The essential role of the CFO in leading finance transformation

8 May 2025Periods of economic and geopolitical instability have a way of revealing the strengths and the weaknesses of an organization. Today, geopolitical tensions, volatile markets, inflationary pressures, and rapid evolutions in technology have only sharpened the need for organizations to become more agile in how they operate. In this environment, the role of the CFO is no longer confined to compliance and financial reporting; it has become a key leadership position that guides companies through transformation.

Finance transformation goes beyond process optimization or implementing new tools. It’s about reimagining how the finance function operates, how it contributes to decision-making, and how it delivers value to the business. It’s about making finance future-proof: not just in systems and structures, but in mindset, skills, and purpose.

Leading that transformation is both an opportunity and a responsibility. CFOs must connect financial discipline with long-term vision and guide their finance teams through continuous change, all while keeping the business running. It’s a balancing act, and one that very few in the organization are equipped to manage.

To explore the complexity of this finance transformation role, this article draws on the insights of three of our experts in finance transformation:

- Johan Reunis, Expert Practice Lead Business Integration, who provides insight in how system architecture and process alignment can create agility

- Filip Ceulemans, Client Partner Pragmatic Advisory and Implementation, whose experience spans strategy development, technology enablement, transformation and the evolving talent landscape

- Alexander Declerck, Business Unit Leader Transition & Support, who focuses on guiding organizations through the practical realities of transformation, from building buy-in to balancing resources

Why the CFO is critical to finance transformation success

The finance department has long been considered a gatekeeper of compliance, reporting, and financial control. But in organizations where transformation is underway, the CFO is stepping into a far broader role.

“The CFO is a central point in the web. They’re in a position to ensure that the organization can actually execute the transformation”, states Filip Ceulemans, Client Partner Pragmatic Advisory and Implementation. In his view, the CFO is uniquely positioned to bridge the gap between high-level strategy and operational execution. “It’s about creating alignment from the top down: understanding the company’s strategic goals, then translating those into the skills, technologies, and processes required across departments.” This role puts the CFO in the driver’s seat when it comes to transformation: not only as a finance leader and finance transformation manager, but as a coordinator of change across the business.

With visibility across departments and a mandate that touches every aspect of the business, the CFO is uniquely equipped to turn strategy into structured change.

Filip Ceulemans, Client Partner Pragmatic Advisory and Implementation

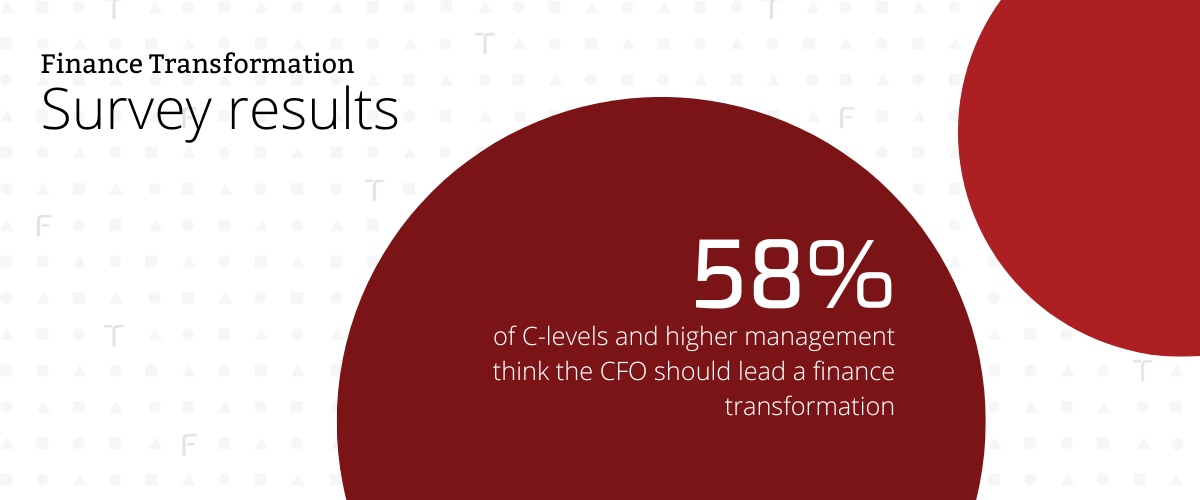

In a survey by TriFinance between late March and early April 2025 among a representative panel of C-levels and higher management familiar with the transformation of the finance function, 58% of respondents indicated that the CFO should be the lead in finance transformation. Nearly 19% believe it should be the CEO and 12% the CIO. The remaining 11% have no opinion or think the finance transformation lead role should be taken up by another function.

Interestingly, 33% of CFOs who participated in the survey believe the CIO is better positioned to take the lead in finance transformation. In turn, 41% of CEOs feel they themselves are best positioned to take on that role.

From financial custodian to strategic partner

Driving value from the finance department means moving beyond traditional finance responsibilities. It requires understanding what drives the business, how different functions interact, and what data is needed to support better decisions. Johan Reunis, Expert Practice Lead Business Integration, emphasizes this point: “It’s not about speaking in financial terminology but translating financial insights into operational reality. What do they mean for production? For sales? That’s when the finance team becomes a real business partner.”

In organizations that are further along in their transformation journey, this shift is already visible. Finance teams that have invested in automation, data integration, and advanced analytics are now positioned to act as catalysts who identify where value is created, spot inefficiencies, and help business leaders prioritize investments. These CFOs are no longer debating the accuracy of the numbers; they’re using those numbers to shape the future. A growing number are also exploring how to leverage AI in finance processes.

However, many organizations aren’t there yet. “There are still companies where finance is very transactional,” notes Alexander Declerck, Business Unit Leader Transition & Support. “In those environments, the CFO’s first task is to build a solid finance foundation. Only then can the function take on a more strategic role. That shift requires tools, but also a completely different skillset, both for the CFO and their finance team.”

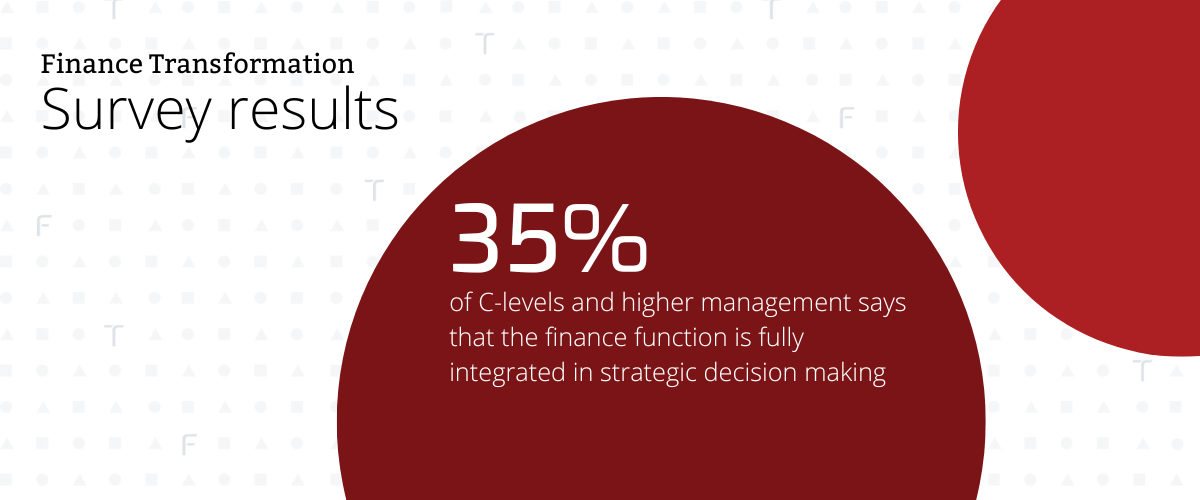

Our survey results indicate that in a majority of companies, the finance function is making the shift from a purely operational role to a more value-driving function: 35% indicate that the finance function is already fully integrated in strategic decision-making, and in another 27% of the organizations, finance is developing as a strategic partner. However, this means that still 31% of respondents indicated that the finance department still has a primarily operational role in their organization. The remaining 7% have no opinion on the matter.

Building adaptability to continuous change

While not all companies have already begun to transform their finance function, neither should it be seen as a one-time change. As Johan Reunis puts it: “Finance transformation is never really finished. It’s a continuous process. The real question is: How do you make your finance function agile enough to adapt at the same pace that the business changes?”

In an era defined by disruption, it’s not a question of whether to transform, but how to best organize continuous transformation. For CFOs, that means keeping a long term view while staying close to operational realities.

Key responsibilities of the CFO in transformation

Successfully leading finance transformation requires more than technical competences. It calls for vision, communication, and the ability to manage change across the entire organization. At the heart of this effort lies a clearly defined transformation strategy that is deeply rooted in business needs and consistently supported by top management.

Filip Ceulemans highlights the foundational role of vision: “It starts with a clear picture of what you want to achieve for the business. Not just for finance, but for the entire company. That vision must be shared and supported by the rest of the C-suite.” Without that alignment, transformation risks becoming a series of disconnected initiatives rather than a cohesive change journey.

Once that vision is in place, the CFO must take on a series of interconnected responsibilities in change management and project management:

- Turning strategy into a concrete roadmap with achievable milestones that not only provide structure and focus, but also generate early wins. These intermediate successes build momentum, keep teams engaged, and serve as tangible proof — especially to skeptics — that the transformation is delivering real value to the organization.

- Selecting the right tools and technologies: not by chasing trends, but by identifying solutions that fit the long-term goals of the business.

- Developing the finance team to match the ambition of the transformation by mapping existing skills, identifying gaps, and using targeted assessments to guide upskilling or hiring. This means combining transactional accuracy with analytical and strategic capabilities, and creating growth paths for those ready to evolve with the organization.

- Accurately estimating the resources needed (both budget and people) to avoid overloading key staff. As Johan Reunis points out: “Resource needs are often underestimated, leading to hiccups or major issues in day-to-day finance operations, delays in the finance transformation project or burnout of key finance staff.”

Balancing financial control with transformation is one of the CFO’s hardest tasks as key talent is temporarily redirected toward the transformation effort. “You need to make hard decisions about who can keep the business running and who can lead the change,” Alexander Declerck adds. “Then make sure the operational gaps are covered.”

People leading the change are often the same ones holding critical compliance roles. You need to free them up and backfill their positions. Otherwise, they’ll burn out, and you’ll lose momentum.

Johan Reunis, Expert Practice Lead Business Integration

Common challenges in finance transformation

Even with a strong vision and a well-defined roadmap, many finance transformations falter when they meet the human side of change. Technical issues can often be solved, but emotional resistance, uncertainty, and lack of engagement are far more difficult to manage.

Some of the most common people-related challenges CFOs face:

- Limited involvement from the start

Transformation efforts can stumble when they’re developed in isolation. If employees aren’t involved from the beginning, the change can feel imposed rather than shared. Filip Ceulemans stresses the importance of early engagement: “People need to understand not just the vision, but what it means for their daily work.” - Lack of visibility into the bigger picture

In many finance functions, individuals only see a fragment of the overall process. Without a clear view of how their tasks fit into the value chain, it’s hard to inspire motivation or surface valuable ideas for improvement. - Fear and uncertainty about role changes

Automation, new tools, and restructured teams change jobs significantly and often trigger anxiety. Johan Reunis notes “Even small process changes can feel threatening if people aren’t prepared or supported. You can’t underestimate the emotional impact and should communicate early and honestly with people whose roles may evolve.” - Too much focus on detractors, not enough on allies

CFOs often invest disproportionate energy in convincing the loudest skeptics. But as Alexander Declerck points out, that energy is better spent supporting those who are ready to help drive the change: “You need to build a core of informal leaders. They’ll help shift the culture from within.”

Left unaddressed, these human challenges can derail transformation. Recognizing them early, addressing them with intention and a continuous attention to change management are essential to keeping both momentum and morale intact.

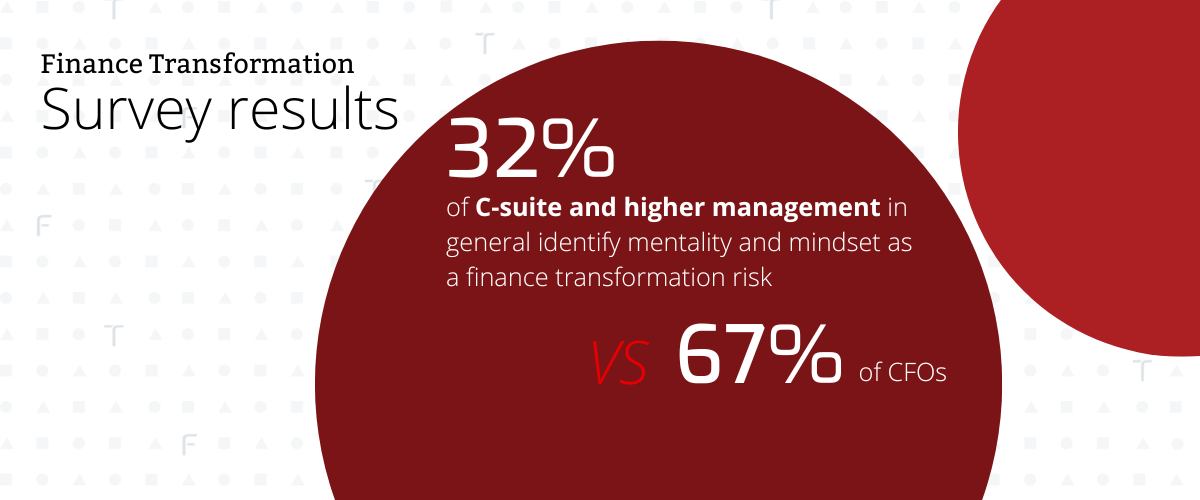

Our survey results reveal that C-suite and higher management in general indicate the lack of appropriate skills and competencies (32%), mentality and mindset (32%) and insufficient understanding of the complexity of the operating model (28%) as the major obstacles for a successful finance transformation. CFOs however identify mentality and mindset (67%) as by far the biggest challenge, followed by a transformation driven by technology first instead of business goals (42%) and faulty communication (42%) as equally important risk factors.

Best practices for CFOs leading transformation

Successful transformations are grounded in business needs and structured around practical choices. A few key practices help CFOs deliver lasting impact:

- Balance operations and transformation

Day-to-day finance responsibilities don’t pause for transformation. CFOs must ensure that compliance and reporting continue smoothly while change efforts are underway. - Simplify where possible

“Complexity slows everything down,” says Alexander Declerck. “Legacy systems and overly customized processes can block progress. Use transformation as an opportunity to reduce complexity and create structures that support continuous transformation to be able to respond to today's fast-evolving business landscape.” - Choose tools that fit the strategy

“Companies often pick tools before they know what they need,” warns Johan Reunis. Tools should follow strategy, not drive it. - Build around real business needs

Engage departments early to understand their challenges. Finance transformation only delivers value when it solves real problems across the organization.

Essential skills for CFOs in transformation

Leading finance transformation means reshaping the role of finance within the business. This requires a skillset that’s broader than what many CFOs were trained for.

CFOs today must move fluently between financial control and strategic leadership, between data and people, between long-term vision and day-to-day execution. Filip Ceulemans sums it up well: “You don’t need to be a specialist in everything, but you have to understand enough about technology, operations, and people to build the right connections and the right team.”

Thus, these five capabilities are becoming key:

- Strategic thinking: linking finance transformation directly to business priorities.

- Business fluency: understanding how operational decisions drive performance.

- Technological literacy: knowing which tools to deploy, and why.

- Being a constructive challenger: questioning assumptions with credibility and using financial insight to improve decisions.

- Leadership and communication: building trust, guiding teams, and developing talent.

As Alexander Declerck concludes: “Transformation also stretches the CFO. It forces you to grow, and makes your role matter more than ever.”

How TriFinance supports CFOs in leading transformation

Clear vision and planning are essential to finance transformation, but it’s the ability to deliver, adapt, and bring in the right expertise that ultimately drives success. At TriFinance, we support CFOs in turning strategy into action by bringing together hands-on financial experience, process and system expertise, and a pragmatic view on change.

Our flexible and pragmatic consultants help maintain daily operations while driving transformation forward. Backed by our advisory experts, we also bring in the strategic and technical know-how to shape the transformation, from designing the roadmap to guiding implementation. Whether it’s building a future-proof finance function, navigating complex system landscapes, or addressing talent gaps, we help finance leaders realize sustainable change with measurable impact.

Related content

-

Article

From Consultant to Finance Manager: how TriFinance accelerates real‑life growth

-

Article

How Belgian C-Suite executives view financial reporting

-

Blog

Lessons from the Belgian e-invoicing frontline

-

Article

Stabilizing Finance functions in a European bank in transition

-

Article

Restoring stability after a challenging ERP transition at SEB Professional

-

Reference case

From back-office support to informed business insights at OMP

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Consultant Public Procurement | Public Sector

-

Career as Consultant

Medior Consultant Public Procurement | Public Sector

-

Career as Consultant

Senior Consultant Public Procurement | Public Sector