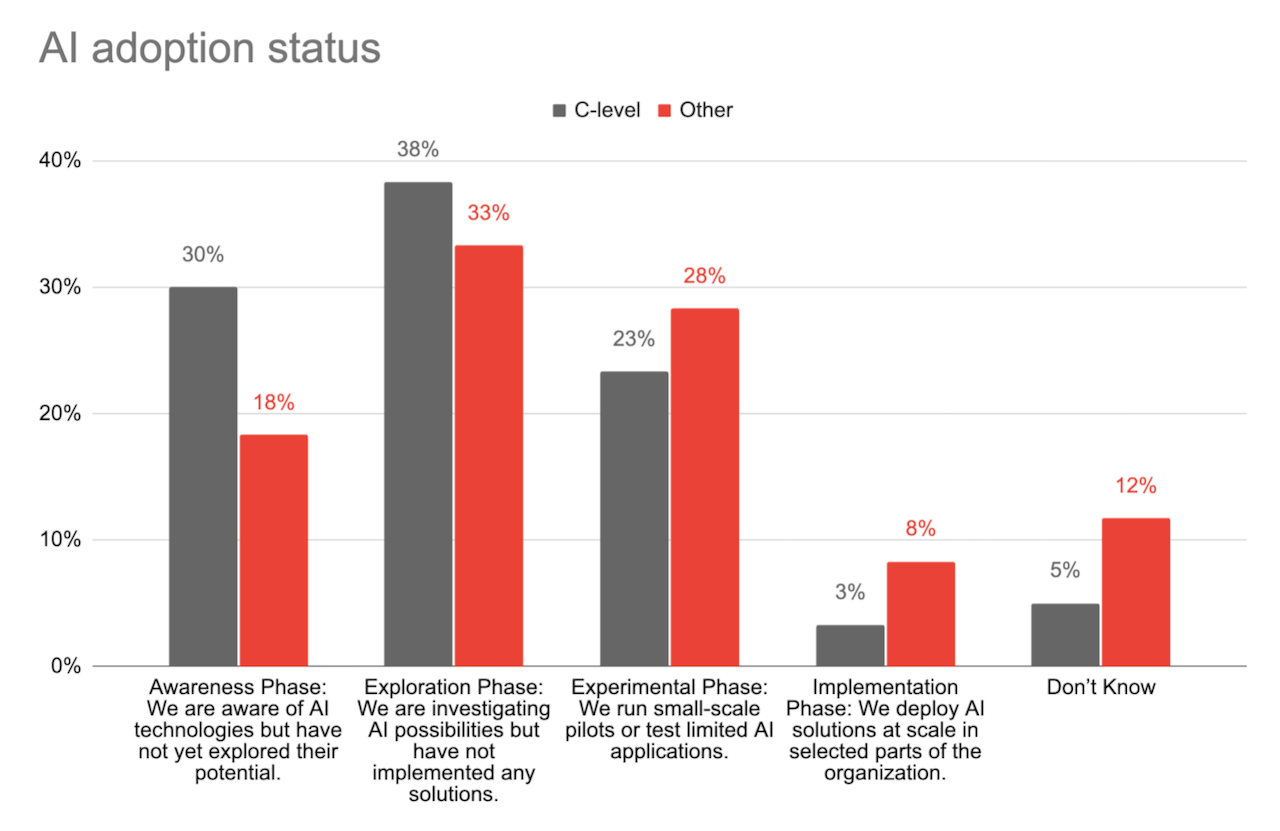

When asked where their organization currently stands in the adoption of artificial intelligence, only 6% of respondents report AI being implemented at scale. In Finance specifically, that figure rises slightly to 8%. In these cases, organizations use AI tools across multiple finance processes, but without full scale-up.

Most Belgian organizations remain in early stages, with 24% in the awareness phase, 36% exploring, and 26% experimenting. Notably, non-C-level respondents more often report experimentation or implementation, while C-level executives tend to place their organizations in earlier phases.

This gap points to a maturity illusion. AI develops in pockets. Teams test. Departments experiment. But without explicit strategic anchoring. What feels like progress at the operational level is not recognized as transformation in the boardroom. As long as this gap persists, large-scale adoption will remain out of reach.

AI develops in pockets. Teams test. Departments experiment. But without explicit strategic anchoring. What feels like progress at the operational level is not recognized as transformation in the boardroom. As long as this gap persists, large-scale adoption will remain out of reach.

The CFO between ambition and discipline

This tension is not unique to Belgium. International research by Economist Impact, cited by Graydon, shows how the role of the CFO has fundamentally expanded. Where Finance once focused primarily on safeguarding the numbers, today’s CFO sits at the center of digital transformation, enterprise risk, and AI strategy.

That expanded role comes with tough expectations. 83% of CFOs believe AI investments must deliver measurable results within twelve months to justify continued funding. At the same time, 87% say they are more closely involved in digital transformation, often beyond the traditional boundaries of Finance.

This dual expectation puts CFOs under pressure. More than half cite fragmented data, legacy systems, and skills shortages as the main barriers to execution. These are not purely IT issues. They are structural constraints across the organization.

They also explain the cautious stance many CFOs take on AI. Investment is possible, but preferably where efficiency gains are fast and demonstrable. While CIOs and CDOs tend to view AI as a foundational transformation layer, CFOs first see it as a lever that must deliver return on investment.

That financial rationality directly shapes the key question: which financial technologies can most effectively improve the efficiency of the Finance function and convince both the shop floor and the boardroom

Which technologies Finance leaders believe will drive efficiency

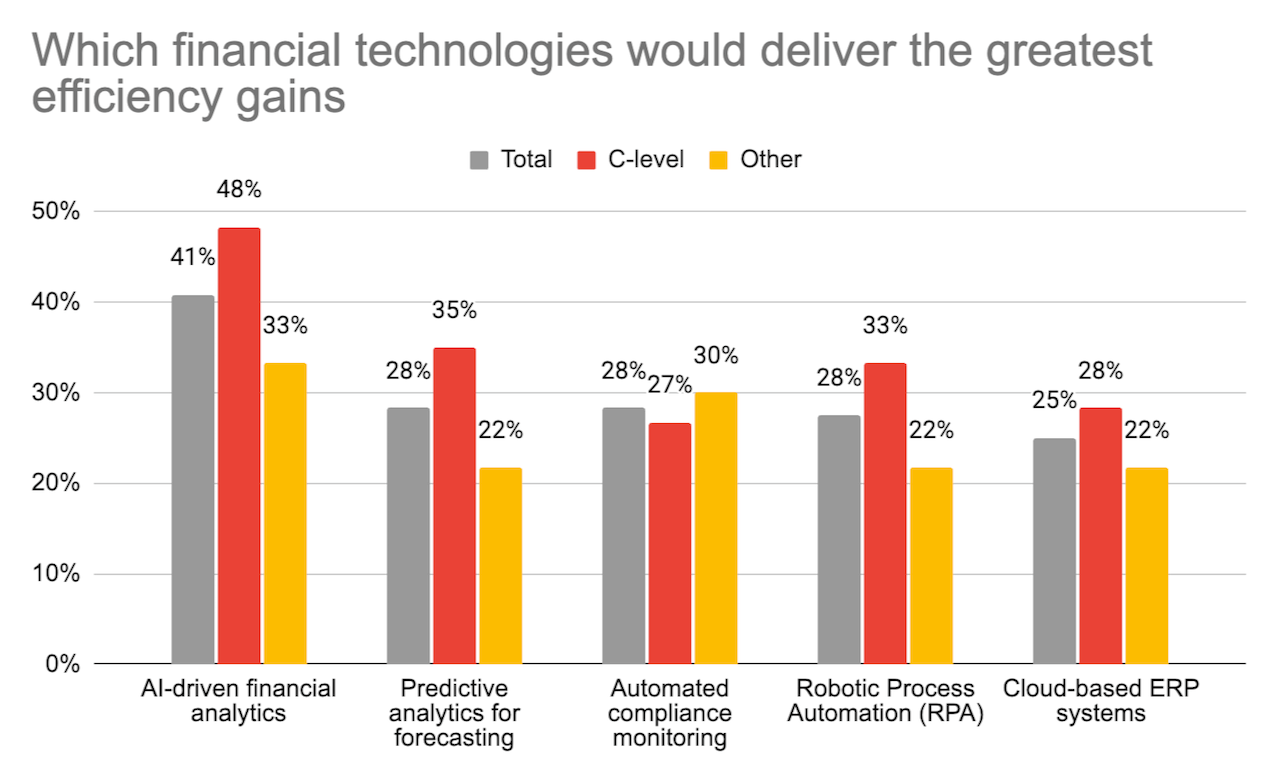

This pragmatism is clearly reflected in the preferences for concrete use cases that respondents believe would most improve the efficiency of the Finance function. AI-driven financial analysis ranks first by a wide margin at 41%, and even more strongly among C-level respondents (48%).

Interestingly, organizations that rank AI lower on their overall priority list select this use case relatively often. That may seem paradoxical, but it is logical. AI is viewed as an analytical accelerator, not a disruptor. Faster reporting, deeper insights, and better decision-making sit squarely within the CFO’s traditional domain.

Predictive analytics for forecasting, automated compliance monitoring, and Robotic Process Automation each score 28%. Cloud-based ERP systems follow at 25%, driven by their directly measurable efficiency gains. These are proven technologies that fit a narrative of control and optimization.

Age plays a role here as well. Younger respondents show more interest in RPA, blockchain, and cloud ERP, but more often admit they do not know which technology delivers the greatest efficiency gains. Respondents aged 35 to 54 most consistently choose AI-driven analytics and compliance solutions. Those 55 and older place greater emphasis on predictability and governance.

The most concerning figure, however, is that 20% of all respondents do not know which technology would most improve efficiency. That share increases in organizations where AI is not a top priority. For a C-level audience, this is not a footnote. It is a warning signal. The issue is not a lack of technology, but a lack of direction.

While CIOs and CDOs often approach AI as a foundational transformation layer, CFOs tend to view it first as a lever for delivering return on investment.

AI as a general-purpose technology

For many Belgian and European companies, the core question is no longer whether AI is relevant. The real issue is whether they can act decisively in a rapidly accelerating AI landscape. And whether they can use AI to create value while safeguarding relevance and competitiveness.

The finding that the C-suite is primarily focused on value creation through AI aligns closely with the international debate.

Erik Brynjolfsson, Professor at Stanford University’s Digital Economy Lab, has long emphasized that AI is a general-purpose technology, comparable to electricity or the internet. At the same time, he warns that economic impact does not follow automatically from technology alone. Productivity gains materialize only when organizations redesign processes, reskill people, and structurally adjust decision-making.

AI, therefore, is less an IT issue and more a leadership challenge.

The CFO Between ambition and discipline

That tension is not a uniquely Belgian phenomenon. International research by Economist Impact, cited by Graydon, shows how the role of the CFO has fundamentally expanded. Where Finance once primarily safeguarded the numbers, today’s CFO is actively involved in steering digital transformation, enterprise risk management, and AI strategy.

But this broadened role comes with stringent expectations. As many as 83% of CFOs believe that AI investments must deliver measurable results within twelve months to justify continued funding. At the same time, 87% report being more closely involved in digital transformation initiatives, often beyond the traditional boundaries of the Finance function.

These dual expectations place CFOs under significant pressure. More than half identify fragmented data, legacy systems, and skills shortages as the primary obstacles to execution. These are not merely IT issues, but structural organizational challenges. They also help explain the cautious stance many CFOs take toward AI: investment is possible, but preferably in areas where efficiency gains are rapid and clearly demonstrable.

While CIOs and CDOs often approach AI as a foundational transformation layer, CFOs tend to view it first as a lever for delivering return on investment. This financial rationality translates directly into the question of which financial technologies can most effectively improve the efficiency of the Finance function—while also gaining acceptance on the work floor and in the boardroom.

Related content

-

Article

How Belgian C-Suite executives view financial reporting

-

Article

Restoring stability after a challenging ERP transition at SEB Professional

-

Reference case

From back-office support to informed business insights at OMP

-

Article

Building a scalable financial backbone for pan-European growth at Macadam Europe

-

Article

Where background stops defining the future: consultancy paths open up at TriFinance

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector