- Start your RPA project from streamlined, end-to-end business processes

- Balance implementation speed and sustainability of the RPA solution

- Cultural adaptation and aftercare are keys to success

The Covid 19 crisis will prove to be an accelerator of digital transformation. For people working from home, not all critical systems are remotely accessible. With properly configured on-site robots having access to these systems, it becomes easy to develop and activate robot scripts from off-site locations. During our Virtual Expert Session on Robotic Process Automation last Spring, leading TriFinance experts demonstrated how RPA helps to ensure business continuity in times of crisis. The session was hosted by Benjamin De Leeuw and Stéphanie Struelens. Text edited by Dean De Busschere and Dirk van Bastelaere.

3 major challenges

Working with clients, we observed three major challenges that will sound familiar to many managerial ears:

- Many processes are error-prone because they are still operated manually. Due to the manual labor creating little value, this comes with a high cost.

- To keep up with competitors, organizations need fast, personalized 24/7 customer service.

- Employees spend up to 80 percent of their time on repetitive, less-challenging activities.

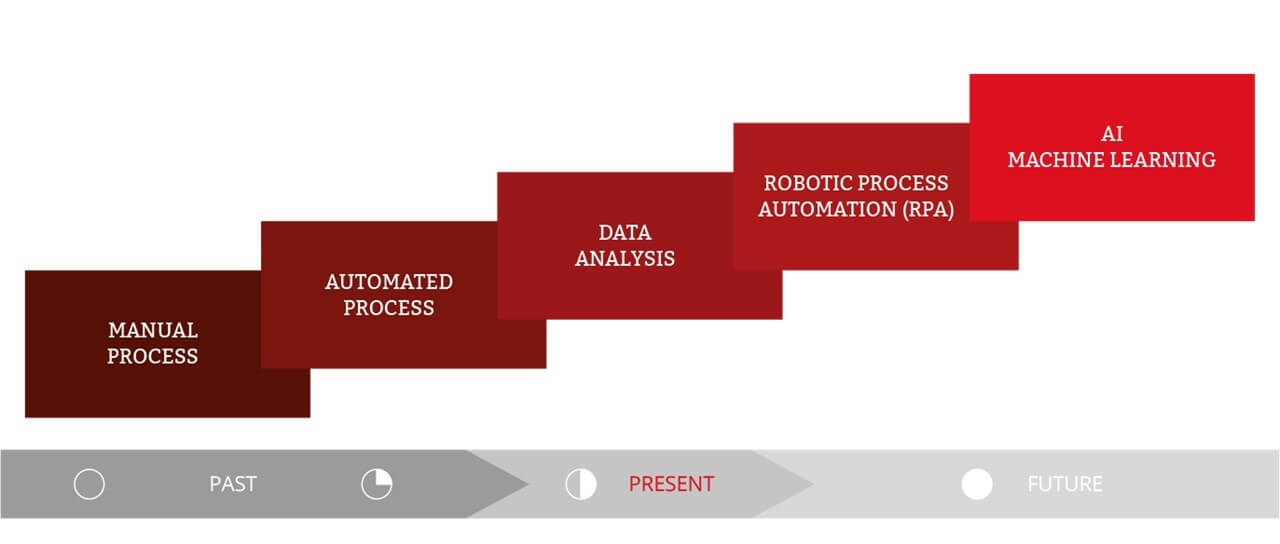

At least two of these challenges are not new. Why would a company choose Robotic Process Automation or software robots to address them? What makes robotization a better solution than the still ongoing wave of software automation and customization that started in the early nillies?

Towards digital self-service

Two important insights explain the growing interest in robots.

- ERP software projects are expensive. Investments

are generally written off over a period of five to ten years.

Customizing existing or legacy ERP software is even more expensive, with

implementation lead times usually taking a lot of time, making ERP

software solutions less suited for the type of automation that is

required today. Robots enable us to build a layer around legacy ERP and CRM systems.

That layer comes on top of installed software systems. To cope with

today’s rapidly changing business environment, it can be developed and

adapted really quickly. By running software robots, most and probably

all company-specific automation can be implemented in this RPA layer,

keeping the organization’s ERP/CRM system stable, while unburdening

employees of the repetitive and procedural tasks that still need to be

performed.

- Digital self-service. Unlike standard software automation, robots can be developed by finance professionals or subject matter experts themselves. This concept is called digital self-service in which robots are developed in a visual process or in a specific programming language easy to understand by people without an IT background. As robot scripters who are also business owners will know their business requirements, they don’t have to formulate these for IT.

We believe in the concept of digital self-service. Software robots can be developed by finance professionals or subject matter experts themselves

Benjamin De Leeuw - CFO Services RPA evangelist

The TriFinance approach to RPA

RPA is often seen as a goal in itself, whereas it is more of a means to optimize processes or fulfill a particular need. ‘RPA is one of many tools to make processes more efficient, suitable to specific processes that show certain properties,' project manager Benjamin De Leeuw says. A company trying to implement robots without identifying suitable processes and setting goals risks disappointing its business users.

RPA sponsors will then quickly lose support for their implementations. It is therefore important to define the main criteria to identify automation opportunities and to recognize the right conditions for processes to be automated.

In this article, we briefly describe the TriFinance approach to RPA, sharing eleven best practices to run your RPA projects.

How to approach an RPA project

Selecting your RPA cases:

TriFinance approaches RPA projects end-to-end says Financial Institutions Business Manager Stéphanie Struelens: 'To identify RPA candidate processes, our experts start in a center of excellence or work with a business team to screen all organizational processes, an activity they excel in because they have acquired specific business knowledge from operational projects and project implementations. Having identified suitable processes, we do an RPA assessment: a scorecard of criteria is used to assess whether a process is really a case for robotization'. The next step is conversion into a business case to prioritize the tasks to be robotized based on savings and other parameters related to business value and operational risk.

Optimizing processes, and developing the robots:

With the robotization case selected, TriFinance expertst start small Agile cycles of analysis, implementation and testing. The first important step is to streamline and optimize the underlying processes to ensure that the process to be automated is running smoothly. Automating a process that is deficient definitely is a no-go. Once that has been done, TriFinance RPA experts start to work out business requirements.

The bridge is then made between the business client and the scripters, following up on the implementation and supporting scripters by helping them answer questions from their business colleagues. After testing the robot, we ensure a smooth handover to the business. The TriFinance team extensively supports users and other stakeholders during this transition period with training and RPA awareness sessions.

During the Virtual Expert Session, a participant from a multinational industrial company illustrated how RPA awareness can be of crucial importance. ‘RPA is a tool in your toolbox to optimize processes and it should not only optimize finance processes,’ he said. ‘It is about bringing value to the organization and that is where the company is now stuck’. Trying to optimize various processes in the company’s shared services center, they got stuck looking for processes to automate.

Financial Institutions business manager Stéphanie Struelens indicated that the business users who should be suggesting processes often don’t know what a robot can do. 'That is why you should first organize RPA awareness sessions,' she says. 'Start working top-down with management selecting an interesting robotization case.'

A successful deployment can show business users the added value of a bot as a proof of concept. In the long term, a bottom-up approach is preferable to get the buy-in from all the people in your organization. In some companies, process teams or black belt teams exist to identify cases that should be improved or automated. A participant of the Virtual Expert session explained how this approach is used in her company. Process teams bring added value because they can look beyond departments to examine the end-to-end processes.

Criteria to identify cases eligible for automation:

To save unnecessary costs, it is crucial to first determine the robotizable processes taking into account six main criteria:

- The process should be rule-based.

- The tasks must be repetitive and

- stable because it makes no sense to automate a process that will soon change.

- Process maturity plays an important role and if it is not yet mature, organizations should foresee a period for standardization and streamlining.

- The data used must be clean and structured: the principle of garbage-in garbage-out also applies in robotization.

- Activities should be time-consuming or high-volume transactions.

Which processes can be robotized - Five examples

- The six criteria that must be met to robotize a process are fulfilled in the case of invoice processing: Invoices can be scanned and registered in an ERP system using RPA. Credit and payment workflows are visible. You can release payments and send notifications towards clients. It is an end-to-end solution where you can even incorporate master data management.

- Another time-consuming activity is the closing process. It is a process that typically applies to all industries. Specifically, a lot of reconciliation and validation processes can be automated. Reconciliation between different systems can be robotized, but also GL versus contracts, PO versus payments and invoice. The many reports that are built for management and that differ from one entity to another make the consolidation intensive. All of this manual work could be robotized so that finance people can focus on the analysis. In intercompany processes, where you have a lot of difference between two entities booking it at a different time. The robot can of course book the debit and the credit at the same moment which at least would avoid conversion differences or timing differences. So it can automate a lot of recurring bookings or types of bookings.

- Automation generates clear added value in payroll activities where companies can automate calculations and payments of salaries but also every administrative task related to sick leave certificates, travel and expense policies, onboarding and offboarding of employees.

- Robotics can definitely be of use in compliance activities such as fraud detection. A lot of compliance checks on customer and transaction master data can be automated. It helps companies to detect fraud on existing transactions quickly while artificial intelligence makes it even possible to predict fraud using historical data.

- A last example is in operations and transactions processing. TriFinance participated in an RPA project at a major Belgian bank. In one month’s time, we supported the implementation of a software robot that handled 50.000 payment delay requests related to the credit reimbursement of capital for households during the Covid-19 crisis (moratory measures). The robot scans the request, checks the parameters and decides whether or not the application can be approved. After that, a new reimbursement table is made up and sent to the client. Robotization can provide many solutions, both for very simple and complex processes.

RPA is too often seen as a remedy for processes not running efficiently, but this will not prevent your process from bleeding.

Stéphanie Struelens, Business Manager Financial Institutions

Best practices before starting with RPA

From experience, TriFinance built a set of RPA best practices. ‘This is probably the most relevant information you can get before, during and even after a robot implementation,’ Stéphanie Struelens says.

Best practices before starting with RPA:

- Ensure that you have a management buy-in or a sponsor willing to stress the importance of an RPA project. ‘It remains a big change management project,’ Stéphanie Struelens says, ‘and if you do not set the tone at the top, you will not get the buy-in: a new mindset is necessary within the company.’

- Start your RPA project from streamlined, end-to-end business processes. RPA is too often seen as a remedy for processes not running efficiently, but this will not prevent your process from bleeding. It should, however, be implemented with an end-to-end perspective. ‘We often see that clients automate only a part of the process, without analyzing what is happening before and afterward,’ Project Manager Benjamin De Leeuw says. With an end-to-end approach, you avoid rework or achieve some savings because you already have prepared for the next step.

- RPA is not a goal. It should be a means to reach your goal. Organizations often decide to do an RPA project, and then start looking for a candidate process, where it should be the other way around. Start by doing process management, identify your process issues and then see which solutions suit you best.

- Be critical in your savings estimations when drafting a business case. Team leaders tend to overestimate the savings because they want their case to be automated. Business users, on the other hand, tend to underestimate: they claim that they still need to work afterward. Moreover, savings are not only a workload or FTE cost reduction. There are other benefits such as a reduction in your operational risk; a more stable business continuity, an enhanced customer value like a shorter time to market, or response rate that is faster for the client, and so on. Organizations should balance all these savings and make sure to include other parameters in their business case than only costs.

All too often, an RPA project is only viewed from a cost perspective, saving FTEs and diminishing work pressure. An Expert Session participant from the insurance sector was fully engaged in automating financial reporting in Asia. Saving FTEs is not always a very effective argument in that region: Asian organizations often want to employ as many people as possible because wage cost is lower than in Europe, making cost-cutting less relevant as an argument. Another participant from a multinational industrial company added that taking away 80 percent of non-value adding work by automating the repetitive work helped to keep people on board, e.g. in their Vietnam subsidiary. People stay longer in the company because their jobs have become more interesting. ‘Instead of workers fearing that robotization might lead to redundancy, they should be made aware that it can uplift the quality of their jobs’

Best practices during RPA implementations

- Start small. Use simple cases to allow a learning curve. Try to find a process that is not very complex, does not have too many interactions with different systems, not too many different exceptions, etc. Nevertheless, the process should generate a lot of value for your business to achieve buy-in from management and employees. In the next phase, we can opt for more complexity.

- Try to find a good balance between implementation speed and sustainability of the RPA solution. We all know that it is quicker to use screen scraping, but if your field changes one month later you will have to rework the script.

- Define clear ownership and accountability during and after the implementation.Who analyzes the error logs and who monitors the processes should be determined beforehand. Clients often believe they are not responsible anymore of the robotized processes. Whereas the truth is that they are still accountable for the outcome and success of their bot. If it is not working properly, they should be responsive and take care of it to support the team.

Cultural adaptation is key for your RPA project: invest in change management initiatives to create awareness among your users

Stéphanie Struelens, Business Manager Financial Institutions

Best Practices after RPA Implementation

- Cultural adaptation is key for your RPA project: invest in change management initiatives to create awareness among your users so they accept the added value of robotization and to support them in the transition from manual to more analytical tasks.

- Aftercare. You can start working on your next bot immediately, but it is better to keep some people working on aftercare. We see clients rushing into a next bot and working on it, which is good, but keeping having people do aftercare for a period of three weeks is better. Even with simple bots, it’s really important to be responsive in the post-implementation era. Otherwise, you risk people saying that “the robot is still not working, I’m losing a lot more time than when I did it manually”.

- Offer a clear overview of automated business activities by using process management and business architecture software. This allows you to see which part of the processes are manual, automated, and robotized, but also to see the interaction between processes and systems. That way, you can determine who is responsible for that particular system and adjust the bot when there are changes.

- Use a part of your budget to install a benefits management system, so that you can effectively monitor the changes and the savings.

Related content

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance