The four functions of Integrated Credit Management

1 April 2022In many companies, misaligned processes and procedures are often a stumbling block. They cause pressure on working capital, leading to frustration amongst employees, low invoice quality and a high DSO, eventually dissatisfied customers.

Toward Integrated Credit Management

Credit Management is still too often regarded as a purely financial and administrative process. Departments such as Marketing, (internal) Sales, Customer Service and Accounting have their own, sometimes conflicting, responsibilities and objectives, which can slow down the optimization of Credit management, working capital and profit margin. These divergent interests within one and the same company can undermine the efficiency of the whole.

Integrated Credit Management can provide an answer/solution to this problem and may even prove to be a strategic advantage for a company.

The core idea behind this approach is to monitor and control the entire O2C process through credit management, in order to optimize working capital and link the company's revenue growth to profit growth.

Integrated Credit Management is a mature process, whereby in addition to the core credit management processes, the integration of these processes into the overall O2C processes is also considered, and vice versa. Its aim is to steer the whole as efficiently as possible, to optimize working capital and the highest possible profit margin.

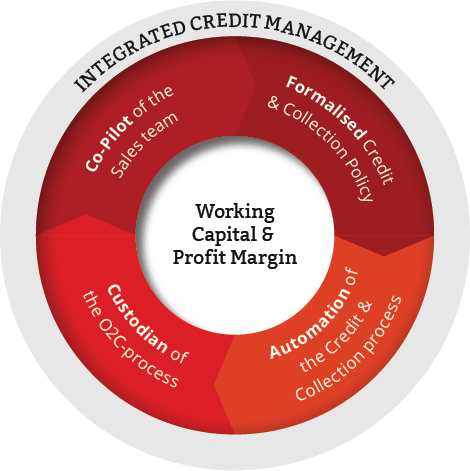

We can visualize this using the figure below. Initially, the functions will move clockwise, starting with the Credit Policy. Once Integrated Credit Management is up and running, each individual function can impact each of the other functions.

Working capital and four satellite functions

The core is formed by working capital and profit margin, which are controlled by 4 satellite functions:

- Formalized credit policy

- Automation of the credit management process

- Credit management as ‘custodian’ of the O2C process

- Credit management as ‘co-pilot’ of the sales team

The circle shows the interaction between these 4 segments as this process is in constant motion, analogous to Deming's quality wheel. Each of these 4 segments influences the others and must be managed in the most optimal way.

For many companies, this approach means a change in mentality, making change management, for implementation, very important. The circle, being the quality wheel, is thus the mortar between the segments.

If implemented properly, credit management can truly take on the role of business partner and add full value to a company.

1. A formalized credit policy

The internal agreements and procedures concerning the allocation of credit limits to customers, the payment conditions, the order release process and the follow-up of outstanding debtors are best formally recorded in a credit policy. Ideally, the CFO, in collaboration with the credit manager, draws up the credit policy in consultation with all stakeholders in the O2C process.

In this way, the credit policy not only provides guidance, transparency, stability and efficiency for the entire company, but also promotes interaction between the various departments.

In short, a good credit policy translates into an appropriate financial and commercial approach tailored to each group of customers, within the framework of the company's working capital.

2. Automation of the Credit Management process

Once the formal credit policy is in place, this document can be translated into workflows, working methods and reports, which form the basis(s) for the setup of your ERP and/or collection software. Automation will minimize purely administrative cumbersome tasks and allow your team to focus on value-added activities, such as:

- Facetime with customers while chasing payments

- Review of credit limits & creditworthiness analyses

- Facetime with Sales team to discuss customer portfolios

- Follow up on complaints with Sales & Customer Service

- Reporting and taking appropriate action

3. Credit Management as the ‘Custodian’ of the OTC process

Next in the circle is the custodian principle. Once processes are automated, credit management has the time to monitor the complete O2C process from a helicopter view. Anything that doesn't go well in the O2C process is eventually reflected in delayed payments, credit notes, dissatisfied customers, etc.

The idea behind this philosophy is that if the processes before invoicing do not run well (or deviate, in practice, from the standard process), this inevitably affects the processes and results after invoicing, such as collection procedure, complaints procedure, DSO, etc. and thus leads to a higher working capital requirement.

If the processes for invoicing are not properly aligned, it will certainly increase the workload on your credit & collection department and DSO.

- As a custodian, credit management should monitor compliance with credit policies and other existing policies of all those involved in the O2C process.

- Credit management should also develop Minimum Internal Control Standards (MICS) with exception reporting to monitor/track deviations, for example:

- Deviations from standard payment terms

- Exceedance of credit limits

- Invoice quality and lead time to resolve complaints

- Since this philosophy must not lead to rigidity, the Credit manager must also aim for the continuous improvement of these processes. This should be done from a working capital and profit margin perspective, involving all stakeholders. Lean processes are key here. Interdepartmental interactions are also encouraged.

4. Credit Management as the "co-pilot" of the sales team

Last, but not least, is the Credit manager acting as cos-pilot of the Sales team. Credit management will no longer be the department that ‘stops the sale’ but will support the sale, by optimizing profit margins, by working with sales to find financing solutions (within the limits of credit policy) to close that important deal, etc.

Based on a thorough analysis, credit management can help and share insights with the sales team, e.g:

- Establishing customer segmentations based on payment behavior and the total cost to serve. This calculates the profitability of a customer account, based on the actual business activities and overhead costs incurred to serve that customer. It includes pre-financing costs, inventory maintenance costs, etc.. It is not equal to gross margin, which only reflects COGS).

- Determining credit limits along with sales, based on, for example, ‘customer lifetime value’. This is the total value of a customer to a company over the entire period of the relationship. It is an important measure because it costs less to retain existing customers than to acquire new ones, so increasing the value of your existing customers is a great way to drive growth..

- Calculate the impact on working capital of specific deals, customer relationships, etc. Based on this analysis, payment terms, for example, can be adjusted.

The sustainability of Integrated Credit Management

The four satellite functions are in constant motion, interacting with each other. Each of them encourages collaboration between departments, drives processes for continuous improvement, enabling a company to respond (proactively) to market changes/trends while optimizing working capital and profit margin.

Because it is an ongoing and inclusive process, Integrated Credit Management (ICM) is a sustainable philosophy.

To establish such a culture, change management is key. You need to keep everyone on board. Top management must empower the Credit department to take on this role.

At the same time, the role of the credit manager has changed. Read more about this in our Credit management White Paper. The chapter Profile of a Credit and Collection Manager’ explains what future skills are required. If you are thinking about starting with Integrated Credit management, you want to be sure to hire the right person.

Related content

-

Article

How Belgian C-Suite executives view financial reporting

-

Blog

Lessons from the Belgian e-invoicing frontline

-

Blog

#takeaways ESG Webinar 12: Navigating the recent changes in the ESG reporting landscape

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector