Different types of controllers in a mass of information

16 January 2024In continuation of Automating work creates more controlling work, my previous article on controlling, I'd like to dive deeper into the role of a controller. A valuable framework for understanding this role is the structure of an analytical Profit and Loss (P&L) statement that gives real insights into an organization's performance.

Introducing the P&L setup

Let’s use the following setup :

Sales

- Cost of Sales at standard cost

= gross margin at standard cost

- Variances (actual vs standard)

= gross margin at actual cost

- Distribution cost

- Selling, General, and Administrative Expenses (SG&A)

= Operating profit

This P&L is a valid structure for production, service and logistic companies. All of them need quick insights into gross margins at standard costs and cannot wait for finance closing activities for initial insights into actual performance.

Distribution costs may not be relevant for all types of companies but the P&L structure can be adjusted based on your organization's activities. This is the big advantage of management accounting over financial accounting where financial statements are predefined and should be respected.

The Commercial Controller

This article will focus further on an example of a production company, but as mentioned also service companies can be valued at a standard cost. The Cost of Sales for a service companies will especially depend on the employee cost provisioned in the period and the projected billable hours for your employees. It's crucial to precisely define both the numerator and denominator in this calculation. Tracking actual hours based on the same definition is essential for reporting variances.

Enter the 'commercial controller'—responsible for budgeting and reporting up to the Gross Margin at standard cost. Driver entities for this calculation become readily available when the initial transaction is recorded in transactional systems, such as a specific e-commerce tool or your ERP system. This enables the commercial controller to promptly report and analyze daily trends for stakeholders, primarily at the C-level and within commercial departments.

It's interesting to split these calculations by product (group), customer group, or region, and include volume-mix calculations. For instance, selling more of a certain product(group) with lower margin percentages will lower the overall margin. This should be well explained to prevent misinterpretations when analyzing periodic results. These dimensions can be reported using dimensional BI applications, a skill set the commercial controller should master.

The Plant Controller's Role in Standard Cost Analysis

To calculate standard costs, the commercial controller depends on the plant controller. This process includes computing production costs, considering the organization's specific operational setup. Has the company invested in production facilities itself, or is this process (partially) outsourced to subcontractors? Are there particular investments in production lines for specific product categories? Is there an inbound warehouse where raw materials are stocked?

(The methodology for calculating standard costs is not covered in this article).

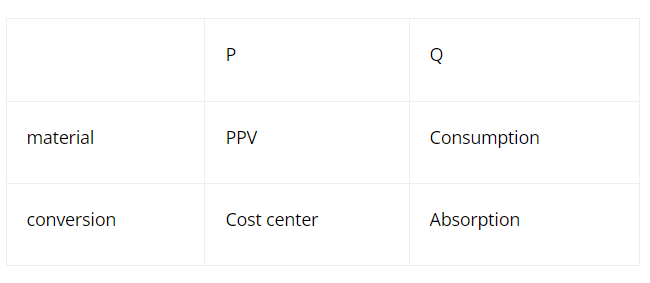

After a certain period, the plant controller must clarify differences with actual performance. The following matrix provides structure to this discussion:

Optimizing variance control

Any deviation that occurs in the production can be allocated to one of these buckets, provided the ERP system is configured according to best practices. Each variance should have its operational dashboard to allow a deep dive in the variance if the materiality of the variance is significant.

Different owners should be assigned to the variances. Procurement oversees the PPV report, while manufacturing is involved with the other three reports. These reports should allow for slicing and dicing. For instance, PPV data should be viewable per material, vendor, and with a breakdown of material cost and inbound cost.

Achieving full control over variances to ensure insights are gained to achieve higher profits by tackling the root causes at the moment they occur can only be accomplished by designing the ERP system in the way described, and by reporting with this level of granularity.

P&L Analysis: Understanding Vertical and Horizontal Variances

When the design is effective, a highly valuable Profit and Loss (P&L) statement is crafted, enabling the analysis of vertical variances within the P&L. Additionally, actuals can be compared with budget, forecast, the previous year, the previous month, etc., resulting in horizontal variances when compared with another P&L.

Without distinguishing between Price and Quantity, discussing mitigating actions becomes difficult because root causes are unclear, and discussions will stay at a surface level with generic remarks. This distinction is crucial as Price and Quantity can contradict each other. For example, hiring more experienced operators may make the machine run faster, resulting in a positive absorption variance.

However, the hourly cost of these experienced operators might surpass that of regular operators, leading to a negative cost center variance.

Controller Roles in Business Collaboration

The plant controller typically collaborates closely with the COO, BU managers, buyers, and operational staff.

Both types of controllers (commercial and plant controllers) are considered business controllers, collaborating closely with the business.

The financial controller leans more towards corporate reporting, accounting, and consolidation, reconciling management with financial information. Their responsibilities include managing annual accounts, contact with the bank, and addressing compliance requirements.

The group controller will ultimately consolidate information from commercial, plant, and financial controlling into an aggregated report. The primary stakeholders of the group controller are mainly the CFO, C-level executives, and board members.

Conclusion

This article explains the controller’s role from a functional perspective. These highlights are tuned by the specific context of the organization you are working in. The various driver units necessary for your work are derived from all the systems within your company. But it's crucial to first understand the key drivers for steering your business before the translation to your systems can be made. We frequently see that new systems (ERP, MES, e-commerce,...) are implemented without adequate preparation and understanding of the broader picture.

Only a well-designed IT architecture can effectively support stakeholders with timely and relevant analytical information. The controller should act as a crucial link to optimize the setup for maximum automation and minimal reconciliation.

Image by rawpixel.com on Freepik

Related content

-

Reference case

From back-office support to informed business insights at OMP

-

Article

Boomerang story: “Leaving showed me how unique TriFinance really is.”

-

Article

Building a scalable financial backbone for pan-European growth at Macadam Europe

-

Article

AI in the boardroom: From pilot to priority

-

Blog

#takeaways ESG Webinar 12: Navigating the recent changes in the ESG reporting landscape

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector