Data & Analytics

Your challenges

- Struggling to become data-driven

- Absence of BI team and/or tool leads to time-consuming reporting

- Added value of advanced analytics is unclear

Data is crucial for business strategy. Seen as an asset, it requires a well-planned strategy and infrastructure. Our experts assist in defining and implementing your data strategy for optimal use.

Insights beyond systems

Our experts have extensive expertise in Data and Analytics, and managerial reporting. They design efficient analytics architectures, identify performance indicators that are vital to your business, and utilize modern analytics solutions to unlock new insights.

This unique combination of functional and technical expertise facilitates effective communication with business and IT, leveraging the quality and the speed of a Data and Analytics project.

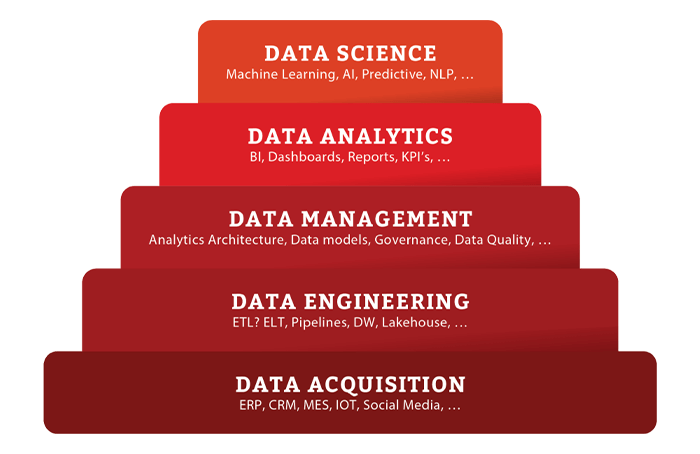

Introducing the Data & Analytics Pyramid

The Data & Analytics pyramid provides an overview of concepts for turning data into actionable insights. Depending on your data organization's maturity level, one or more of these concepts will apply.

The organization of our Data & Analytics team is based upon this pyramid, enabling us to support customers throughout their data & analytics journey:

- Integrate data from a diversity of sources

- Develop, establish, and design descriptive analytics with Power BI dashboards and data models

- Initiate, explore, and set up predictive analytics for forward-looking insights

- Govern and document your analytics solutions efficiently and effectively.

Data Engineering

Our Data Engineers ensure the extraction, transformation, and loading of data from various sources into a central Datawarehouse or Lakehouse. We focus on the Microsoft Azure Data & Analytics stack and Databricks.

Data Management

Our Analytics architects design a high-performance and future-proof Analytics architecture. Our reporting data models are designed from a business perspective, ensuring that all business reporting requirements are considered.

We assist in monitoring data quality and ensure effective governance of your Analytics solution. For the governance and documentation of your data assets, we partner with a data catalog solution that is built from a business perspective (and not from a technical IT perspective).

Data Analytics

Our Data Analysts are Power BI experts who blend robust functional and technical knowledge. They assist in identifying and defining the most relevant KPIs, translating them into a Power BI model, and designing actionable dashboards and reports. They ensure that the solution is embedded into your organization through coaching and training.

Data Science

Our Data Scientists help organizations in identifying opportunities for advanced analytics. We aim to make machine learning and predictive analytics accessible to our customers in a pragmatic manner. Beyond designing and implementing these advanced analytics solutions, we provide assistance in the interpretation and analysis of the results, enabling you to become more data driven.

Our offering

1. Data Strategy and Data & Analytics Architecture

We define your Data Strategy

- We create a future-proof Data strategy aligning with your strategic objectives

- We assess the value of data for your company

- We identify data & analytics topics that will create value for your business

- We define the to-be architecture for your data organization, processes, and systems

- We create a roadmap for implementing this data strategy

2. Design and Implementation of a Data & Analytics Architecture

We design and implement Data and Analytics Architecture

- We conduct business & functional analysis leading to best practice design of new analytics architecture, data models & dashboards

- We provide a detailed budget estimation at the project start based on our analysis phase

- We design and set up analytics architecture in Azure and Power BI

- We manage the project comprehensively, including project management with delivery responsibility

- We ensure well-documented and governed solutions by your team

- You get the opportunity to purchase & use our off-the-shelf reporting solution MyInsights (Finance, Sales, Operations, HR, Cash analytics).

3. Data Science Projects

Our team specializes in designing and implementing predictive models through machine learning. Utilize advanced analytics for tasks like data quality analysis, outlier detection, and churn prediction. Beyond implementation, we analyze and interpret the outcomes of machine learning models, providing valuable insights to refine and elevate your business decision-making processes.

Our off-the-shelf reporting solution, the MyInsights Cash Analytics Tool streamlines cash prediction processes for enhanced financial planning.

4. Coaching, Audits and Support

Your key users can be coached by our experts to improve existing models or explore new scopes. Benefit from thorough reviews of your current analytics architecture and Power BI design.

5. Outsourcing Solutions

You can staff your analytics team with consultants of varying expertise levels in Microsoft BI. We maintain, expand, and support your analytics setup flexibly, tailored to your evolving needs.

6. Training Initiatives

Our comprehensive Data & Analytics Training Program comes with a major focus on Power BI; both functionally and technically. The program caters to end-users and administrators, available through open enrollment or in-house arrangements. Training can be tailored to your own needs.

The Data & Analytics Training Program covers a diversity of topics, from beginner to advanced levels, enhancing your skills in DAX and Excel. You will be able to expand your expertise with expert-level training in Advanced Excel, Power Query Advanced, and Dimensional Modeling.

7. Support

We offer business support on your Power BI reports using our ticketing system according a set of possible SLA’s.

8. Kick-starting reporting models

Since a lot of reporting projects deal with similar questions and requirements, we developed a kickstart model for SMEs (MyInsights) and Local governments (MATiz). You will not have to start from scratch. Based on our business knowledge, we have already implemented a lot of reporting needs in these models. As our models contain different modules, you can tailor them to your personal needs.

More on MyInsights

More on MATiz

More on our Cash Analytics Tool

Who will support you?

Our specific subject-matter expertise, industry knowledge and pragmatic advisory methodologies are delivered by Management Information & Systems (MI&S).

Discover our Data & Analytics expertise

Discover how our expertise can drive your organization forward. This 2-pager provides a concise overview of our approach, key insights, and concrete benefits.

Download the 2-pager (pdf)

Get in touch

Or discuss your needs, contact us for an exploratory meeting, at no charge and with no further obligations.

Contact our expert

Maarten Lauwaert

Expert Practice Leader Data & AnalyticsRelated content

-

Reference case

From back-office support to informed business insights at OMP

-

Article

Building a scalable financial backbone for pan-European growth at Macadam Europe

-

Article

AI in the boardroom: From pilot to priority

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Career in Internal Team

IT Infrastructure and Workplace Engineer

-

Career as Consultant

Power BI Consultant

-

Career as Consultant

Data Engineer

-

Career as Consultant

Senior Risk Advisory Consultant

-

Career as Consultant

Senior Finance Transformation Consultant

-

Career as Consultant

Business Analyst - Banking/Insurance