Striking results from our 2025 Finance Transformation Survey

25 June 2025In today’s world of constant and accelerating change, continuous transformation has become the new normal for Finance. Earlier this year, TriFinance conducted an online survey on Finance transformation to explore how organizations are redefining and preparing the Finance function for the future. To better understand how organizations are transforming the Finance function, TriFinance surveyed 120 C-suite and senior management leaders asking for their insights on the drivers, challenges, and ambitions of Finance transformation.

Over the past weeks, we have been sharing key numbers from this survey on LinkedIn, each accompanied by a short explanation. In this article, we have collected some of these figures and insights. The result: a snapshot of how Finance teams today are evolving toward strategic partnership, driven by digitization, process improvement, and a purpose-focused, long-term vision for value creation.

These are the top 5 Finance operational challenges Belgian CFOs are facing:

- Manual, time-consuming processes (58%)

- Regulatory pressure (50%)

- High operational costs (50%)

- Lack of system integration (42%)

- Data accuracy issues (25%)

These challenges are deeply interconnected: manual workflows drive up costs, disconnected systems undermine data integrity, and growing compliance demands stretch resources even thinner.

What's your experience? Is your finance department feeling these same pressures? What solutions are you implementing to address them?

73% of Belgian C-level execs report ongoing transformation - 43% of CFOs are transforming Finance.

The pressure to adapt is real - and Finance is feeling it. Our recent TriFinance survey shows that transformation efforts aren't isolated; more than half of respondents say the entire organization is involved.

What’s driving this change?

- 61% are improving internal processes

- 51% are digitizing workflows

- 42% aim to boost operational efficiency

- 38% are rethinking their business models

- 34% focus on AI and automation in Finance

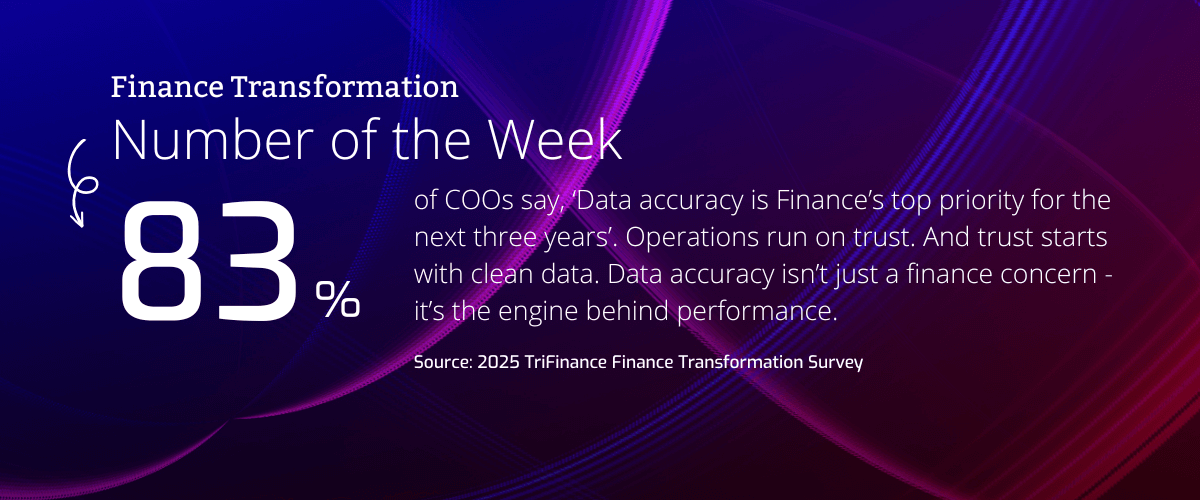

For Belgian leaders, accuracy is at the heart of Finance transformation. When asked about their top Finance transformation priorities for the next three years, 60% of Belgian executives - and a striking 83% of COOs - pointed to one thing above all: "Greater data accuracy and improved reporting."

Why? Because without trusted data, there's no strategic insight, no scenario planning, no solid decision-making.

But that's not the full story.

- 50% are focused on strengthening financial planning and forecasting

- 47% want more automation and efficiency

- 43% are pushing for better integration of Finance with the rest of the business

- 42% aim to enhance compliance and risk management

- And one in three are targeting a clear reduction in operational costs

The message is clear: Finance transformation is not a one-dimensional effort; it's about rethinking the entire operating model to make Finance faster, smarter, and more connected. Less firefighting. More forward-looking value creation.

Who should own the data strategy? Is Finance underestimating its role in digital transformation? CEOs vs. the rest of the C-suite.

TriFinance survey results show a significant gap in expectations on leading the organization’s data strategy:

- 41% of CEOs believe Finance should lead their organization's data strategy.

- Only 25% of CFOs agree - and among CHROs (0%) and CIOs (7%), confidence in Finance taking the lead is nearly nonexistent.

Instead, most CHROs (73%) and CIOs (60%) see Finance as a collaborator with IT on data governance - not a driver.

This contrast highlights a critical leadership question: Is Finance underestimating its role in digital transformation? Are CFOs too modest - or simply realistic about cross-functional dynamics?

Alignment across the C-suite is crucial. Finance can be the steward of data-driven decision-making - but only if it embraces both collaboration and leadership.

50% of CFOs rate systems integration as good to very good - compared to only 41% of their C-level peers. In a recent TriFinance survey, CFOs stood out with a more explicit opinion on how well financial systems (ERP, accounting, planning tools…) integrate with other business platforms like HR, CRM, procurement, or ESG tools.

- 25% of CFOs say integration is poor, compared to only 14% of non-CFOs.

- Yet 33% of CFOs also call it very good - triple the number of their peers (11%).

That’s what we call a polarized view. CFOs are closest to the data flows, friction points, and dependencies between systems. They feel the inefficiencies - or the gains - more directly than others.

Other executives aren’t that outspoken, and remain on the fence (35% of non-CFOs responded neutrally).

One thing is clear: systems integration is not a back-office IT issue - it’s a business-critical enabler. Especially in Finance.

83% of Belgian executives say ‘improving data accuracy and reporting’ is the top Finance priority for the next three years.

But here’s the real surprise:

- 83% of COOs put ‘data accuracy and improved reporting’ at the top of their list

- Only 29% of CDOs agree

Instead, CDOs are focused on compliance and risk (86%). They see Finance Transformation as a governance challenge, while COOs and Finance teams see it as a performance imperative.

For 86% of Finance Directors, forecasting and better integration with other business functions are among their top priorities.

So what does this tell us?

- Finance wants to shift from control to strategic leadership

- COOs want clean, reliable data to run the business

- CDOs want to ensure the data is compliant and under control

It’s clear that transformation won’t happen through tech alone. It will take alignment across a number of roles - starting with a shared understanding of what Finance is here to enable.

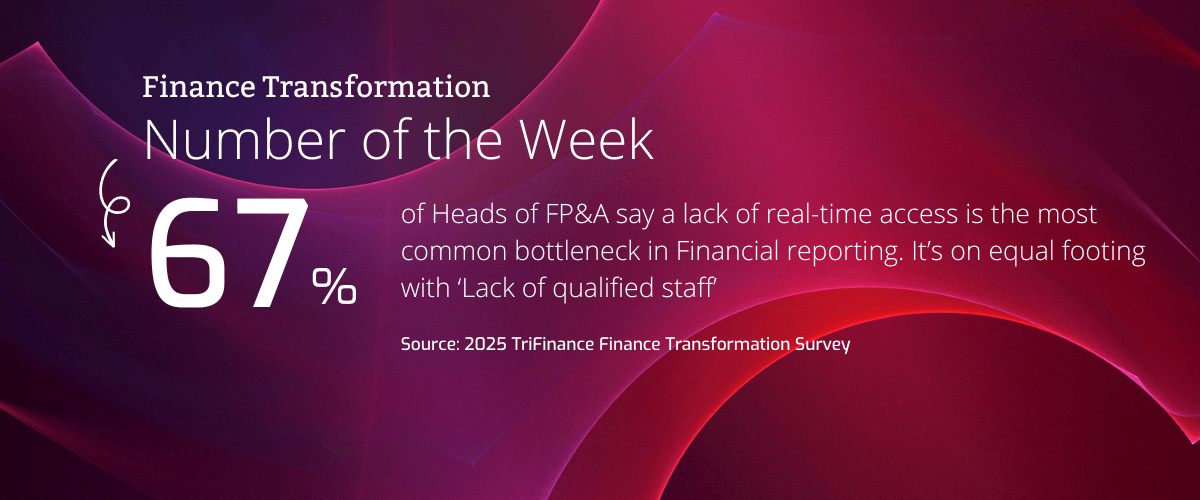

We asked senior finance leaders - CFOs, Finance Directors, Heads of FP&A, Heads of Accounting, and C-level executives - for the most common bottlenecks in financial reporting in their organizations.

The results show how each role experiences the finance function differently. There’s no one-size-fits-all view of finance transformation. To fix reporting, we need cross-functional visibility - not just better tools.

Here are some striking contrasts:

Manual adjustments: A nightmare for Heads of Accounting (82%) and Finance Directors (71%) but only 33% of FP&A Heads see it as a problem.

👉 Shows how manual work is concentrated in accounting operations, but not always visible in strategic planning.

Lack of real-time access: 67% of FP&A Heads, 50% of CFOs, and 46% of Accounting Heads report issues.

👉 Real-time insight remains out of reach for many, especially those closest to planning and reporting.

Data inconsistencies and inefficient approvals: Finance Directors (57%) and CFOs (58%) are most concerned.

👉 Those roles face the dual challenge of execution and oversight.

Outdated systems: Half of C-levels (52%) say it’s a problem, but just 9% of Accounting Heads agree

👉 A classic perception gap—strategic leaders see systemic risk; operators may have adapted.

Lack of qualified staff: 67% of FP&A leaders feel the squeeze, but only 37% of C-level execs do.

👉 Operational teams are under real pressure. But is leadership seeing the full picture?

More on Finance Transformation

Find out more on Finance Transformation via these insights and be inspired to get ready for your finance transformation journey.

Related content

-

Blog

#takeaways ESG Webinar 12: Navigating the recent changes in the ESG reporting landscape

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025