How to optimize your Working Capital and Cash Flow forecasting

- 'Cash Analytics' gets all necessary details out of the ERP

- Accuracy testing is good practice

- Applying sensitivities to data sources helps you determine key points where you run into cash trouble

Reliable cash forecasting is absolutely essential if you want to mitigate liquidity risk during a crisis that erupted as suddenly as Covid-19. To reduce funding needs, optimizing your working capital is an important step to take. Working capital management allows a company to keep the working capital need as low as possible while freeing up cash that is tied up in the exploitation cycle. Companies that fall short of cash risk to be dead in the water.

During the first online Expert Session on Working Capital and Cash flow forecasting, TriFinance experts Benjamin Celis and Mario Matthys shared their knowledge with participants from diverse backgrounds such as the Tank Terminal, Food, Construction, Sports facilities, Heating, Pharmaceutical, and Media industries. All company experts were trying to optimize their working capital management and cash flow forecasting ability.

The roundtable was hosted by CFO Services’ Client Partner, Filip Ceulemans.

Integrating cash forecasting into a long-term strategy

The last few months, our virtual round-table participants had seen their working capital indicators deteriorating. Cash forecasting for short- and mid-term had become much more important than before, even critical. In general, companies were running cash forecasting for the short- and even mid-term, with most of them trying to integrate their approach into a long-term strategy.

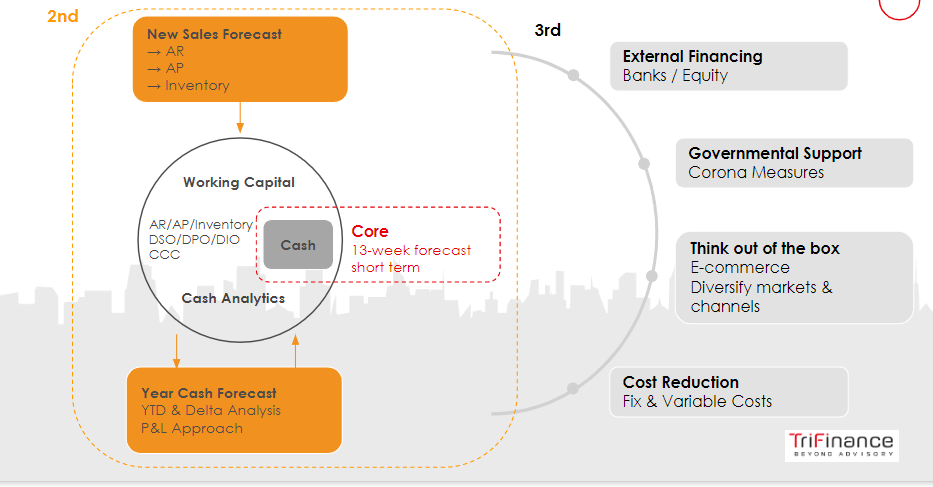

When looking at cash flow forecasting, TriFinance experts use a framework that contains all essential elements to navigate through the Corona Crisis.

The core of the model is an organization’s working capital which is now in many companies under severe pressure. The working capital being the difference between a company’s current assets and current liabilities, it contains well-known components like Accounts Receivable, Inventory and Accounts Payable, with well-known KPI’s such as DSO, DIO and DPO.

Cash Analytics is a tool Trifinance uses to optimize these parameters, freeing up cash that is tied up in the exploitation cycle.

On a second level, short-term cash planning is crucial for any company, especially to make sure that short-term payments are guaranteed. A commonly used methodology is the rolling 13-week cash forecast, fed by actuals, the order book, uninvoiced orders in the pipeline, and by your forecast. A company's sales and cost forecast is a very important part of its cash flow.

To complement the short-term cash planning, companies use mid-term or even longer-term cash flow forecasts starting from sales forecasts, budgets, or even strategic plans. That basically allows an organization to calculate how big the pressure on cash needs will be and to develop different scenarios to determine a strategy when the organization would fall short on cash.

The third layer is more strategic and goes beyond the scope of this exercise. It’s the phase where organizations reduce their cost structure and reorganize their supply chain, assessing its impact on the organization.

Boosting cash flow by analyzing your working capital drivers

Quickly available cash can be identified by managing receivables and payables. The outcome will be a number of opportunities that can be grabbed to boost cash flow on a short-time basis. Tools can be helpful in analyzing the drivers of DSO and DPO, creating a possibility for organizations to manage crucial parameters.

For cash flow forecasting, TriFinance uses the self-developed Cash Analytics tool. A proven rescue program from the 2008 financial crisis, it’s basically a Power BI tool that can be connected to any ERP system. It gets all the necessary details out of the ERP to analyze Working Capital components, ranking drivers in terms of their impact. If a company wants to make the right analyses and the right decisions to act, it is crucial be provided with correct information. Cash Analytics determines the company’s as-is position, identifies the most critical problems and allows companies to take appropriate action.

Working capital expert Benjamin Celis pointed out how the tool uses a 4 phase Input/Output model, fed with historical data. Using this model, an organization can unveil structural liquidity opportunities that are hidden in the process. To be checked are for instance the company’s invoicing pattern or their customers' payment terms. Analyzing the organization’s credit process maturity level and its customers’ payment behavior can generate knowledge about the best possible DSO, as well as about the spread, being the number of extra days customers take to pay their bills.

Cash flow reporting and forecasting within different timeframes

Reporting layers must be defined by each company individually, depending on the specific needs and reporting categories that are important for the company. The goal is to identify liquidity shortfalls as soon as possible, based on actuals and short-term forecasts. Possible sources are, for instance, uninvoiced orders, order books, or expected sales.

'As companies tend to differentiate between operational, investment and financial cash flows, this forecast can be tailormade,' Mario Matthys explained. 'Not only in terms of format but also in terms of granularity. Companies use to define cash flows on a corporate or affiliate level, but higher granularity will generate cash flow information on a departmental, divisional, product or business line level, provided of course the required data sources are available.'

In terms of format, direct and indirect cash flow forecasting can both be used, with direct forecasting being mainly used for the 13-week rolling forecast and indirect cash flow mainly for the longer term. The same format can, of course, be used for both short and long term forecasts.

Different data sources are used based on the forecasting horizon, with actuals, forecasts, and pipeline data to be used for the short-term and latest estimates, budget data and long-term plans for the longer term. Finally, it might be good to have a look at the track record, because historical data will show how certain payment patterns, behaviors and seasonalities will influence the cash flow forecast.

'Applying sensitivities to data sources helps you determine key points in time where you run out of credit facilities or into cash trouble'

Mario Matthys

Accuracy Testing

The wider the company’s range, the less accurate a forecast will be. In general, a 13-week forecast can be quite accurate, though some accuracy might be lost in this period of global turmoil.

'Accuracy testing is certainly good practice,' Mario Matthys says, 'as it will get you information about correct and incorrect estimates.' It should be done as soon as the model is set up. Any deviation between forecast and actuals will oblige you to evaluate your data sources or get back to your sales force for more accurate input. Certain Treasury or Accounting departments even put targets on accuracy.

'Working with a liquidity risk team can be helpful,' Benjamin Celis explains. 'On a weekly basis, stakeholders like AP, AR and sales that contribute to the model can contextualize their input, possibly explaining why their contribution may not have been correct.'

Also crucial in today’s crisis is that forecasts can be updated as soon as possible. Agility and speed are key because cash flow analytics can be time-consuming.

Adding sensitivities to data sources

That’s why applying certain sensitivities to data sources can be important. By adding a sensitivity analysis to a forecast, it becomes possible to determine key points in time where you run out of credit facilities or into cash trouble.

With working capital becoming tighter, companies all over the world will be asking their clients to pay in time, while in their turn, they will try to postpone their payments to suppliers to free up cash. ‘In a 13-week forecast, or any other longer-term forecast, it becomes interesting to add some sensitivities,’ Filip Ceulemans says. ‘It enables companies to check if a benchmark DSO of for instance 35 days, will not increase to 50 or 60 days in the weeks to come. It enables companies to forecast their cash position if that happens.’

Adding a sensitivity to a number of variables in the Cash analytics tool will show how the cash position evolves when certain variables diverge. Visualizing that deviation can, for instance, help salespeople to understand what the short- or mid-term effect will be of a client paying a few days earlier or later.

‘Working this way can improve the relationship between the Sales department and Finance,’ Mario Matthys says. ‘With Sales striving to maximize turnover and Finance wanting to see receivables paid, it is certainly important for Finance to increase the level of accountability in the Sales division. In some organizations, the Sales Division gets a number of targets on, for instance, payment losses.’

It is also important to know exactly what you are measuring. Certain core working capital items like receivables and payables are components that a company can influence, which is more difficult with non-core components like taxes or social liabilities. Looking at corporate cash flow, you need to take the impact of exchange rates into account, as well as CAPEX investments, dividend policy, M&A, etc.

In an ideal world, a 13-week rolling forecast will be complemented by a longer-term cash flow plan. For any organization, defining the time horizon and the exact goals is crucial. From an accurate 13-week rolling to a longer-term forecast, both can bring the necessary insights.

Related content

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance