- Adapting business models and beyond banking

- Cooperation between banks and fintechs

- Regulations in the financial sector

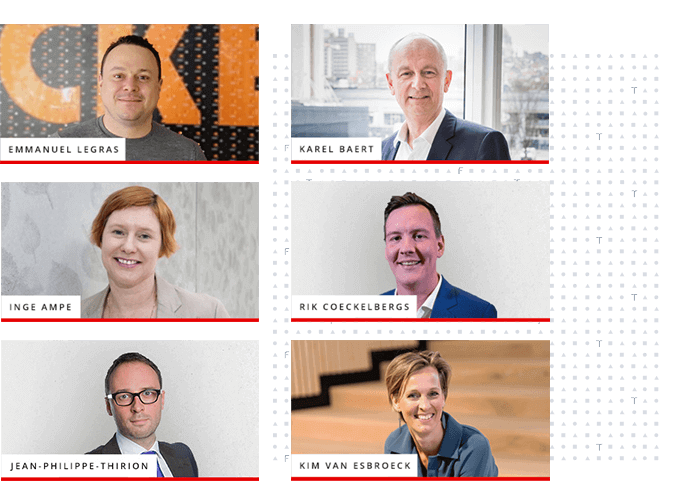

From launching a new bank during a global pandemic, over adapting business models, new and exciting value propositions and ecosystem building to hybrid models, the Finance of Things and rules and regulations, the panel discussion organized by Aion Bank and TriFinance on 30 September touched upon a lot of topics related to the future of banking. Panelists were Emmanuel Legras (CEO Belgium at Nickel), Inge Ampe (CCO at Argenta), Jean-Philippe Thirion (BU Leader Financial Institutions at TriFinance), Karel Baert (CEO at Febelfin) and Kim Van Esbroeck (Country Head at Aion Bank). The panel was moderated by Rik Coeckelbergs (Managing Director of The Banking Scene).

The pandemic and its impact on financial institutions

In the past two years the global pandemic has definitely impacted financial institutions and their clients. Aion bank launched two weeks prior to the first lockdown and due to the bank's digital first operating model it was able to get off to a flying start. All panelists concurred that the pandemic didn’t instigate digitisation, but accelerated the process. Numbers on the use of digital banking applications, reduced cash usage and an enormous rise in contactless payments show how fast client habits can change when pressured by such external factors. Personal contact during the pandemic remained essential for some clients and experience shows that at key points in life people prefer the human touch on top of the digital experience.

Prior to the Covid pandemic people already used mobile banking and other digital tools, during the pandemic people got more acquainted to ask all their questions in a digital way, sign documents or contracts through digital means which changed their banking habits.

Kim Van Esbroeck, Country Head at Aion Bank

Keeping everybody on board

Banks should thus make sure they are keeping an eye out for the less digital savvy and make sure that they will be able to continue to have a good banking experience. Digital inclusion is one of the main action points of the future to Febelfin and its members. It is a shared responsibility for all societal stakeholders and the authorities.

Open banking could allow us to quickly develop new services for our clients in cooperation with partners. This doesn’t imply that we will launch a new service just to launch a new service. Banks need to be useful to society. Since quite some clients still rely heavily on cash, we cooperate with press shops to remain physically close to our clients.

Emmanuel Legras, CEO Belgium at Nickel

Striving for more synergies

Through the past years, several trends have seen the light in the world of finance. Terms such as open banking, regulations (PSD2, etc.), financial mentoring, the Finance of Things and banks serving as financial butlers were discussed. From the consulting point of view, Jean-Philippe thinks of the post-pandemic period as a period of opportunity for more synergies and cooperation between financial and non-financial players, leading to a variety of services. Multiple panelists share the view of financial institutions becoming more than a provider of payments, investment, and insurance products. The possibilities enabled by new regulations are extensive and banks could grow to become a larger part of their client’s life to support them with a variety of financial and non-financial services. With partnerships between different banks and other companies, clients could benefit from large ecosystems linked to their trusted bank. Think about e.g. tickets for public transportation, comparing prices and switching to a new energy provider, performance management for professional clients, insights in saving- and spending habits, etc.).

Banks will create a new combination of services, more powerful than the current Beyond Banking trend. Over the past few years we talked a lot about the ‘Internet of Things’. In ten years time I believe there will be a ‘Finance of Things’ as well.

BU Leader Financial Institutions at TriFinance

‘Culture eats strategy for breakfast’

These large ecosystems could be beneficial to the clients but to the banks and fintechs as well. Not all banks or fintechs have the scale to carry large developments themselves, but cooperation could fix this and make some financial institutions evolve to technological providers as well. Panelists agree that alignment in culture and value propositions is leading when deciding to cooperate. Banking as a service can be an extension of the current value proposition of several financial institutions. Through cooperation, banks will still serve their unique target customers, but with an extended portfolio of services and truly go beyond banking.

Argenta wants to take advantage of technological evolutions, but we don’t necessarily have to execute them by ourselves. The combination of our willingness to grow, the distribution network and scale automatically leads us to open banking. If startups, fintechs or scaleups fit in our value proposition and culture we are open to working together.

Inge Ampe, CCO at Argenta

Regulation and consumer protection

The financial world is moving but needs to take into account the applicable rules and regulations. All banks, be they incumbent players or neobanks, need to follow the same rules and regulations. Next to digital tools to mitigate risks and follow-up compliance, human interference remains a factor in risk mitigation. Febelfin and its members see the need for a regulatory framework and consumer protection for new technologies as well. Since cryptocurrencies and their underlying technology (blockchain, distributed ledger, etc.) is a reality, the sector needs to be prepared and consumers need to be informed about the risks and benefits.

Financial institutions in Belgium could benefit from more synergies. Everyone faces the same problems or needs to tackle the same challenges and complexity. In a far future we could imagine a few big banks that can support smaller banks or brands each offering services to their unique clientele.

Rik Coeckelbergs, Managing Director of The Banking Scene

Sustainability in the banking sector

Finally, the panelists concurred that a focus on governmental, environmental, and social criteria is a must for banks. Coherency with regards to ESG (Environmental, Social and Governance), CSR (Corporate Social Responsibility) and diversity is necessary. Environmental and social criteria need to be linked to the culture of the financial institutions since non compliance from within the organization can have an impact on the trust clients put in their bank and the bank's reputation. Febelfin supports several campaigns and initiatives for inclusion and diversity, in cooperation with other sectors. Concrete examples are charters to cover diversity in boards and diversity in panel discussions.

Innovations beyond banking is something we should embrace. Some banks will be pioneers, others will be followers and some might not follow at all. We will need to see how these initiatives will evolve in the future. This evolution creates a perfect opportunity for banks to scrutinize their mission, vision and strategy.

Karel Baert, CEO at Febelfin

The panel discussion

The Future of Banking panel discussion touched upon a wide array of topics including some buzzwords related to the future of banking. Think about open banking, beyond banking, and embedded finance. Sustainability, governance, CSR, and ESG were tackled as well.

Want to watch the integral discussion? You can do it here.

The Future of Banking - Panel discussion 30/09/2021

Related content

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance

-

Career as Consultant

Business Analyst - Banking/Insurance

-

Career as Consultant

Operations consultant - Banking

-

Career as Consultant

Treasury & Financial Markets Consultant

-

Career as Consultant

Finance professional - Banking/Insurance

-

Freelance opportunities

Freelance Assignments - Banking/Insurance

-

Career as Consultant

Medior Project Manager - Banking/Insurance