Key Trends in Financial Planning & Analysis (FP&A) for 2025. Insights from our Vena Solutions workshop

19 June 2025What are the key trends in Financial Planning & Analysis (FP&A) in 2025? How are leading companies addressing challenges related to forecasting, data management, ESG reporting, and AI within their Finance function? Last May, TriFinance BCB MI&S organized an interactive lunch & learn session on these topics, in collaboration with Vena Solutions, our Canadian partner and a fast-growing player in the Enterprise Performance Management (EPM) software market.

- Poor data quality remains the biggest obstacle to AI and automation.

- AI is often embedded in finance tools, but manual oversight is still required.

- A data lake as central data hub strengthens reporting and analysis.

- Finance teams—not IT—should manage their own applications.

- Consultants are increasingly taking on coaching and expert roles.

From data quality to AI in forecasting: current FP&A trends

The event featured an interactive session including a live demonstration of the Vena tool. Together with CFOs, Finance Managers, and (Group) Controllers from internationally active Belgian companies, we discussed common challenges in planning, forecasting, and data management:

- Building a future-proof data architecture for FP&A

- Using AI in finance software, from automation to forecasting

- The importance of data quality and master data for reliable insights

- The need for knowledge management and ownership within the Finance team

- The advantages of a data lake as a central data hub

Discussions were based on current challenges of participating companies, and on best practices in FP&A. This input was complemented with practical experience from recent TriFinance MI&S FP&A projects.

This article summarizes the key insights from the workshop, along with best practices and reflections from participants.

Data Architecture and tool usage: making structural choices

A recurring theme was the appropriate use of various applications. "Appropriate use" mainly refers to deciding which process runs in which tool.

Common FP&A/EPM-related questions include:

- Is the budgeting exercise conducted within or outside the ERP system?

- Are aggregated budget data uploaded into the ERP?

- Which domains (Finance, Sales, Logistics, HR, etc.) are set up in EPM and at what level of detail?

- What granularity is used in budgeting and forecasting?

- What data is captured directly in the EPM tool for ESG reporting purposes?

Answers to these questions are rarely black and white. Each organization must find a balance between centralization, flexibility, and technical feasibility.

The solution lies in analyzing the current architecture and aligning it with the company’s strategy for future developments. It is crucial to gather transactional data in the ERP (or other transactional system) and use it in aggregated form in the FP&A environment. For fast budget monitoring, it may be useful to reload aggregated budget data into the ERP system, but using the ERP for detailed budgeting is not considered best practice.

Regarding ESG data, many different systems are used to collect transactional ESG data. If none are available, an FP&A tool can be used to input and store this data for reporting.

Best practices often refer to a generic model known as the information pyramid.

A generic information model: the information pyramid

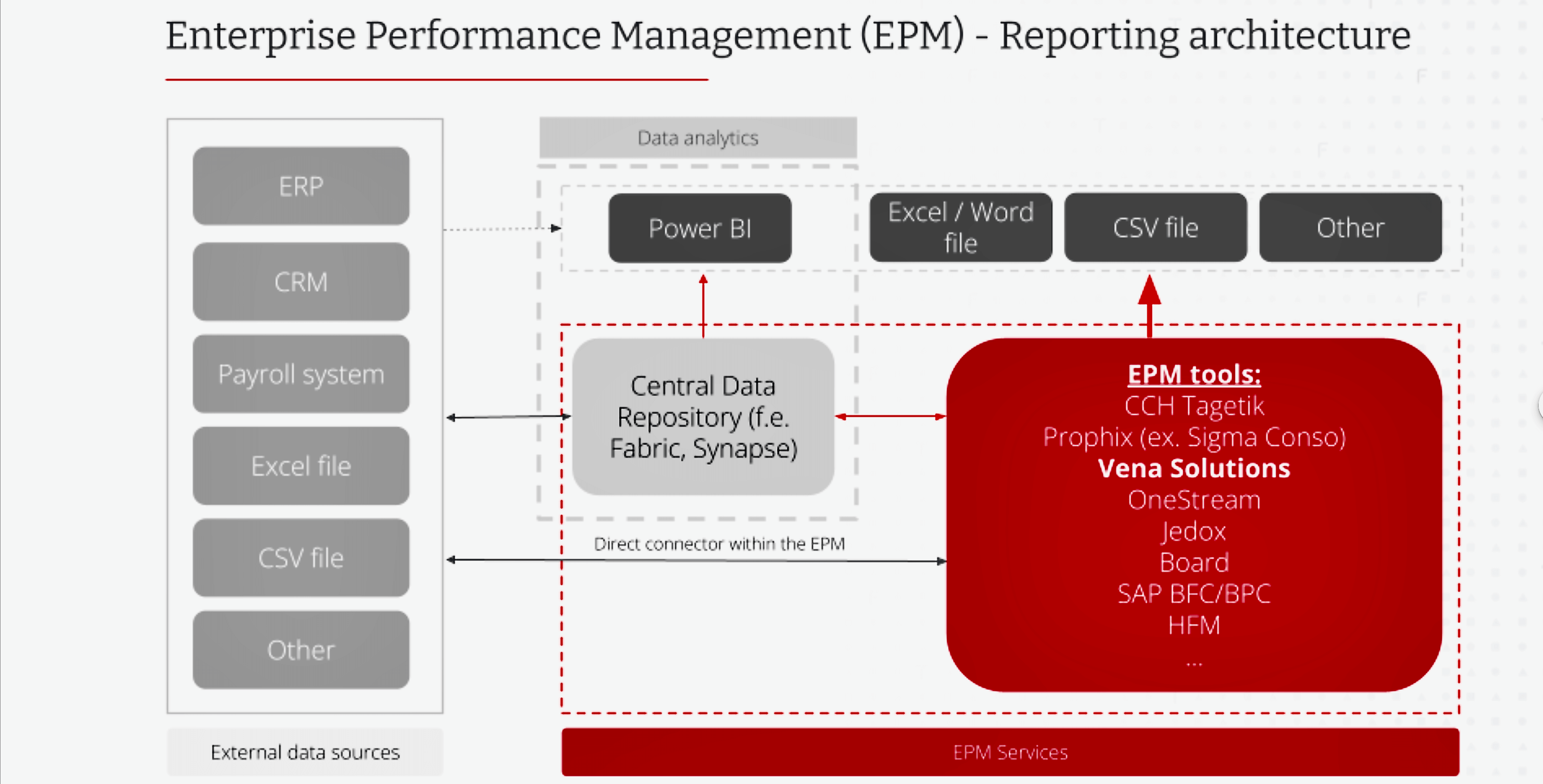

While there is no one-size-fits-all solution, we believe strongly in using a generic, clearly structured information model. During the session, we discussed a high-level version of the information pyramid that illustrates how different layers of data, processes, and decision-making interact.

Transactional data flows from the left-hand column into a central data repository (data lake), where it is prepared for further use at an aggregated level or for reporting.

In a modern data architecture, setting up and properly managing a data lake as a central data repository provides significant advantages.

Serge Vigoureux, BCB Leader Management Information & Systems, TriFinance

The role of a Data Lake as central data hub

In a modern data architecture, a well-managed data lake as central repository offers key advantages. By positioning a data lake as the central storage for structured and unstructured data, you create a flexible and scalable environment in which transactional systems can operate at their full potential. It provides a flexible and scalable environment that allows transactional systems to operate efficiently.

Main advantages:

- Decouples transactional systems from the central storage layer, allowing each to serve its intended function.

- Stores transactional data only once, resulting in a clean and efficient data structure.

- Eliminates data-level reconciliation issues due to a single source of truth.

- Allows easy integration of new applications that add value.

- Centralizes access rights and data security management.

- Optimizes reporting performance and data models.

A data lake serves as a solid foundation for reporting, analysis, and planning, and supports the professionalization of the FP&A function. While governance remains a challenge, the benefits outweigh the drawbacks.

Knowledge of financial applications

Recent CFO surveys show that knowledge management is a top priority for Finance teams. Several participants asked whether new finance applications can be managed by Finance directly.

The Finance function is becoming more complex, mainly due to increasing regulation, and requires ongoing upskilling. The role is also expanding, with a growing need for fast report delivery to the business, where controllers play a key role. ESG reporting adds further responsibility.

Finance is using more strategically important applications. It is essential that Finance takes ownership of these applications and not delegate this to IT. The Finance team cannot afford prolonged system downtime or misconfigured processes.

This requires continuous learning. Finance professionals must stay updated on functional changes, improve soft skills to clearly explain complex topics to stakeholders, and maintain broad application knowledge without becoming IT specialists.

To meet this need, a clear trend is emerging: consultants are moving into coaching roles, offering expert knowledge in specialized areas. For clients, keeping up with developments alone is nearly impossible.

The finance professional of the future must be able to reconcile and interpret AI outputs

Serge Vigoureux, BCB Leader Management Information & Systems, TriFinance

From automation to forecasting: AI in finance software

What is currently happening in Finance? Everyone is exploring AI, but few participants shared concrete use cases. Most finance software now includes AI features—from low-code automation and basic analysis to predictive models in budgeting tools.

Participants agreed: AI already offers a useful foundation, but still needs manual intervention and human oversight.It cannot yet act as a fully autonomous assistant. In the near future, AI will increase complexity and demand more expertise from Finance professionals.

Finance professionals will need to reconcile and interpret data produced by AI. This requires understanding of the underlying algorithms and statistical models, which is a significant challenge.

A concrete example shared involved using AI in forecasting. One result: sales forecasts generated by AI were more accurate than those produced by the sales team.

Data accuracy: master data quality as a key obstacle to AI

One of the biggest challenges in using AI in Finance remains master data quality. In many organizations, data is incomplete, fragmented, or of insufficient quality for automated decision-making. Datasets are often scattered across departments and not consolidated enough to support reliable statistical analysis.

This is risky: using AI on low-quality data only increases confusion. As a result, Finance teams still spend too much time collecting data instead of analyzing it. This deadlock must be broken.

Automating repetitive tasks through AI makes the Finance function more attractive and meaningful. It frees up time for strategic and value-added work, helping employees remain motivated and engaged, and more likely to stay longer within the organization.

Related content

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance

-

Blog

The Omnibus vote: Europe votes to weaken sustainability reporting rules

-

Article

E-Invoicing: Only one in three medium and large companies in Belgium is ready

-

Blog

The Omnibus reversal: a decidedly unsustainable step backward in ESG policy