#1: Careers are all about confidence and trust.

#2: Banks do not work efficiently, not even internally.

#3: Soft skills will matter more than hard skills.

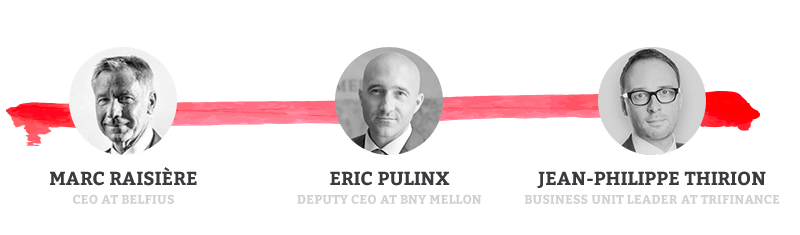

Top bank executives about their careers, their role in the growth of employees and about the future of their sector: Who has the most successful career? He who does not have a career plan? Or he who thoroughly maps out his career? Opinions are divided. This became clear during the virtual panel discussion TriFinance organised with the CEO of Belfius, Marc Raisière and Eric Pulinx, the deputy CEO of BNY Mellon. There was unanimity about the role organisations should play in the growth of their employees and about the huge changes the sector is going through.

Professor Ans De Vos (Antwerp Management School - UAntwerp) kicks off debate with her statement that those who do not have a fixed career plan are the most successful. For her, this presupposes: knowing oneself well, being open to opportunities and learning from possible setbacks. The CEO of Belfius, Marc Raisière, agrees. He studied mathematics at the KULeuven and became an actuary, an insurance mathematician. As he wanted to carry out an activity aimed at the customer, he also followed training in marketing. "But what was I: an actuary or a marketer? I was thirty years old and didn't know. It took a long time before I realised that both studies were complementary. This became very clear to me during the technological crisis of the century. Unlike others, I had sensed it and that gave me self-confidence".

"A career is not the result of chance, but of strategic reflection.”

Eric Pulinx, the deputy CEO of BNY Mellon, sees things differently. He expresses his vision in six words: "Plan, plan, execute, revise, start over". In his career, he said he left nothing to chance. "A career is not the result of chance, but of strategic reflection. A career is like climbing a mountain, in which you divide the journey into foreseeable stages and adapt it according to circumstances. In a career you have a goal and a step-by-step plan, which is flexible, to get there. Opportunities should always be considered in terms of that goal".

Trimor Bardoniqi, new Project Consultant of TriFinance's Blue Chip Boutique (BCB) 'Financial Institutions', tells us afterward that he agrees with Eric Pulinx's vision. "The first step of a career is to establish a clear long-term objective. For me, as a young professional, it is important to pursue a goal from which my choices and decisions result. That requires a well-formulated strategy, which has to be flexible because the context can change".

“It is the task of leaders and mentors to contribute to that goal and help employees to make their own business plan".

During the debate, Jean-Philippe Thirion, Leader of the Belgian BCB 'Financial Institutions' and of the BCB in Luxembourg, makes the bridge between preferring to plan a career or not. For him, the evolution of careers depends on the people involved, who have to work on their reputation as a company does. Jean-Philippe explains that TriFinance considers employees as intrapreneurs, who manage their careers like a company. "The Project Consultants with whom we work come and go from one project to another - as travelers flying from a 'Hub' from one destination to another".

In this context, the BCB Leader sees a role for the organization as a motor that helps to increase the employability of employees. "It is important that organizations have a reason to exist. The why-question of what people and an organization do is paramount. At TriFinance this is: making people grow. Furthering People for Better Performance in Do-How. It is the task of leaders and mentors to contribute to that goal and help employees to make their own business plan".

"If you cannot identify with the raison d'être of your organisation and its values, it is better to leave."

Marc Raisière says that he rejoices in the fact that colleagues are developing themselves and he, too, states that an organization has a role to play in this. An organization owes its success in the first place to the talents that work for it. "I do not like competition between people. Fighting each other does not pay off. Working and growing together brings success. But I do challenge my employees to get the best out of themselves and the team. They form a strong team of talents who are complementary". For the CEO of Belfius, it is important that employees can identify with the raison d'être of their organization and the values it espouses. "If not, it is better to leave the company. Something I also had to do in the course of my career".

Digital revolution

The financial world has been going through heavy weather for some time now. The CEO of Belfius takes a step back in time and refers to the banking crisis of 2008 and the deteriorating budgetary situation of countries that followed. And now there is the coronary pandemic. Eric Pulinx completes the picture with Brexit and, since the banking crisis, stricter rules for financial institutions. At the same time, he emphasises that the latter elements also provide opportunities. Activities from the City of London are moving to continental Europe and the stricter rules require people with specific skills.

Above all, there is the digital revolution which is profoundly affecting the functioning of financial institutions and careers related to it. Marc Raisière: "Everyone should be digital, partly because the relationship with the customer has changed dramatically. Banks do not work efficiently, not even internally. Their processes are too heavy and that applies to all banks in our country. Banks still have a long way to go in terms of efficiency and experience. The financial world still scores poorly compared to the experience leaders outside the financial sector, who are the benchmark for our clients. We should therefore compare ourselves with them rather than with other banks".

Banks still have a long way to go in terms of efficiency and experience. They need to be inspired by experience leaders who set the benchmark, rather than comparing themselves with each other.

Marc Raisière, CEO Belfius

A better ability to anticipate unforeseen events will greatly change careers.

For Jean-Philippe Thirion, the changes necessitate reinventing the workplace. "Digitisation has to do with technical knowledge, such as coding. But it is even more important to turn the mindset towards the digital. This requires soft skills such as entrepreneurial spirit, analytical ability, flexibility, critical attitude, empathy and resilience. A better ability to anticipate events will greatly change careers". The BCB Leader is convinced that the business model of banks will look different within 10 years. "Instead of being a mere service provider, they will become the 'butler', the thoroughbred advisor for all our financial activities".

Careers are all about confidence and trust.

Marc Raisière explains that, six years ago, Belfius went back to the essentials: "supporting the Belgian economy with people's savings". "That is at the heart of the banking profession and we had forgotten that. We refocused our strategy to this and, at the same time, went full steam ahead with the digital. Travelling to the US and China with 300 employees taught us that we are too modest and that we can become fintech ourselves. That gave our people confidence, resulting in very concrete successes and digital leadership from Belfius. Careers are all about confidence and trust.”

Covid-19

The final part of the debate focuses on the opportunities and risks of the corona crisis in which we find ourselves, in particular, teleworking with its online meetings. Eric Pulinx: "You see the extroverts everywhere and the introverts not at all. The first ones are bubbling with energy, which is, admittedly, diminishing. The second group feels at ease and continues to work with constant energy. For all of them, the feeling of belonging to the organization decreases. The social cement is crumbling and that is something we have to be attentive to. Employees are more inclined to leave their comfort zone and are more willing to change companies". For Jean-Philippe Thirion, the important thing is to reassure the employees, who are looking for security, and to help them work on their employability. "A company that takes initiatives in this area is an attractive employer. Marc Raisière adds that times are appropriate for checking where you are at in your career and where you want to go. He indicates that Belfius looks to the future with confidence, but expects the effects of Covid-19 to be felt in the financial sector as well.

Never waste a good crisis, use this current crisis to think about your career and make sure it gives you pleasure and satisfaction

Eric Pulinx, Deputy CEO BNYM

Mentors

For Eric Pulinx, mentors are very grateful when reflecting on your career. "But conversations with them are no free lunches. They are meant as win-win meetings where you also have to give something, for example, experience in another sector". The deputy CEO of BNY Mellon mentions his mentors: Filip Dierckx (SDWorx and ex-BNP Paribas Fortis) and Luc Bertrand (Ackermans & van Haaren). Marc Raisière points out that when researching your career, you should certainly not only analyse your technical skills. "Soft skills such as skills related to emotion and behaviour are at least as important. They are the skills that I pay particular attention to". The final word is for Eric Pulinx: "Don't be afraid when it comes to your career. Never waste a good crisis, use this corona crisis to think about your career and make sure it gives you pleasure and satisfaction".

It is an advice that Trimor Baldoniqi is already taking to heart. After the debate, he says that taking part in the event was a good start to reflect on his career development: "How do we want to develop our careers and how should we behave in order to achieve the goals we have set for ourselves". Be the owner of your career, be open to new opportunities and leave your mark, are ideas he stresses on.

Marie Vandoorne, Project Consultant of the BCB Financial Institutions, concludes after the event that you must never stop discovering who you are and what you want to become. She believes it is important to be open to new possibilities, to anticipate and to continue to perfect oneself. She emphasises that the CEO of Belfius pays more attention to soft skills than to hard skills. "It wasn't written in the stars where those top men would end up. They reached the top thanks to choices of which they didn't immediately know where it would take them". With these words, we can say that Marie belongs more to Marc Raisière's camp.

The panel discussion is part of the virtual roadshow TriFinance organizes after publishing its book: ‘Zo maak je carrière in finance’ - Comment faire carrière dans la finance?’ ('How to make a career in finance).

Related content

-

Article

Stabilizing Finance functions in a European bank in transition

-

Article

Building a scalable financial backbone for pan-European growth at Macadam Europe

-

Article

AI in the boardroom: From pilot to priority

-

Article

Data Strategy and Data Management: Two prerequisites for Data-Driven Finance

-

Article

How data management enables faster, better decision-making across the organization

-

Reference case

Power BI drives a reporting transformation at a global industrial group

-

Career as Consultant

Business Analyst - Banking/Insurance

-

Career as Consultant

Operations consultant - Banking

-

Career as Consultant

Treasury & Financial Markets Operations

-

Career as Consultant

Finance professional - Banking/Insurance

-

Freelance opportunities

Freelance Assignments - Banking/Insurance

-

Career in Internal Team

IT Infrastructure and Workplace Engineer