Applying the standard risk management cycle in change projects

- How to apply the standard risk management cycle in change projects

- The importance of stakeholder management

- Building a product incrementally and working together in an Agile Team

Fascinating, varied and challenging projects in Banking and Insurance were the reason why I chose TriFinance almost 16 years ago and why I am still working here. During this project - the set-up and implementation of a risk management framework for change projects - I got to know the world of Non-Financial Risk Management (NFRM) and its importance in both smaller and larger projects.

Understanding the background

The client is a Belgium based bank and insurance company that provides retail financial services (savings, lending, insurance and investments) for clients in Belgium and the Netherlands. Its mission is to assist families and individuals in living financially healthy lives with a product offering focused on simplicity and a long-term relationship of trust. Thanks to both our previous track record at the client and our specific TriFinance approach - consisting in combining our know-how (advice, expertise) with our do-how (implementation) - we were able to support the client in the best way. On top of that, there was a good match between the expectations of the client and the experience we could offer in Business Analysis and Agile Project Management. Our hands-on mentality and follow-up by mentors were undoubtedly an added value.

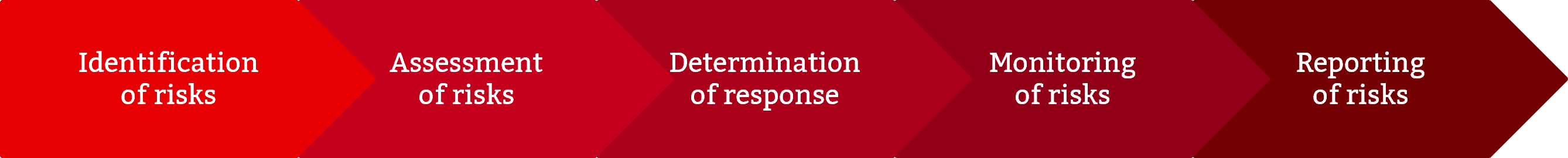

The standard risk management cycle

The standard risk management cycle consists of the following steps:

The project’s main objective was to write a procedure that describes how this cycle should be applied in change projects so that it can be demonstrated whether the project risks taken are within the scope of the risk appetite of the client.

The procedure deepened, via a set of minimal standards, the following guiding principles:

- Develop and implement a risk management framework,

- Advise the organization on the implementation and monitoring of risk management,

- Increase risk awareness within the organization (supported risk culture),

- Help to ensure that the risk appetite is respected company-wide.

The main challenges we encountered were

- The lack of literature available on risk management in change projects, especially for agile projects,

- The fact that the agile way of working was new to the customer,

- The allocation of responsibilities in the context of risk management in change projects,

- The many stakeholders who had to read and approve the procedure,

- The new risk framework in change projects needed alignment with other existing NFRM frameworks in the context of Process Management and Third-Party Risk Management.

Setting up a Risk Management framework

Together with the client, we succeeded in setting up a Risk Management framework to identify, assess and follow up on project risks applicable for both Waterfall & Agile projects. To ensure the support to the new framework, many stakeholders were involved in its creation. They were among others, Compliance, Financial Risk Management, Information Security & Risk Management, Quality Assurance, Process Excellence, Strategy & Transversal Services and Enterprise Architecture.

Next to the framework, we implemented the operationalization in the form of procedures, templates, work instructions, training for the internal NFRM colleagues, a change risk classification matrix and a risk logging system. To test the theory into practice, we performed several proofs of concept.

If applied correctly, the new Project Risk Management framework implies

- The selection of the right change projects (prioritization according to strategy, customer interest, legal requirements, benefits and risks),

- Awareness of risks during the change project and at handover to the run,

- Timely escalation if successful implementation is jeopardized (time, cost, scope and quality),

- Managing the risks in a responsible, verifiable and consistent manner,

- Provide assurance that change risk is in control,

- Realization of change projects through controlled go-live decisions.

Fascinating, varied and challenging projects in Banking and Insurance were the reason why I chose Trifinance and why I am still working here.

Bram Servaes, Project Manager at TriFinance Financial Institutions

The energy I get from working in an Agile Team

From a personal point of view, I enjoyed being on this project because I got to know the field of Non-Financial Risk Management and many people from different departments and levels.

I learned a lot from preparing and participating in presentations and meetings with other managers, directors and C-level executives. The meetings helped me to develop my presentation and people management skills.

This assignment also made it clear to me that I prefer working in an agile work environment compared to a waterfall project approach. I rediscovered that I get a lot of energy from building a product incrementally and from seeing people work together in an Agile Team. My next project is well in line with this chosen path.

Related content

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance

-

Career as Consultant

Business Analyst - Banking/Insurance

-

Career as Consultant

Operations consultant - Banking

-

Career as Consultant

Treasury & Financial Markets Consultant

-

Career as Consultant

Finance professional - Banking/Insurance

-

Freelance opportunities

Freelance Assignments - Banking/Insurance

-

Career as Consultant

Medior Project Manager - Banking/Insurance