Managing risk in 2022

13 October 2022FOCUS ON THE FUTURE OF YOUR BUSINESS 1: RISK MANAGEMENT

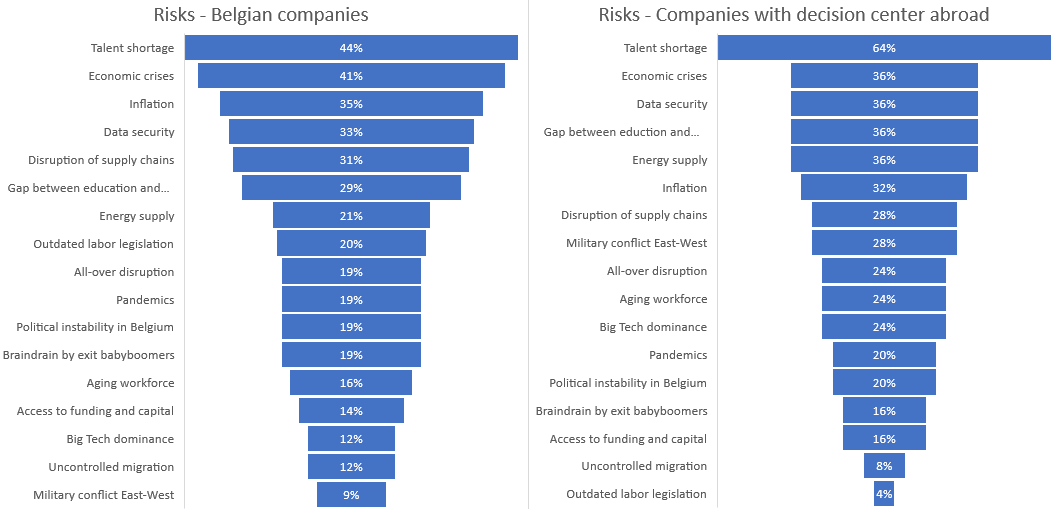

Top risks for firms according to Belgian executives

In June, TriFinance surveyed 111 executives to understand their approach to the talent crunch; the nature and extent of the transformations underway in their companies; and the extent to which sustainability is impacting the growth of their business. First of all, we asked them to highlight the risks they thought to have the greatest impact on their businesses.

Three risks not in the Top 5: Energy, Supply chains, Military conflict

At the time of the survey (June 2022), it was not clear yet that Europe would be struck by the biggest energy crisis since 1973, and by the weaponization of energy by the Putin regime. That might explain why only one in four participants flagged ‘energy supply’ as a major risk.

The issue did not make the top 5 and landed in the 7th place, just behind the more pressing ‘disruption of supply chains’, a problem we had become all too familiar with since the outbreak of COVID-19. Only 3 out of 10 executives considered supply chain disruption to be a major risk.

Though Russia had already attacked Ukraine in February of this year, only 14 percent considered a military conflict between East and West a major risk. Significantly more companies having their decision center abroad, however, put a military conflict among their Top-5 (28 percent). Only 9 percent of Belgian participants did so.

More differences in risk assessment between Belgian and foreign companies drew our attention. Slightly more Belgian companies than foreign companies flagged inflation as a major risk, for example. But more foreign companies were worried about energy supply, voting it into their Top 5.

The fact that 20 percent of Belgian companies cited 'outdated labor legislation' as a major risk against only 4 percent of foreign companies underlines that this is an age-old Belgian problem. The modernization of Belgian labor legislation is certainly overdue.

Risk #5: Skills Gap

Three in ten respondents see a clear gap between the education people get and the skill set that is required by companies. Kristoff Temmerman, TriFinance bcb leader Ghent, had already addressed that issue in a 2021 interview on the evolution of the labor market:

‘What we see is that young graduates, in general, know little or nothing about IT systems, SAP, automation, artificial intelligence, etc.,’ Kristoff noted. ‘There’s a clear lack of knowledge about new technologies, including the new business models that are being built on this technology. It takes a well-balanced training and mentoring program from our side to teach them how to cope with this.’

Interestingly enough, ‘Continuous learning’ is the top answer to the question ‘What method does your organization use to keep talented people on board?’ that we presented to our participants.

One in two executives says their company uses extensive learning, skills development, and training as retention tools. Skills development thus appears to be a win-win: employees benefit because they can continuously upskill; companies benefit because they can close the skills gap that becomes apparent immediately after graduation.

Risk #4: Data security

For one in three C-levels, data security is a major risk, and very understandably so. Many companies became aware of data security during COVID-19 when a large number of people started working from home. CFO Services bcb leader Alexander Van Caeneghem sees the heightened concern as justified. ‘Without data security, there can be no digital transformation,’ he says. ’The ability to work remotely has been important since the corona crisis, but it has to be done securely. So we all have some catching up to do. This issue will loom even larger when 5G comes along.’

Risk #3 Inflation and Risk#2 Economic crisis

Considered risky and very problematic by one in three C-levels are the increasing inflation and the resulting pressure on costs. With Eurozone inflation levels reaching 10 percent in the year to September, the highest in the 23 years of existence of the euro, expectations for a recession in the EU are increasing.

With Central Banks raising interest rates to battle inflation, a recession is now predicted for the EU, the US, and the UK, with the EU recession driven by high energy costs that will eventually unleash the economic crisis that four in ten respondents say is the biggest risk for their organization at this moment.

Already the corona-crisis caused prices to rise on a global scale. The energy crisis is now making this challenge more acute than ever.

Reducing costs in the short term, for reasons of prudence, is often a good strategy. In the long term, a much broader take is needed. When discussing this topic earlier this year, Alexander Van Caeneghem emphasized the role of the CFO as a ‘Value Officer’. ‘Obviously, cost-reduction exercises shouldn’t come at the expense of future growth,’ he said. ‘The CFO must be able to pinpoint strategic costs. A good concept here is zero-based budgeting. What shouldn’t we do, what should we do, and what should we improve?’

A well-balanced talent management is needed, including resource planning that allows room for temporary project-based support as a structural part of the workforce

Hanne Hellemans

Risk #1 Talent shortage

The absolute number one risk, however, is talent shortage. One in two executives put talent shortage in their top 5 risks. Half of the respondents also say it is difficult to fill vacant positions, and it appears to be equally difficult for all sorts of companies spread evenly over industries: large and small companies, generating high or lower revenue.

Listed companies seem to be the only exception, with 60 percent saying it is easy for them to attract talent, a significant difference from only 28 percent of privately held companies that have no difficulties attracting the exact talent they need.

Doing the right thing to tackle talent shortage is far from evident. ‘Shortage will not be solved if companies keep thinking in terms of filling a vacancy,’ says TriFinance BCB Leader Hanne Hellemans. ‘They risk hiring the wrong people when they simply want to fill a vacant position, with all the long-term effects that entails: putting too much work pressure on existing teams, for instance, which can result in burnouts & people leaving the organization, making this a vicious circle. Existing employees drown in operational tasks, and as a result lack the mental space they definitely need for long-term projects, innovation, or process improvements.’

To avoid these pitfalls, Hanne Hellemans says well-balanced talent management is needed, including resource planning that allows room for temporary project-based support as a structural part of the workforce.

‘Many companies are running behind the facts today,’ she says. ‘It is crucial to proactively map out the competencies you will need in the future and act upfront. That’s why organizations need to embrace diversity and inclusion, for example, and invest in upskilling & reskilling people.’

Related content

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance

-

Blog

The Omnibus vote: Europe votes to weaken sustainability reporting rules

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector