Optimizing property asset management

Your challenges

- You experience challenges managing your assets in a structured and process-oriented way.

- Your organization's property assets are used suboptimally (due to ad-hoc decisions).

- You lack the financial resources to optimize your assets and meet climate objectives.

TriFinance supports public and non-profit organizations with strategic property asset management, translating insights into sustainable, well-founded asset plans.

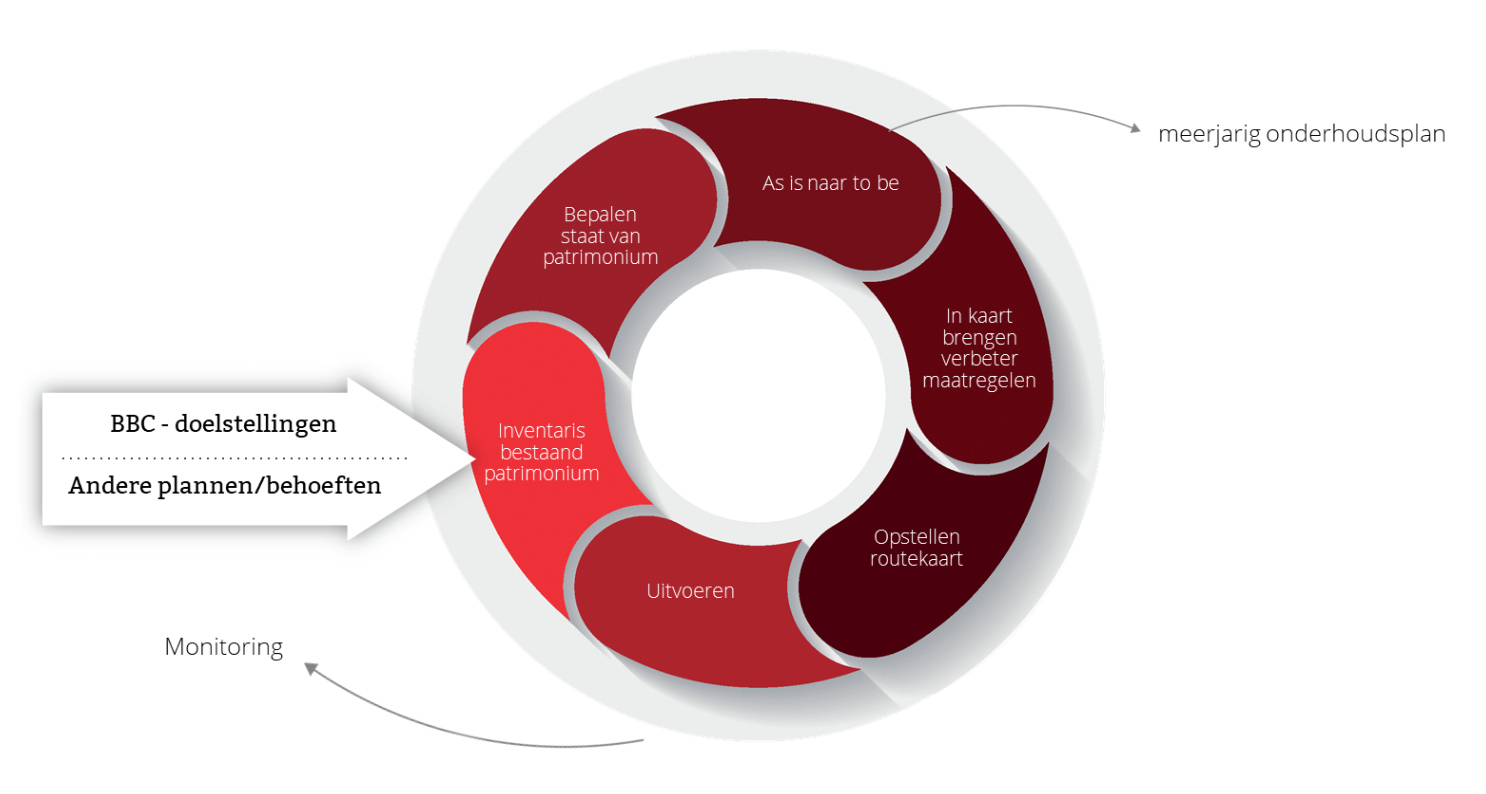

Our approach to strategic property asset management

Optimal asset management is crucial for achieving your organizational goals. It’s not just about ownership, but above all about using your resources efficiently. TriFinance offers a structured process to optimize your asset management:

- We start with a detailed inventory of your current assets.

- We map each component at the required and agreed level of detail.

- Together with your team, we develop a strategic vision and a multi-year maintenance plan.

- We translate this vision into concrete improvement measures for each building or location.

- An operational roadmap defines the practical implementation, including timelines, financial implications, and specific requirements.

With this approach, we ensure not only effective management but also continuous improvement. Your assets are closely monitored and evaluated, enabling you to adapt continuously and achieve maximum performance and sustainability.

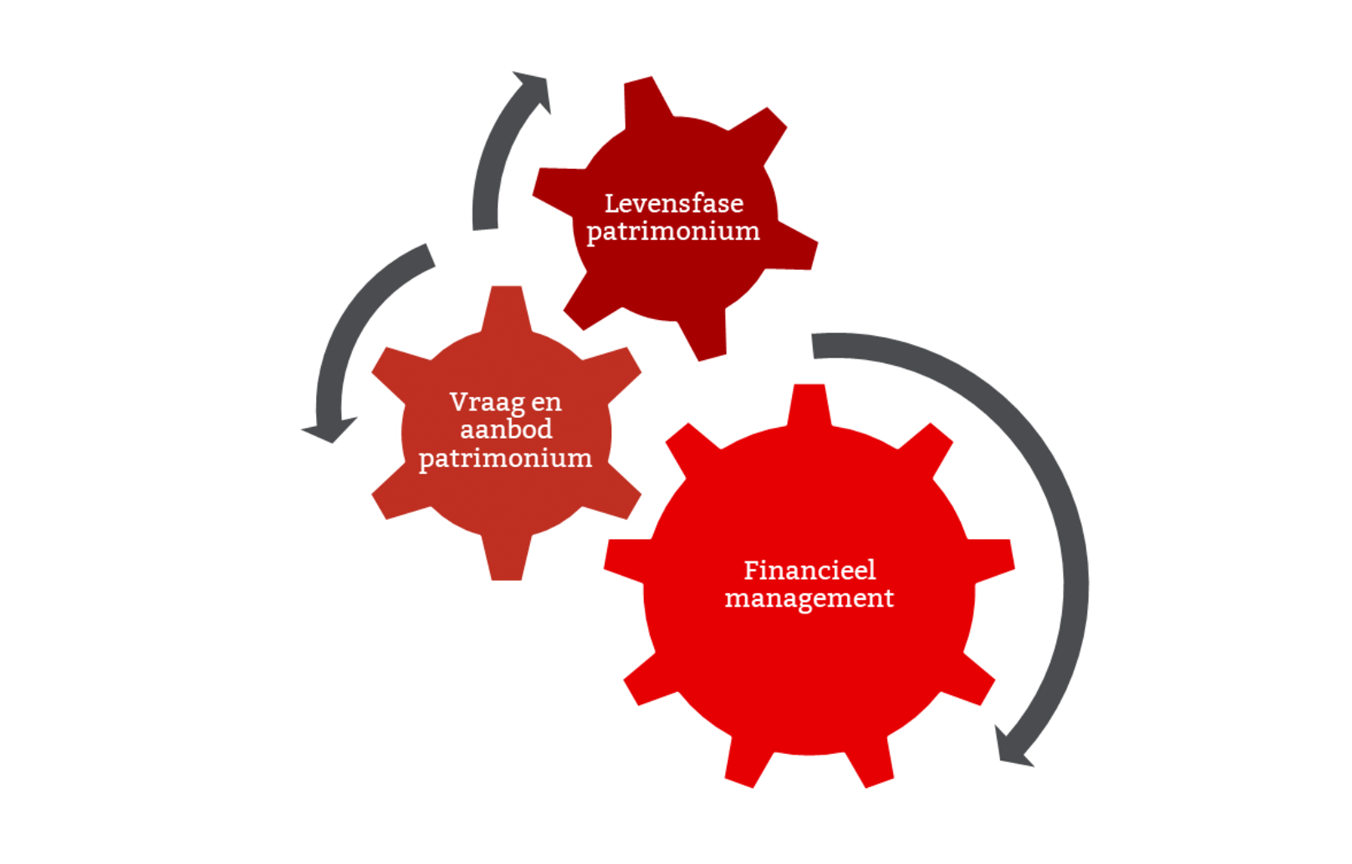

Levers for property asset management

Your property assets are more than just bricks and mortar, they represent financial, social, and functional value. TriFinance helps you unlock this value and use it strategically.

Together, we analyze your property portfolio and refine your vision. We apply three powerful levers:

- Lifecycle: Is the building in the design, operational, or transition phase? And what is its current condition?

- Supply and demand: Does the building’s use align with the needs of (potential) users? What is the occupancy rate?

- Financial management: Are costs and benefits balanced? And how can revenues be increased responsibly?

Using these levers enables you to translate the value of your property assets into concrete strategic decisions that have the greatest impact on your organization.

Lever 1: Insight into the lifecycle of your property assets

A strong property asset policy starts with a clear vision. TriFinance maps your buildings in a uniform and structured way to provide a comprehensive overview of your estate.

Through a standardised condition assessment (in accordance with NEN 2767), we analyze the technical state of each building, from a global picture to an in-depth analysis. This enables us to quickly identify key risks and areas requiring attention.

We translate these insights into a realistic multi-year maintenance plan, built on key figures and tailored to your specific context, such as intensity of use, exposure, maintenance history, and more.

The result? Full control over your operations and investments, and a solid foundation for making sustainable, well-informed decisions about the future of your property.

Lever 2: Balancing supply and demand

TriFinance helps you align your property assets with the needs of today and tomorrow.

We analyze the current occupancy rates of your facilities and identify areas where space remains unused. Simultaneously, we gather insights into the needs of citizens, associations, and other potential users through existing data and participatory engagement. This approach makes it possible to align supply and demand while uncovering opportunities for more efficient and future-oriented use of your buildings.

Through a co-creation process involving the board and relevant partners, we work towards balanced scenarios for repurposing, optimization, or cooperation.

The result? A broadly supported plan of requirements that guides your property asset policy, with maximum focus on social value, efficiency, and the sustainable use of available space.

Lever 3: Financial management as a guide

A sound property asset policy stands or falls on financial feasibility. TriFinance helps you translate ambitions into realistic plans tailored to your available resources.

We transform the maintenance strategy into a multi-year financial maintenance plan and calculate investment needs based on key figures. This quickly provides a clear estimate of the costs required to balance supply and demand.

By linking this estimate to the BBC framework, we simulate the impact on your self-financing margin and provide insights into the balance between operations, investments, and financing.

We explore the optimal path by developing various scenarios summarized in clear roadmaps, enabling you to pursue a property asset policy that is not only ambitious but also affordable and sustainable.

Our strengths in property asset and real estate management

At TriFinance, we combine deep expertise with an approach that works for your organization:

- Experience in the public sector

We understand your reality, processes, and challenges inside out, both at the political and administrative levels, as well as from the perspective of those who use your facilities - Strong policy and technical expertise

We connect strategic advice with financial, technical, and operational insights. - Co-creative customization

No standard solutions, but tailored processes fully aligned with your organizational culture and specific context. - Clear reporting

Our tools make policy tangible and transparent. No black box, but a measurable impact. - Sustainable capacity building

We help develop internal competencies, enabling you to independently and confidently implement your property asset strategy. Together, we create a property asset policy that works – now and in the future.

Ready to optimize your property assets?

Are you looking to manage your property assets strategically and sustainably? Discover how TriFinance can support you with real estate optimization and tailored property asset management.

Get in touch

Or discuss your needs, contact us for an exploratory meeting, at no charge and with no further obligations.

Related content

-

Reference case

From back-office support to informed business insights at OMP

-

Article

Boomerang story: “Leaving showed me how unique TriFinance really is.”

-

Article

From e-invoicing compliance to a scalable finance architecture

-

Article

Building a scalable financial backbone for pan-European growth at Macadam Europe

-

Article

AI in the boardroom: From pilot to priority

-

Article

Where background stops defining the future: consultancy paths open up at TriFinance

-

Career in Internal Team

IT Infrastructure and Workplace Engineer

-

Career as Consultant

Power BI Consultant

-

Career as Consultant

Data Engineer

-

Career as Consultant

Senior Risk Advisory Consultant

-

Career as Consultant

Senior Finance Transformation Consultant

-

Career as Consultant

Business Analyst - Banking/Insurance